Military Satellite Market Trends 2025: Market Share Shifts Driven by ISR and Secure Connectivity

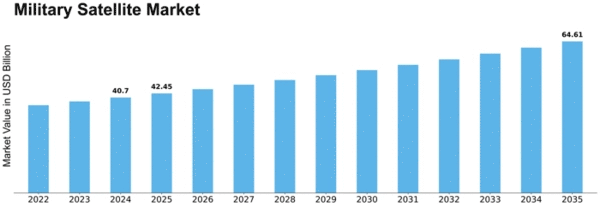

The Military Satellite Market is as much an industrial arena as it is a geopolitical one, blending technological ingenuity with strategic defense imperatives. According to (MRFR), the market stood at USD 40.70 billion in 2024 and is projected to reach USD 64.61 billion by 2035, expanding at a CAGR of 4.29% over the forecast period. This growth reflects widespread modernization efforts among national defense establishments, driven by the growing complexity of global security threats and an increased reliance on space infrastructure.

A central aspect of the competitive landscape is the presence of leading defense and aerospace firms that design, manufacture, and deploy military satellites Market. Companies such as Lockheed Martin, Boeing, Airbus Defence and Space, Northrop Grumman, Raytheon Technologies, SES S.A., Leonardo, and L3 Technologies are frequently cited as key market players. These organizations are at the forefront of innovation, investing heavily in research and development to deliver advanced satellites with enhanced performance, reliability, and adaptability.

The importance of competitive differentiation is profound in this market because military satellites must meet extremely strict performance and resilience standards. Systems must operate reliably under hostile conditions, provide secure communication channels, and resist interception and jamming attempts. Manufacturers are responding by equipping satellites with advanced encryption, hardened electronics, and resilient architectures capable of maintaining connectivity even under duress.

Another dimension of competition lies in payload innovation. Modern military satellites carry diverse payloads — ranging from high-resolution electro-optical and SAR sensors for imagery, to signals intelligence (SIGINT) systems that intercept and analyze electronic emissions. Communication payloads, meanwhile, support encrypted voice and data transmission across military domains. The versatility and sophistication of these payloads directly influence satellite value and mission utility, making payload innovation a key competitive battleground.

Satellite type is another competitive axis. Low Earth Orbit (LEO) satellites are gaining traction due to their lower latency and greater revisit times compared with traditional geostationary platforms. As launch costs decline and small satellite technologies mature, LEO constellations are becoming more viable for military applications, including real-time reconnaissance and rapid data dissemination. Medium Earth Orbit (MEO) platforms also offer a balance between coverage and latency, giving military planners flexibility in constellation design.

Innovation isn’t limited to hardware alone; software and services form an integral part of competitive strategy. AI-driven data analytics, machine learning for predictive maintenance, and autonomous task scheduling are enhancing satellite ground segment capabilities. These software systems turn vast streams of satellite data into actionable insights for defense operations, giving nations that adopt them significant strategic advantage.

Public-private collaboration is increasingly vital as well. Governments are partnering with commercial satellite operators to develop dual-use capabilities that can serve both defense and civilian needs. Such collaborations allow militaries to tap into commercial innovation cycles, reduce redundancy in development, and achieve cost efficiencies. However, they must balance this with sovereignty concerns, ensuring secure control over defense-critical satellite functions.

Regionally, the North American market remains dominant due to heavy defense spending and advanced space capabilities. Meanwhile, Europe continues to expand its military satellite programs, often through multinational cooperation within NATO and the EU framework. Asia Pacific and Middle East & Africa represent growth frontiers, as nations in these regions boost defense budgets and pursue independent satellite capabilities to reduce reliance on foreign systems.

Challenges persist, particularly in managing space traffic and mitigating space debris, which threatens satellite longevity and operational safety. Additionally, cybersecurity concerns remain paramount as satellites become increasingly connected and data-driven. Addressing these issues will be crucial for sustaining market growth and maintaining operational integrity as the military satellite ecosystem evolves toward 2035 and beyond.

Related Report:

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness