Saudi Arabia Laptop Market Size, Growth, and Forecast 2025-2033

Saudi Arabia Laptop Market Overview

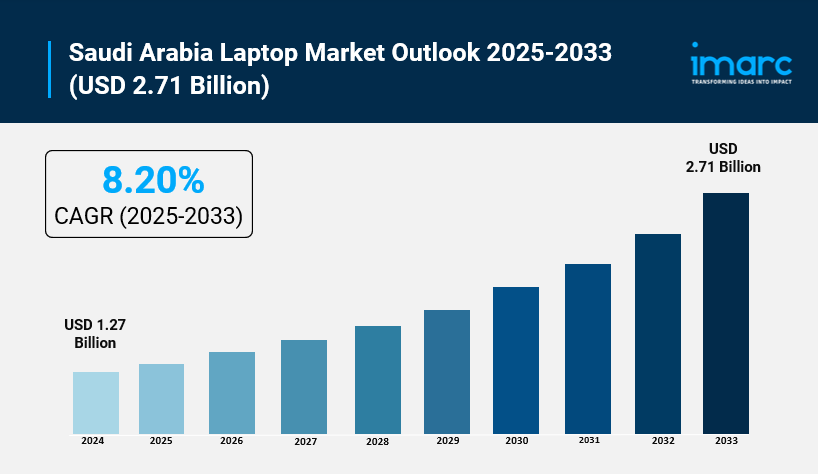

Market Size in 2024: USD 1.27 Billion

Market Forecast in 2033: USD 2.71 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Laptop Market Report by Type (Traditional Laptop, 2-in-1 Laptop), Screen Size (Up to 10.9", 11" to 12.9", 13" to 14.9", 15.0" to 16.9", More Than 17"), Price (Up to USD 500, USD 501 to USD 1000, USD 1001 to USD 1500, USD 1501 to USD 2000, Above USD 2001), End Use (Personal, Business, Gaming), and Region 2025-2033", the Saudi Arabia laptop market size reached USD 1.27 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.71 Billion by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-laptop-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Laptop Market

- AI is boosting laptop performance in Saudi Arabia by powering faster processing, smarter software, and AI-optimized chips driving better multitasking and gaming experiences.

- The government’s AI initiatives, like the Saudi Data and Artificial Intelligence Authority (SDAIA), support local AI software and hardware advancements, helping laptop makers innovate.

- With a $14.9 billion AI push, Saudi Arabia is building an AI ecosystem that encourages hardware manufacturers to integrate cutting-edge AI features in laptops for security and productivity.

- AI-driven personalized learning and digital workspaces are increasing laptop demand as educational institutions and businesses adopt AI-powered solutions under Vision 2030.

- Leading brands such as Apple, Microsoft, and Lenovo are rolling out AI-enhanced laptops that meet Saudi consumers’ growing needs for smarter, more efficient devices.

Saudi Arabia Laptop Market Trends & Drivers:

Rising digital adoption across work, education, and entertainment is one of the strongest drivers of laptop demand in Saudi Arabia, with the market already exceeding USD 1.2 billion in annual revenue. The Kingdom’s high internet penetration and growing use of cloud and collaboration tools make laptops a default productivity device for offices, universities, and freelancers, especially as many companies maintain some hybrid work flexibility. At the same time, imports of laptops and palm‑top computers have surged in value, reflecting robust consumer appetite for portable devices over traditional desktops as users prioritize mobility and always‑connected lifestyles.

Government-led digital transformation and education initiatives under Vision 2030 are another major force pushing laptop sales, particularly among students and younger professionals. The Ministry of Education has rolled out large-scale digital programs, expanding platforms like Madrasati and promoting smart classrooms that depend on personal devices. One recent initiative equipped around 500,000 students with devices, while broader e-learning and digital skills programs continue to normalize laptop use from school age upward. At the policy level, multi-billion-dollar investments in the digital economy, 5G coverage, and e-government services make laptops indispensable tools for accessing learning platforms, public services, and online job opportunities.

Shifting consumer preferences toward premium, gaming, and eco-friendly models form an important emerging trend reshaping the Saudi laptop landscape, especially with about 65 percent of the population under 35. The local gaming sector is valued at more than USD 600 million, helping drive demand for high-performance laptops from brands such as ASUS ROG and Acer Predator, which have reported double-digit sales growth in cities like Riyadh. At the same time, sustainability is climbing the agenda, with government emissions-reduction targets encouraging brands like Dell and HP to offer low-power, energy-efficient laptops that cut consumption by roughly a quarter and resonate strongly with younger, eco-conscious buyers.

Saudi Arabia Laptop Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Type:

- Traditional Laptop

- 2-in-1 Laptop

Breakup by Screen Size:

- Up to 10.9"

- 11" to 12.9"

- 13" to 14.9"

- 15.0" to 16.9"

- More Than 17"

Breakup by Price:

- Up to USD 500

- USD 501 to USD 1000

- USD 1001 to USD 1500

- USD 1501 to USD 2000

- Above USD 2001

Breakup by End Use:

- Personal

- Business

- Gaming

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Laptop Market

- 2025 August: Saudi Arabia expands AI curriculum for over six million students, increasing demand for AI-optimized laptops tailored for education and remote learning.

- 2025 July: Lenovo announces a major new manufacturing facility in Saudi Arabia, boosting local production capacity and AI-integrated laptop innovation.

- 2025 May: Premium gaming laptops surge in popularity, with brands introducing advanced cooling technologies and high-refresh-rate displays to cater to young Saudi gamers.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness