Hybrid Offshore Accounting Models: Best Picks for U.S. CPA Firms in 2025

As U.S. businesses face rising labor costs, talent shortages, and increasing financial complexity, offshore accounting has moved from a cost-saving tactic to a strategic growth decision. In 2025, companies of all sizes—from startups to mid-market enterprises—are leveraging offshore accounting services to improve accuracy, scalability, and financial visibility without expanding in-house teams.

But with so many providers in the market, how do you choose the right one? What services should you expect, and how does pricing typically work? This guide breaks it all down.

Why Offshore Accounting Is Gaining Momentum in 2025

Several trends are driving adoption among U.S. businesses:

-

Ongoing shortage of qualified accountants

-

Increased reliance on cloud accounting platforms

-

Demand for real-time financial reporting

-

Pressure to control operating costs

-

Growth of remote and hybrid finance teams

Offshore accounting offers access to skilled professionals who understand U.S. accounting standards while operating at a more sustainable cost structure.

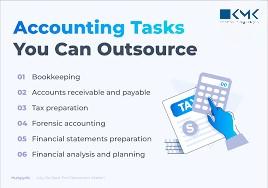

What Are Offshore Accounting Services?

Offshore accounting services involve outsourcing accounting and bookkeeping tasks to qualified professionals located outside the U.S. These teams work as an extension of your internal finance function and commonly support:

-

Bookkeeping and reconciliations

-

Accounts payable and receivable

-

Financial reporting and close support

-

Payroll processing

-

Tax preparation support

-

Compliance documentation

Most reputable providers use U.S. GAAP-aligned processes and secure cloud systems.

17 Common Offshore Accounting Services U.S. Businesses Use

Instead of ranking vendors by name, it’s more useful to understand the top service categories businesses evaluate when comparing offshore providers.

1. Day-to-Day Bookkeeping

Accurate transaction recording, chart of accounts management, and journal entries.

2. Bank and Credit Card Reconciliations

Ensuring cash balances match statements monthly.

3. Accounts Payable Management

Invoice processing, vendor management, and payment scheduling.

4. Accounts Receivable Support

Invoicing, collections tracking, and aging reports.

5. Month-End Close Assistance

Supporting faster, cleaner financial closes.

6. Financial Statement Preparation

Income statements, balance sheets, and cash flow reports.

7. Payroll Processing Support

Multi-state payroll preparation and compliance coordination.

8. Expense Management

Policy enforcement and reimbursement tracking.

9. Fixed Asset Accounting

Depreciation schedules and rollforwards.

10. Sales Tax & Compliance Support

Multi-state sales tax tracking and reporting assistance.

11. Budgeting and Forecasting Support

Data preparation for planning and analysis.

12. Cash Flow Reporting

Weekly and monthly cash visibility.

13. Audit Preparation Support

Workpapers and documentation readiness.

14. Software Migration Assistance

QuickBooks, Xero, NetSuite transitions.

15. Industry-Specific Accounting

Retail, SaaS, healthcare, and professional services.

16. CFO Back-Office Support

CAS and virtual CFO data preparation.

17. Scalable Seasonal Support

Extra capacity during peak periods without permanent hires.

How Reviews Should Be Evaluated

When reviewing offshore accounting providers, U.S. businesses should focus on capabilities, not just testimonials.

Key evaluation questions:

-

Do they follow U.S. GAAP consistently?

-

What cloud platforms do they support?

-

Is there a dedicated team model?

-

How is data security handled?

-

What review and escalation processes exist?

Strong providers emphasize transparency, documentation, and long-term partnerships.

Pricing Models Explained

Offshore accounting pricing typically falls into three models:

1. Fixed Monthly Pricing

Best for ongoing bookkeeping and AP/AR services. Predictable and scalable.

2. Dedicated Resource (FTE) Model

A full-time offshore accountant working exclusively for your business.

3. Task-Based or Project Pricing

Ideal for cleanups, migrations, or short-term needs.

While pricing varies by complexity and scope, offshore services generally cost significantly less than equivalent U.S. in-house roles.

Questions Businesses Ask

Are offshore accounting services safe for U.S. companies?

Yes, when providers use secure cloud systems, role-based access, and documented controls.

Will offshore teams replace my internal accountant?

No. They support internal teams, allowing them to focus on higher-value work.

Can small businesses use offshore accounting?

Absolutely. Small and mid-sized businesses often benefit the most.

How long does onboarding take?

Typically faster than local hiring—often within weeks.

Benefits Beyond Cost Savings

While cost efficiency matters, businesses also gain:

-

Faster turnaround times

-

Improved accuracy through specialization

-

Better financial visibility

-

Scalable capacity without hiring risk

-

Reduced burnout for internal teams

In 2025, offshore accounting is about operational resilience—not just savings.

Common Mistakes to Avoid When Choosing a Provider

-

Selecting based on price alone

-

Lack of clear scope definition

-

Poor communication expectations

-

No defined review process

-

Treating offshore teams as temporary labor

The most successful partnerships treat offshore accountants as long-term team members.

Best Practices for Long-Term Success

To maximize value:

-

Standardize workflows

-

Document procedures

-

Maintain regular check-ins

-

Assign consistent reviewers

-

Share business context, not just tasks

Integration is the difference between outsourcing and true partnership.

Final Thoughts

In 2025, offshore accounting services are no longer a niche option—they are a mainstream strategy for U.S. businesses seeking efficiency, scalability, and financial clarity. By understanding the service categories, pricing models, and evaluation criteria, companies can confidently choose partners that support sustainable growth.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness