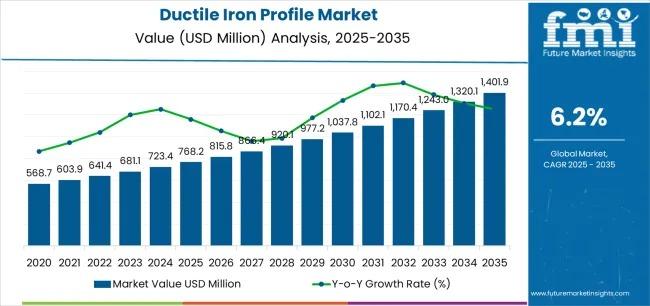

Ductile Iron Profile Market to Surpass USD 1,401.9 million by 2035

The global Ductile Iron Profile Market is entering a decade of strong expansion, fueled by rapid infrastructure development, rising automotive output, and increasing adoption of high-performance metallic materials across industries. According to recent assessments, the market is forecast to grow from USD 768.2 million in 2025 to USD 1,401.9 million by 2035, advancing at a 6.2% CAGR. This trajectory reflects a widespread shift toward materials that combine strength, durability, and cost efficiency—attributes that position ductile iron profiles as an indispensable industrial component.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates

https://www.futuremarketinsights.com/reports/sample/rep-gb-28406

Growing global emphasis on reliable municipal infrastructure—especially water supply, sewage management, and transportation networks—continues to amplify the use of ductile iron profiles due to their superior corrosion resistance and long service life. From pipelines and valves to heavy machinery and automotive systems, ductile iron provides the mechanical strength and performance characteristics required for high-stress environments.

Market Momentum Driven by Industrial Expansion

Between 2025 and 2030, the market is projected to add USD 269.6 million, reaching USD 1,037.8 million. This 35% rise is closely linked to widespread infrastructure upgrades in developing economies and increased deployment of high-strength components in manufacturing and transportation.

From 2030 to 2035, the industry will see an even stronger rise—adding USD 364.1 million—as industrial automation, advanced machining technologies, and sustainability-focused manufacturing practices boost demand for ductile iron profiles across sectors.

Automotive manufacturers continue to rely heavily on ductile iron for engine components, crankshafts, suspension systems, and structural parts due to its favorable strength-to-weight ratio and resistance to vibration and impact. As OEMs improve efficiency and transition toward next-generation electric vehicle platforms, high-performance ductile iron components remain essential.

Why Ductile Iron Profiles Are Gaining Ground

Multiple sectors are contributing to the market’s upward trend:

- Automotive: Accounts for nearly 30% of market share. Ductile iron’s machinability, fatigue strength, and shock absorption make it a preferred material for critical vehicle components.

- Construction and Infrastructure: Increasing investments in water distribution systems, drainage networks, and municipal engineering projects accelerate demand for corrosion-resistant, long-lasting materials.

- Machinery & Energy: Heavy-duty applications such as turbines, machine frames, power transmission parts, and industrial equipment rely on ductile iron’s structural stability and wear resistance.

Advancements in continuous casting and heat-treatment technologies are enabling manufacturers to meet evolving performance requirements while reducing operational costs. Additionally, sustainability initiatives favor ductile iron due to its compatibility with recycled raw materials and circular manufacturing models.

Round Profiles Lead the Market

The round profile segment represents nearly 50% of global revenue, driven by strong demand in automotive and construction where load-bearing capacity and precision casting are essential. Their versatility and ability to withstand high pressure and vibration make round profiles the dominant choice across industrial applications.

Regional Growth Outlook

The global market landscape remains diverse, with emerging economies leading growth:

- China: Expected CAGR of 8.4%, strengthened by massive infrastructure spending and a robust automotive manufacturing base.

- India: Growing at 7.8%, driven by rapid urbanization, heavy machinery production, and domestic foundry expansion.

- Germany: Advancing at 7.1%, supported by advanced engineering, automation, and strong industrial equipment demand.

- Brazil: Projected CAGR of 6.5%, reflecting increased infrastructure activity and machinery manufacturing.

- USA & UK: Moderate but steady growth (5.9% and 5.3%), driven by advanced automotive and industrial sectors.

- Japan: Slower but stable expansion at 4.7%, reflecting competition with alternative lightweight materials.

Competitive Landscape

The ductile iron profile market is competitive and innovation-driven, with major players investing in automation, sustainable production, and customized high-performance solutions. Leading companies include:

- United Cast Bar Group

- Dura-Bar

- BIRN Group

- ACO Eurobar

- Hitachi Metals

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Musik

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness