Small Satellite Industry Outlook 2035: Market Share Expansion Driven by Earth Observation & IoT

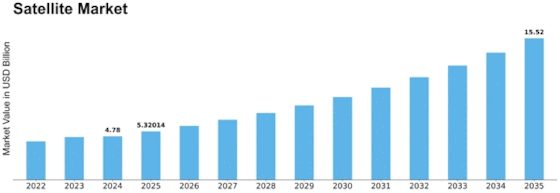

The small satellite market is experiencing a breathtaking surge, fueled by innovation, demand, and dramatically lower costs. According to MRFR, the small satellite market was valued at about USD 4.899 billion in 2024, and it is forecast to expand to USD 5.855 billion in 2025, before rocketing to USD 34.77 billion by 2035, growing at a CAGR of 19.5% during this period. This growth underscores a profound shift in the satellite market, one where smaller, lighter, and more agile spacecraft are displacing traditional giants and democratizing access to space. As development cycles shorten and the barrier to entry lowers, a broader range of players — from academic institutions to startups and national space agencies — can now deploy satellites for their missions.

Driving this meteoric rise is the remarkable pace of technological progress. Miniaturized payloads, modular satellite designs, 3D-printed structures, and electric propulsion systems are all converging to make small satellites more capable than ever. These innovations are creating new business models in the satellite market, such as satellite-as-a-service and data-as-a-service, where even organizations that lack the capital or expertise to build their own spacecraft can lease orbital capacity or purchase data. Such shifts are redefining who can participate in space, opening the small satellite market to a much more diverse set of customers. Moreover, the lower cost per unit and the ability to launch constellation missions make small satellites very attractive for large-scale, distributed systems.

The demand side is equally compelling. Earth observation applications are growing rapidly, as governments and companies scramble to monitor climate change, natural resources, and agricultural trends in near real time. Small satellites are well-suited for this because they offer relatively frequent revisit times, high-resolution imaging, and, importantly, cost-efficiency compared to traditional large satellites. At the same time, communications use cases are booming: low Earth orbit constellations of small satellites promise to close the digital divide, bring broadband to remote regions, and support massive Internet of Things (IoT) networks. These communications applications are increasingly central to the broader satellite market’s growth story.

Geographically, North America currently dominates the small satellite market Size, thanks to its deep pockets, advanced infrastructure, and concentration of leading players. But the Asia-Pacific region is emerging as the most dynamic frontier, with countries like India and China ramping up both government-sponsored and commercial space activity. The combination of rising national ambitions, lower costs, and growing private-sector interest is fueling rapid expansion in this region. Key companies propelling this wave include SpaceX, Planet Labs, Maxar Technologies, Airbus, Rocket Lab, BlackSky, Spire Global, and ISRO.

Looking ahead, the future of the small satellite market seems remarkably bright. As modular satellite platforms mature, AI-enabled data processing becomes standard, and satellite-as-a-service models scale up, small satellites are poised to dramatically expand their role in the satellite market. Their agility, combined with cost-efficiency, means that more organizations than ever can leverage space-based capabilities, fundamentally reshaping how data is collected, analyzed, and monetized from orbit.

Releated Report:

Satellite Propulsion System Market OverView

Radar Simulator Market OverView

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness