UAE Cement Market Size & Trends Forecast 2025-2033

UAE Cement Market Overview

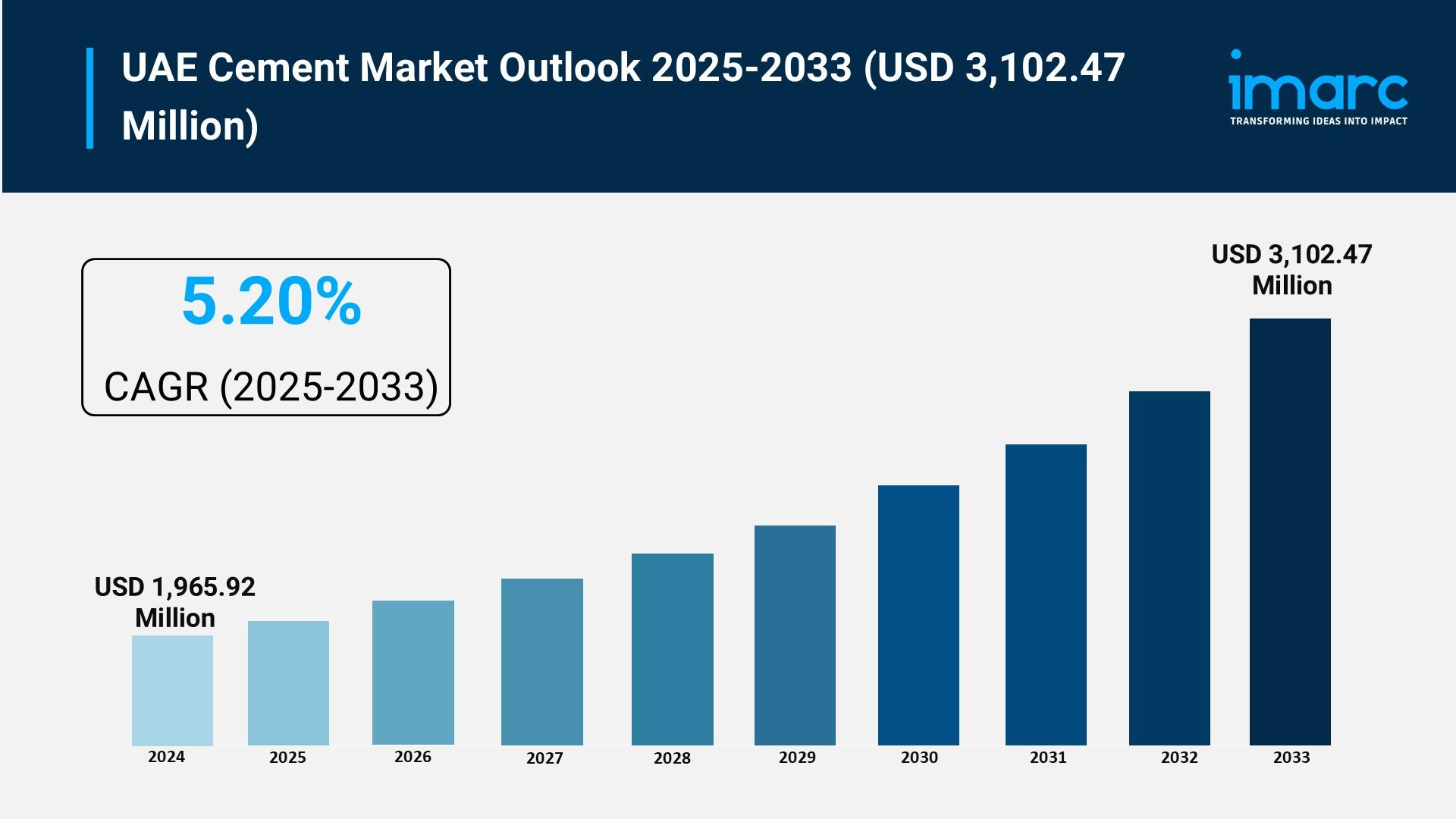

Market Size in 2024: USD 1,965.92 Million

Market Size in 2033: USD 3,102.47 Million

Market Growth Rate 2025-2033: 5.20%

According to IMARC Group's latest research publication, "UAE Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033", the UAE cement market size reached USD 1,965.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,102.47 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033.

How AI is Reshaping the Future of UAE Cement Market

- Predictive Maintenance Optimization: AI-driven analytics are transforming UAE cement plants by forecasting equipment failures in kilns and crushers, reducing unplanned downtime by up to 20% and extending asset life.

- Energy Efficiency Enhancement: Machine learning models are optimizing kiln operations and fuel consumption in UAE facilities, cutting energy use by 8-15% while meeting stringent sustainability targets.

- Quality Control Automation: AI-powered systems using real-time monitoring are ensuring consistent cement composition across UAE production lines, boosting product reliability and reducing off-spec output by over 10%.

- Supply Chain and Demand Forecasting: Advanced AI algorithms are predicting market fluctuations tied to UAE's infrastructure investments, streamlining logistics and minimizing inventory waste.

- Emission Reduction Strategies: AI is enabling greener cement blends with alternative fuels and carbon tracking, supporting net-zero goals by reducing CO2 emissions by up to 65% via low-clinker formulations.

Download a sample PDF of this report: https://www.imarcgroup.com/uae-cement-market/requestsample

Uae Cement Market Trends & Drivers

Sustainability has become a defining factor in the UAE's cement landscape, fundamentally reshaping how producers design and deliver their products. Companies are increasingly adopting environmentally responsible approaches including low-carbon cement formulations, alternative fuel usage, and carbon capture technologies that resonate with the UAE's ambitious net-zero goals by 2050. This shift aligns perfectly with broader national sustainability initiatives like the UAE Energy Strategy 2050 and the Green Agenda 2030, making environmental responsibility both a consumer preference and a regulatory imperative. Brands are also emphasizing transparency in their emissions reporting and production processes, which builds trust and cultivates long-term partnerships with construction firms. A prime example is Exeed Industries' collaboration with Partanna Oasis, exploring the development of carbon-negative cement technologies through a memorandum of understanding signed in May 2025, offering innovative solutions that reduce the sector's carbon footprint while maintaining structural integrity. This initiative promotes sustainable construction by showcasing low-emission alternatives to traditional Portland cement, appealing to the UAE's growing community of eco-conscious developers and investors. As sustainability continues to influence project decisions, its integration into cement offerings is becoming essential for brand differentiation and market competitiveness.

The UAE cement market is experiencing remarkable growth through niche targeting and specialized offerings that move beyond generic Portland cement assortments. Producers are increasingly focusing on highly specific applications ranging from high-performance concrete for skyscrapers to eco-friendly variants for residential developments and durable mixes for infrastructure like roads and rail networks. These tailored products allow companies to serve specific construction segments more effectively, resulting in significantly higher adoption rates and project efficiencies compared to one-size-fits-all approaches. Niche cements also foster a strong sense of innovation and reliability among users, often transforming routine suppliers into strategic partners in mega-projects. Dubai-based Union Cement exemplifies this trend perfectly, offering specialized cement blends that support authentic high-rise constructions directly integrated into landmark developments. Each formulation is curated by strength requirements, environmental standards, or project timelines, featuring additives for rapid setting, sulfate resistance, and enhanced durability sourced from advanced local and international technologies. The service delivers unexpected, high-quality solutions that appeal to engineers and architects seeking to optimize builds in the UAE's dynamic urban environment. As demand continues shifting toward performance and relevance over volume, companies that identify and serve unique market needs are positioned to capture substantial market share and drive category growth.

The expansion of the UAE's construction infrastructure is creating unprecedented opportunities for cement services to reach broader audiences and deliver enhanced project experiences. The UAE's construction sector reached AED 300 billion in value in 2024, representing 8 percent growth from the previous year, with approximately 500 major projects now underway regularly. The country's infrastructure market is projected to grow significantly, with public-private partnerships generating 70 percent of national investments and the overall building ecosystem valued at over AED 1 trillion. This robust foundation is supporting cement growth through improved supply chains, advanced logistics networks, and sophisticated procurement platforms that make bulk deliveries seamless. Digital integration is particularly influential, enabling stakeholders to manage orders, customize specifications, and track sustainability metrics conveniently via AI-driven tools. The combination of increasing project pipelines, enhanced last-mile distribution capabilities, and evolving industry habits toward efficiency-focused builds is creating ideal conditions for cement services to flourish across residential towers, commercial complexes, transport hubs, energy facilities, and tourism developments throughout the UAE's diverse emirate markets.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging UAE cement market trends.

UAE Cement Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Blended

- Portland

- Others

End-Use Insights:

- Residential

- Commercial

- Infrastructure

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Recent News and Developments in UAE Cement Market

- October 2025: The UAE cement industry saw a 12% year-on-year increase in production capacity, driven by major infrastructure projects like the expansion of Dubai's Expo City and Abu Dhabi's sustainable urban developments, with Union Cement Company announcing a new eco-friendly production line to meet rising demand for green building materials.

- September 2025: Emirates Cement Factory reported a 15% surge in exports to GCC neighbors amid regional construction booms, attributing the growth to enhanced logistics partnerships and government incentives for low-carbon cement variants, bolstering the UAE's position as a key regional supplier.

- July 2025: In response to global sustainability mandates, LafargeHolcim UAE launched its first carbon-captured cement plant in Ras Al Khaimah, reducing emissions by 30% and aligning with the UAE's Net Zero 2050 strategy, attracting international investments worth AED 500 million.

- May 2025: Dubai Municipality approved new regulations mandating 20% recycled content in public construction cement, spurring market innovation as local producers like Al Ain Cement ramp up R&D for compliant products, projected to add AED 2 billion to the sector's value by 2026.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness