Automotive Microcontrollers Market Supports Innovation Through Partnerships Between Automakers and Semiconductor Designers

Automotive microcontrollers market is advancing through expanded partnerships between vehicle manufacturers and semiconductor designers, as joint development programs focus on customized chips, software integration, and faster deployment of electronics supporting electrified, connected, and software-defined vehicle platforms.

Growing Collaboration Across the Value Chain

Automakers are increasing direct engagement with semiconductor design teams to align component capabilities with evolving vehicle requirements. Historically, chip selection occurred through tier suppliers, but growing electronic complexity has encouraged earlier collaboration during the design stage. These interactions allow manufacturers to define processing power, energy efficiency, and safety features tailored to specific platforms.

Joint engineering efforts are now common for next-generation vehicles incorporating electrification and connectivity functions. By coordinating requirements in advance, both parties aim to reduce development time and avoid compatibility challenges during production. This approach has led to structured co-development agreements covering hardware architecture, embedded software, and lifecycle support.

Customized Chip Architectures

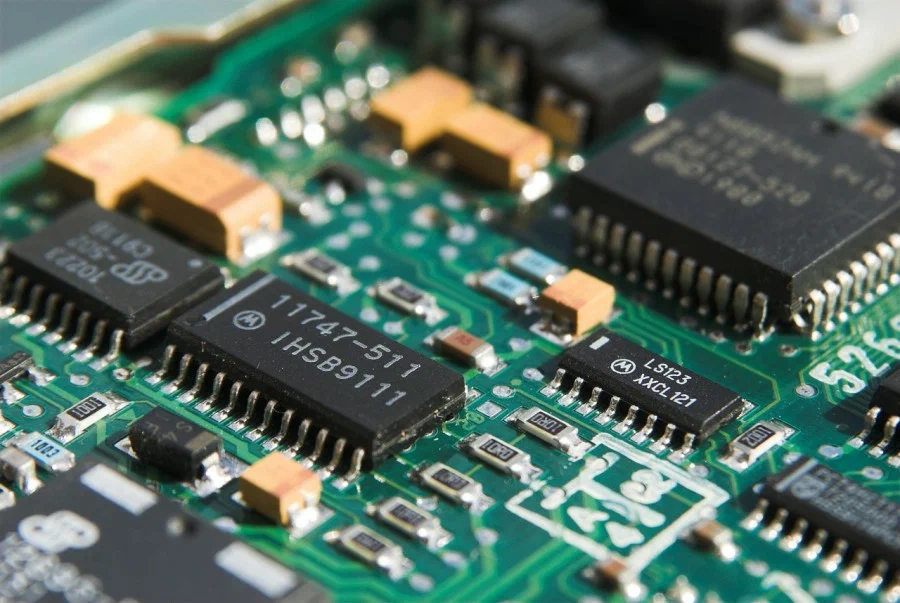

Vehicle platforms increasingly demand specialized processing solutions rather than standard components. Microcontrollers designed specifically for automotive use integrate features such as real-time control, low-latency communication, and extended durability. Through partnerships, automakers provide performance targets and environmental constraints, while semiconductor engineers adapt designs accordingly.

These customized architectures address needs across battery management, motor control, advanced driver assistance, and infotainment systems. Integrated features reduce the number of separate chips required, enabling simplified electronic control units and lower power consumption. Industry participants report that such optimization improves reliability while meeting stricter regulatory standards.

Faster Development Cycles

The shift toward software-defined vehicles has shortened product development timelines, requiring electronics to evolve more quickly. Collaboration between automakers and chip designers helps synchronize release schedules. Shared roadmaps ensure that new processors are ready to support upcoming vehicle launches without delays.

Engineering teams are also adopting parallel testing methods. Hardware prototypes and software stacks are validated simultaneously, allowing faster identification of design issues. This coordinated process reduces rework and accelerates certification, which is particularly important for safety-critical applications.

Integration of Software and Hardware

Modern vehicles depend heavily on embedded software, making integration between code and silicon essential. Partnerships facilitate joint optimization of firmware, operating systems, and hardware interfaces. Developers can fine-tune performance by aligning processing resources with application requirements.

This approach supports features such as over-the-air updates, cybersecurity protections, and remote diagnostics. Microcontrollers are increasingly equipped with secure boot mechanisms and encryption modules to protect vehicle networks. Coordinated design ensures these capabilities are embedded at the silicon level rather than added later through external components.

Regional Innovation Hubs

Collaboration efforts are concentrated in established automotive and semiconductor clusters. Regions in Europe, East Asia, and North America host joint laboratories where engineers from both sectors work alongside each other. These facilities focus on prototype testing, reliability assessments, and system integration.

Local governments and academic institutions often support these initiatives through research programs and workforce training. The concentration of expertise accelerates knowledge transfer and helps maintain consistent technical standards. As a result, new microcontroller designs are moving more quickly from concept to production.

Supply Chain Stability Benefits

Partnerships also contribute to improved supply chain coordination. Long-term agreements provide visibility into future demand, enabling semiconductor producers to plan capacity and allocate resources effectively. Automakers gain assurance that critical components will be available throughout the vehicle lifecycle.

This stability reduces exposure to sudden shortages that previously disrupted production. By sharing forecasts and technical requirements, both sides can anticipate changes and adjust manufacturing plans accordingly. Industry observers note that such collaboration supports smoother operations during periods of fluctuating demand.

Investment in Research and Testing

Joint programs frequently include shared investment in research and validation facilities. Testing environments simulate extreme temperatures, vibration, and electrical stress to ensure durability. Microcontrollers must meet strict automotive reliability standards, and collaborative testing helps verify compliance before mass production.

Engineers are also exploring new semiconductor materials and packaging techniques to improve heat dissipation and efficiency. These innovations are particularly relevant for electric vehicles, where power electronics operate under high loads. Research outcomes are expected to enhance performance while lowering energy consumption.

Expanding Role in Emerging Technologies

Partnerships are extending into emerging areas such as edge computing and artificial intelligence. Microcontrollers are being designed to handle greater data processing directly within vehicles, reducing reliance on external servers. This capability supports real-time decision-making for safety and navigation systems.

Connected vehicle platforms also require reliable communication between multiple electronic units. Joint development ensures compatibility with evolving network protocols and standards. These efforts aim to create scalable architectures capable of supporting future feature additions without extensive hardware changes.

Outlook for Continued Cooperation

Industry participants expect collaboration between automakers and semiconductor designers to intensify as vehicles become more electronically sophisticated. Future platforms will likely depend on integrated systems that combine control, connectivity, and security functions within fewer but more capable chips. Early coordination is viewed as essential to achieving these goals.

While economic conditions and regional policies may influence investment patterns, the broader trend toward partnership-driven innovation remains consistent. Manufacturers and chip developers are aligning strategies to manage complexity, enhance reliability, and accelerate deployment of new technologies.

Overall, the automotive microcontrollers market is being shaped by closer cooperation across the value chain. These partnerships are enabling tailored solutions, improving supply predictability, and supporting the rapid evolution of vehicle electronics. As integration deepens, collaborative development is expected to remain central to future advancements.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Music

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness