Crypto Asset Management Market Overview, Trends, and Forecast 2024-2030

Crypto Asset Management Market: Navigating the Growth of Digital Finance

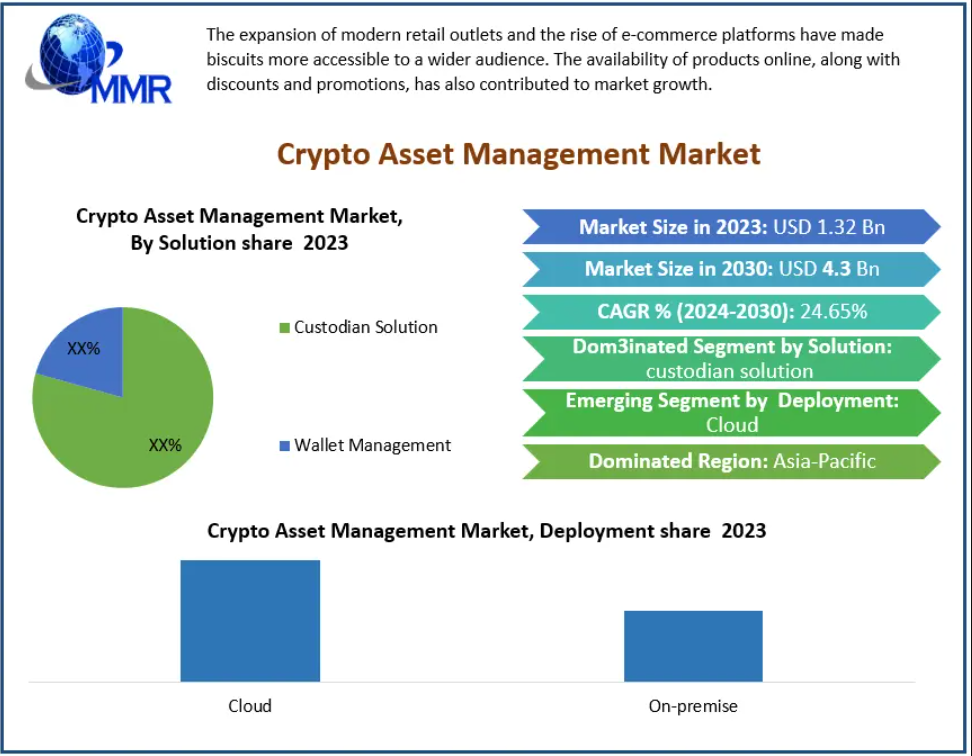

The Crypto Asset Management Market was valued at USD 1.32 billion in 2023 and is projected to grow at a CAGR of 24.65%, reaching nearly USD 4.3 billion by 2030. This rapid expansion is fueled by the increasing adoption of blockchain technology, rising institutional investments, and the growing integration of cryptocurrencies into mainstream financial systems.

Market Overview

Crypto asset management refers to the professional management, storage, and optimization of digital assets such as cryptocurrencies and tokenized assets. With blockchain technology providing security, transparency, and efficiency, these solutions are becoming essential for both individual and institutional investors. The growing volume and complexity of digital assets have created a demand for advanced systems that ensure secure, compliant, and effective management of crypto portfolios.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/27361/

Key Market Drivers

- Institutional Adoption – Major financial institutions are increasingly incorporating crypto assets into their portfolios. This influx of institutional capital necessitates sophisticated asset management solutions that meet rigorous regulatory and operational standards.

- Growing Investment Opportunities – The rising popularity of cryptocurrencies among retail investors and businesses has created demand for reliable asset management tools. Effective management systems help investors optimize portfolios, mitigate risks, and ensure security.

- Integration with Traditional Finance – Crypto asset management solutions are increasingly integrating with conventional banking and financial systems. This integration allows investors to manage digital and traditional assets seamlessly, improving user experience, trust, and adoption rates.

Market Segmentation

By Solution:

- Custodian Solutions – Offer secure storage and management of crypto assets for institutions and individuals.

- Wallet Management – Focus on accessibility, convenience, and security for retail and enterprise users.

By Deployment:

- Cloud – Dominates the market due to scalability, remote access, and advanced security protocols. Cloud-based platforms also leverage AI and machine learning to enhance risk assessment, portfolio optimization, and transaction efficiency.

- On-Premises – Preferred by organizations seeking greater control over their data and infrastructure.

By Application:

- Mobile – Mobile solutions lead the market, enabling investors to manage digital assets on-the-go with enhanced security features like biometrics and secure enclaves. Integration with decentralized finance (DeFi) protocols further boosts mobile adoption.

- Web-Based – Web platforms provide accessibility, real-time tracking, cross-device compatibility, and advanced analytics, catering to both individual and institutional investors.

By End Use:

- Individuals, enterprises, institutions, retail & e-commerce, healthcare, travel & hospitality, and others all increasingly rely on crypto asset management solutions to manage portfolios securely and efficiently.

Regional Insights

- North America – Holds the largest market share (30.4% in 2023), supported by strong legal frameworks, institutional finance, and a mature blockchain ecosystem. The presence of major players and regulatory clarity fosters growth.

- Asia Pacific – Expected to experience robust growth, driven by a tech-savvy population, vibrant fintech startup ecosystem, and favorable regulatory developments in countries such as Japan, South Korea, Singapore, and Australia.

- Europe – Emerges as a significant market due to growing institutional participation, crypto-friendly regulations, and technological advancements. European financial institutions are increasingly offering crypto-secured products.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/27361/

Recent Market Developments

- Gemini Trust Company – In September 2023, the firm planned a $24 million investment to expand operations in India, establishing a growth center in Gurgaon.

- Amberdata – In June 2023, the company expanded into the Asia-Pacific region with a new office in Hong Kong, supporting products across DeFi, derivatives, and on-chain market intelligence.

Leading Players

The market is highly competitive with several global and regional players innovating to meet growing demand:

- Coinbase Custody

- Gemini Trust Company

- BitGo

- Binance

- Fidelity Digital Assets

- Anchorage

- Grayscale Investments

- Ledger

- Galaxy Digital

- Metaco

- Paxos Trust Company

- SwissBorg

- CoinShares

- Zerion

- Cobo

- Alameda Research

- BlockFi

- Bakkt

- Crypto Finance AG

- Trustology

These companies are focusing on technological innovation, regulatory compliance, and service diversification to expand market share and enhance the security and usability of crypto asset management solutions.

Future Outlook

The Crypto Asset Management Market is poised for rapid expansion as digital assets become more mainstream. Increased institutional adoption, regulatory clarity, and the integration of advanced technologies such as AI, blockchain analytics, and mobile platforms will continue to drive growth. With digital finance evolving rapidly, robust crypto asset management solutions will remain critical for investors seeking security, efficiency, and seamless integration with traditional financial systems.

More Trending Reports:

Global Construction Stone Market https://www.maximizemarketresearch.com/market-report/global-construction-stone-market/64991/

Global Metal Nanoparticles Market https://www.maximizemarketresearch.com/market-report/global-metal-nanoparticles-market/32705/

Cases and Trays Market https://www.maximizemarketresearch.com/market-report/cases-and-trays-market/78850/

Global Boom Trucks Market https://www.maximizemarketresearch.com/market-report/global-boom-trucks-market/39039/

Spark Plug Market https://www.maximizemarketresearch.com/market-report/global-spark-plug-market/23937/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness