Saudi Arabia Foreign Exchange Market Trading Trends and Market Research 2026-2034

Saudi Arabia Foreign Exchange Market Overview

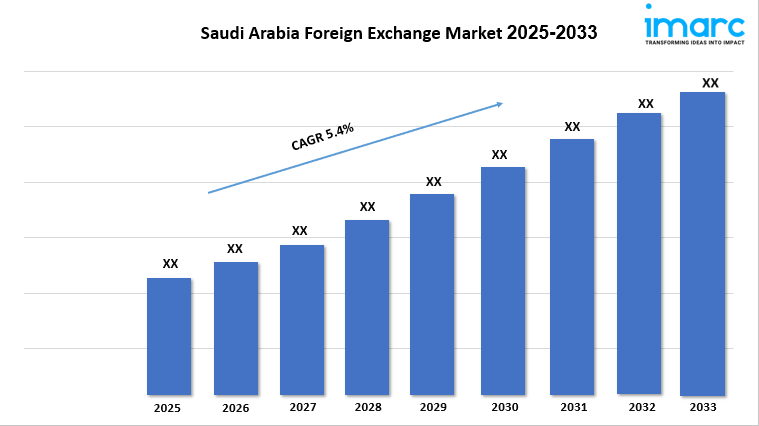

Market Size in 2025: USD 6.5 Billion

Market Size in 2034: USD 10.4 Billion

Market Growth Rate 2026-2034: 5.35%

According to IMARC Group's latest research publication, "Saudi Arabia Foreign Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia foreign exchange market size reached USD 6.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 10.4 Billion by 2034, exhibiting a CAGR of 5.35% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Foreign Exchange Market

- AI-powered algorithmic trading systems analyze currency market patterns across Saudi Arabia, executing high-frequency trades automatically while managing risk exposure more effectively than traditional manual methods.

- Machine learning platforms predict exchange rate fluctuations by processing vast datasets including oil prices, geopolitical events, and economic indicators affecting Saudi Riyal valuations.

- Natural language processing technology monitors global news and sentiment across financial markets, providing Saudi forex traders with real-time insights into market-moving events and trends.

- AI-driven compliance systems automate regulatory reporting and transaction monitoring for Saudi financial institutions, ensuring adherence to foreign exchange regulations while reducing administrative burdens.

- Predictive analytics models optimize currency hedging strategies for Saudi businesses, analyzing exposure risks and recommending timing for foreign exchange transactions minimizing cost volatility.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-foreign-exchange-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Foreign Exchange Industry

Saudi Arabia’s Vision 2030 is transforming the foreign exchange industry by modernizing financial regulations, strengthening fintech infrastructure, and attracting global investment. Reduced reliance on oil, rising non-oil trade, tourism growth, and increased foreign direct investment are driving higher demand for multi-currency transactions and advanced forex services. Regulatory reforms, digital trading platforms, and talent development are positioning Saudi Arabia—especially Riyadh—as a regional financial hub with a transparent, efficient, and globally competitive foreign exchange market.

Saudi Arabia Foreign Exchange Market Trends & Drivers:

Saudi Arabia's foreign exchange market is experiencing robust growth, driven by oil price volatility significantly impacting currency valuations and foreign exchange reserves. As the world's largest oil exporter, fluctuations in crude oil prices directly affect Saudi Riyal strength, with rising prices improving revenues and attracting foreign investment while declining prices depleting reserves and creating currency depreciation pressures. The Kingdom's heavy reliance on oil exports necessitates constant monitoring of international energy market trends influencing short-term and long-term foreign exchange conditions.

Government fiscal policies under Vision 2030 promoting economic diversification continuously impact foreign exchange market dynamics, with substantial investments in infrastructure, technology, and non-oil sectors affecting foreign investment confidence and currency stability. Fiscal surpluses increase market liquidity strengthening the Riyal, while deficits or unexpected challenges potentially weaken currency values as investor confidence fluctuates. Monetary policy decisions by the Saudi Central Bank (SAMA) represent significant market drivers, with interest rate adjustments influencing foreign investment attractiveness and capital inflows. Higher interest rates attract foreign investors seeking improved returns, increasing Riyal demand, while lower rates potentially reduce foreign exchange inflows as investment appeal diminishes across competing markets.

Saudi Arabia Foreign Exchange Market Industry Segmentation:

The report has segmented the market into the following categories:

Product Insights:

- Reporting Dealers

- Non-financial Customers

- Others

Application Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Foreign Exchange Market

- September 2025: MoneyGram entered partnership with Enjaz Payment Services to expand remittance network capabilities, strengthening foreign exchange service accessibility for individuals and businesses throughout Saudi Arabia.

- August 2025: Saudi Arabia's stock exchange announced regulatory modifications expanding investor access to capital markets, potentially affecting foreign exchange flows as international participation increases in Saudi financial markets.

- May 2025: AstroLabs collaborated with Saudi Awwal Bank strengthening support for businesses entering Saudi Arabia, providing foreign exchange services and trade finance solutions supporting international expansion objectives.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness