Saudi Arabia Ophthalmic Devices Market Demand Analysis, Share Trends and Outlook Report 2026-2034

Saudi Arabia Ophthalmic Devices Market Overview

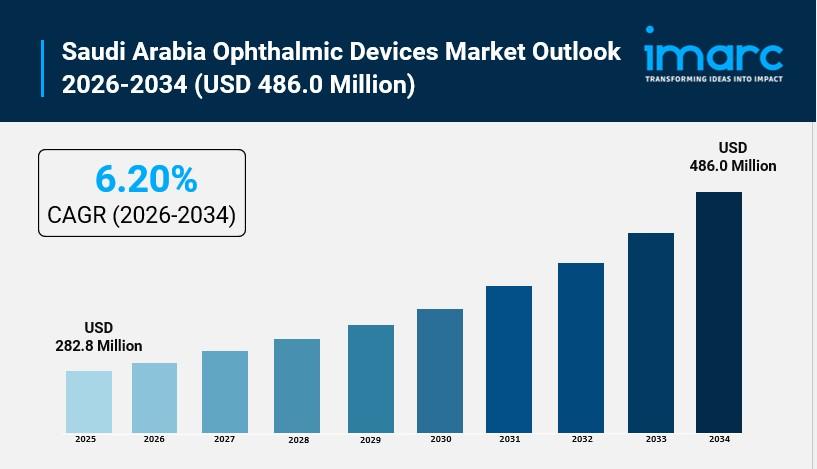

Market Size in 2025: USD 282.8 Million

Market Size in 2034: USD 486.0 Million

Market Growth Rate 2026-2034: 6.20%

According to IMARC Group's latest research publication, "Saudi Arabia Ophthalmic Devices Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia ophthalmic devices market size was valued at USD 282.8 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 486.0 Million by 2034, exhibiting a CAGR of 6.20% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Ophthalmic Devices Market

- AI-powered diagnostic imaging systems transform early detection of retinal diseases, enhancing accuracy in identifying diabetic retinopathy and macular degeneration across Saudi ophthalmology clinics.

- Machine learning algorithms optimize surgical planning for cataract and refractive procedures, improving precision and patient outcomes through advanced preoperative assessments and intraoperative guidance.

- Intelligent screening platforms enable automated detection of glaucoma and other eye conditions, expanding access to diagnostic services in remote and underserved areas throughout the Kingdom.

- AI-driven telemedicine solutions enhance remote ophthalmology consultations, allowing specialists to assess patients virtually and recommend appropriate treatment pathways efficiently across regions.

- Predictive analytics powered by artificial intelligence improve clinical decision-making by analyzing patient data patterns, reducing complications and enhancing personalized treatment protocols for eye diseases.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-ophthalmic-devices-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Ophthalmic Devices Industry

Saudi Arabia's Vision 2030 is revolutionizing the ophthalmic devices industry by prioritizing healthcare modernization, accessibility, and technological innovation across eye care services. The initiative drives unprecedented investments in specialized eye care infrastructure through the expansion of ophthalmology departments, establishment of dedicated eye hospitals, and integration of cutting-edge diagnostic and surgical equipment. With the government allocating substantial funding toward healthcare transformation and encouraging private sector participation through public-private partnerships, the ophthalmic devices market is experiencing exponential growth. Strategic initiatives promoting telemedicine, AI-based diagnostics, and advanced surgical training programs are positioning Saudi Arabia as a regional leader in ophthalmology innovation. The establishment of world-class training facilities, such as Alcon's first Experience Center in the Middle East and Africa located in Jeddah, demonstrates the Kingdom's commitment to developing local talent and integrating advanced ophthalmic technologies. Regulatory reforms streamlining device approvals, enhanced insurance coverage for eye procedures, and increased awareness campaigns about preventive eye care are making sophisticated ophthalmic treatments accessible to broader segments of the population. Ultimately, Vision 2030 elevates ophthalmic devices as a critical component of the Kingdom's healthcare transformation, addressing the rising prevalence of eye diseases while supporting the development of a knowledge-based economy focused on medical innovation and excellence in patient care.

Saudi Arabia Ophthalmic Devices Market Trends & Drivers:

Saudi Arabia's ophthalmic devices market is experiencing robust growth, primarily driven by technological advancements and the increasing prevalence of eye-related disorders across all age groups. Innovations such as high-resolution imaging systems, minimally invasive surgical instruments, and advanced diagnostic equipment including optical coherence tomography machines are enabling more accurate diagnosis and less invasive treatment options, fostering patient confidence and driving market demand. The widespread adoption of cutting-edge technologies like automated visual field testing, advanced phacoemulsification systems for cataract surgery, and sophisticated laser platforms for refractive procedures is transforming clinical practice standards throughout the Kingdom.

The aging regional population represents a significant driver for market expansion, as the elderly population continues to grow with life expectancy rising steadily. The prevalence of age-related eye diseases like cataracts, glaucoma, and age-related macular degeneration is increasing substantially, necessitating greater demand for surgical devices, diagnostic equipment, and vision correction solutions. The growing incidence of diabetes across Saudi Arabia is contributing to rising cases of diabetic retinopathy, further amplifying the need for advanced retinal imaging devices and treatment equipment. The heightened awareness of eye health importance and the availability of comprehensive insurance coverage for eye-related procedures have made eye care services more accessible to the general population, further propelling market growth.

Saudi Arabia Ophthalmic Devices Market Industry Segmentation:

The report has segmented the market into the following categories:

Devices Insights:

- Surgical Devices

- Diagnostic and Monitoring Devices

- Vision Correction Devices

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Ophthalmic Devices Market

- November 2025: The Saudi Ophthalmology Society Conference brought together thousands of regional and international ophthalmologists, fellows, residents, optometrists, and allied professionals in Riyadh, featuring lectures, workshops, wet-labs, live surgeries, and an exhibition showcasing cutting-edge ophthalmic technologies.

- September 2025: Major healthcare facilities across Saudi Arabia expanded their ophthalmology departments with new diagnostic equipment and surgical platforms, supporting the growing demand for specialized eye care services in urban centers.

- August 2025: Healthcare authorities in Saudi Arabia continued implementing initiatives to raise public awareness about common eye diseases, preventive care, and the importance of regular eye examinations across all age groups.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness