United States Biologics Market Size, Share, Industry Overview, Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled “United States Biologics Market Size, Share, Trends and Forecast by Source, Product, Disease, Manufacturing and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

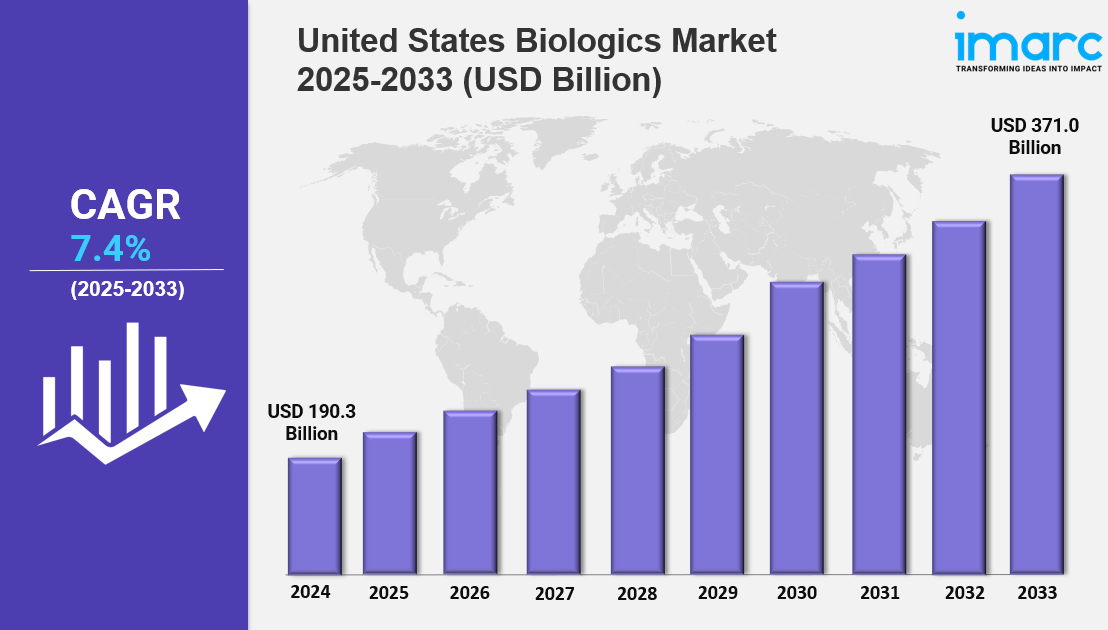

The United States Biologics Market Size was valued at USD 190.3 Billion in 2024 and is expected to reach USD 371.0 Billion by 2033. This market is forecasted to grow at a CAGR of 7.4% during 2025-2033. Key market drivers include advancements in bioprocessing technologies, expansion of biosimilars for affordability, and increasing integration of AI in biologics discovery and manufacturing.

Study Assumption Years

-

Base Year: 2024

-

Historical Year/Period: 2019-2024

-

Forecast Year/Period: 2025-2033

United States Biologics Market Key Takeaways

-

Current Market Size: USD 190.3 Billion in 2024

-

CAGR: 7.4% (2025-2033)

-

Forecast Period: 2025-2033

-

The market growth is driven by innovations in biotechnology including therapies like monoclonal antibodies and gene therapies.

-

Chronic diseases affecting 129 million Americans fuel demand for biologics addressing complex health needs.

-

FDA support with frameworks like fast-track approvals accelerates new biologics introduction.

-

The adoption of personalized and precision medicine is reshaping treatment approaches and outcomes.

-

Bioprocessing technology advancements improve manufacturing scalability and efficiency.

Sample Request Link: https://www.imarcgroup.com/united-states-biologics-market/requestsample

United States Biologics Market Growth Factors

Advancements in Biotechnology and Chronic Disease Burden

The U.S. biologics market growth is propelled by continuous biotechnology innovations enabling the development of monoclonal antibodies, gene therapies, and biosimilars. According to the CDC, about 129 million Americans suffer from at least one chronic disease, with 42% managing two or more and 12% experiencing five or more conditions. Chronic diseases contribute to 90% of the healthcare expenditure worth USD 4.1 trillion annually, emphasizing the need for effective biologics. Pharmaceutical and biotech companies are increasing R&D investments to develop next-generation treatments, supported by FDA’s fast-track approval mechanisms that speed up market access for breakthrough therapies.

Expansion of Biosimilars and Bioprocessing Technologies

The rising adoption of biosimilars in the U.S. biologics market addresses cost-effectiveness and affordability barriers. The FDA’s Biosimilar Approval Pathway facilitates easier market entry and competition, which lowers treatment costs for conditions like cancer and autoimmune disorders. For instance, the July 2, 2024, rolling BLA submission by Sobi for SEL-212 targets chronic refractory gout patients. Additionally, the market benefits from rapid adoption of bioprocessing technologies such as single-use bioreactors and continuous manufacturing, enhancing production efficiency and scalability. Rentschler Biopharma’s Milford facility doubling cGMP capacity with 2,000L single-use bioreactors exemplifies this trend, reducing manufacturing costs and improving product accessibility.

Integration of Artificial Intelligence (AI) in Biologics Development

AI is transforming biologics development by accelerating drug discovery, optimizing clinical trials, and improving manufacturing processes. AI platforms analyze vast datasets to identify promising biologic candidates while shortening development timelines and reducing costs. AI also enhances clinical trial efficiency through real-time patient recruitment, data monitoring, and outcome prediction. In manufacturing, AI supports quality control, predictive maintenance, and workflow optimization. Collaborations between tech firms and biopharma companies are expanding AI applications, fueling innovation and increasing patient access to advanced therapies.

United States Biologics Market Segmentation

Analysis by Source:

-

Microbial: Microbial systems, including E. coli and yeast, are key for large-scale production of recombinant proteins, enzymes, and vaccines due to rapid growth and cost-effectiveness. Synthetic biology advancements further improve microbial biologic precision and efficiency.

-

Mammalian: Critical for complex biologics like monoclonal antibodies and cell therapies, mammalian systems such as CHO cells provide superior post-translational modifications, bioactivity, and human compatibility, despite higher resource demands.

-

Others

Analysis by Product:

-

Monoclonal Antibodies: Dominant therapies for cancer, autoimmune diseases, and infections, with innovations like antibody-drug conjugates and bispecific antibodies.

-

Vaccines: Rapidly growing segment driven by mRNA technology advances and pandemic preparedness, including COVID-19 vaccines and developing cancer and personalized vaccines.

-

Recombinant Proteins: Used for diabetes, anemia, and growth disorders treatment, enhanced by protein engineering; biosimilars improve accessibility.

-

Antisense, RNAi and Molecular Therapy: Not provided in source.

-

Others

Analysis by Disease:

-

Oncology: Leading segment due to high cancer incidence; includes monoclonal antibodies, immune checkpoint inhibitors, CAR-T cell therapies, and personalized medicine.

-

Immunological Disorders: Growing demand for treatments targeting rheumatoid arthritis, psoriasis, and inflammatory bowel disease via cytokine inhibitors, TNF blockers, and biosimilars.

-

Cardiovascular Disorders: Increasing use of biologics such as PCSK9 inhibitors for cholesterol regulation and regenerative therapies, supported by growing investments.

-

Hematological Disorders: Not provided in source.

-

Others

Analysis by Manufacturing:

-

Outsourced: Growing reliance on contract research and manufacturing organizations for cost-effective, compliant, and scalable production, particularly for emerging therapies like biosimilars and gene therapies.

-

In-House: Maintains control over processes, quality, and intellectual property; large firms invest in advanced facilities for high-value biologics, sustaining innovation and flexibility despite higher costs.

Regional Analysis:

-

Northeast: Driven by biotech and pharma hubs in Massachusetts and New York, supported by strong R&D infrastructure, skilled workforce, and regulatory support.

-

Midwest: Rapidly growing biologics manufacturing with strong pharmaceutical bases in Illinois and Indiana, boosted by technology investments and government incentives.

-

South: Major biopharma companies and favorable climates in North Carolina and Texas spur clinical trials, research, and health infrastructure development.

-

West: Dominates biologics innovation, especially California with Silicon Valley biotech and research centers, strong venture capital, and focus on personalized medicine and sustainability.

Regional Insights

The West region, particularly California, dominates the United States biologics market with leadership in innovation such as CAR-T cell therapies and mRNA vaccines. Supported by Silicon Valley biotechnology firms, research institutions, strong venture capital, and collaborative ecosystems, the West is at the forefront of personalized medicine and sustainability. This positions the region as a key driver shaping the future of biologics and healthcare in the U.S.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=20441&flag=C

Recent Developments & News

-

September 27, 2024: The FDA approved Dupixent (dupilumab) as the first biologic for inadequately controlled COPD with an eosinophilic phenotype. Phase 3 trials demonstrated a 34% reduction in exacerbations, lung function improvement, and enhanced quality of life.

-

February 29, 2024: Biocon Biologics Ltd signed a settlement and license agreement with Janssen Biotech to commercialize Bmab 1200, a biosimilar to Stelara (Ustekinumab), in the U.S. starting February 2025, pending FDA approval. Stelara is a USD 7 billion medication treating immune diseases like psoriasis and Crohn’s disease.

Key Players

-

Galapagos NV

-

Blood Centers of America

-

Rentschler Biopharma

-

Sobi

-

Biocon Biologics Ltd

-

Janssen Biotech

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness