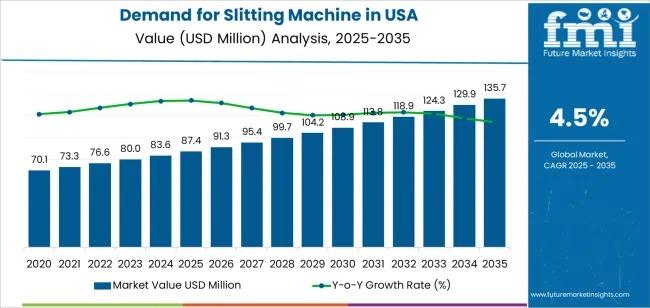

USA Slitting Machine Market to Surpass USD 135.7 million by 2035

The United States is entering a decisive phase of manufacturing modernization, with rapidly rising investments in advanced cutting technologies, automated processing lines, and precision-driven production systems. According to latest projections, the Demand for Slitting Machine in USA is set to increase from USD 87.4 million in 2025 to USD 135.7 million by 2035—expanding at a robust 4.5% CAGR. This growth reflects expanding material accuracy requirements, accelerated Industry 4.0 integration, and a heightened nationwide focus on production quality and operational efficiency.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates:

https://www.futuremarketinsights.com/reports/sample/rep-gb-28373

Manufacturing Transformation Fuels Adoption of Advanced Slitting Technologies

Demand is projected to rise 1.53X between 2025 and 2035, with metal slitting machines accounting for a commanding 65.8% share in 2025. These systems remain essential across large-scale steel, aluminum, and fabrication operations, particularly in Midwest and West Coast industrial corridors. Their ability to deliver consistent slit widths, repeatable tolerances, and seamless integration with coil-handling systems makes them indispensable in modern production environments.

Metal processing leads all applications with a 47.3% share, driven by automotive, construction, and appliance production—sectors where dimensional accuracy and repeatability are non-negotiable. Over the next decade, the shift toward automated workflows, modular system architectures, and digitally enabled slitting lines will continue accelerating plant-wide modernization.

Growth Outlook: 2025–2030 and 2030–2035

Between 2025 and 2030, the market is forecast to add USD 19.8 million in new value, capturing 42.6% of the decade’s total expansion. This stage will be defined by factory upgrades, smart-manufacturing pilot deployments, and strategic retrofitting to replace manual cutting processes.

From 2030 to 2035, growth accelerates further as fully integrated automation platforms, advanced cutting algorithms, and IoT-enabled controls gain widespread adoption. This phase adds USD 26.7 million—representing 57.4% of overall growth.

Why Demand Is Rising: Key Drivers

- Industry 4.0 acceleration: Advanced sensors, automated controls, and real-time monitoring systems are elevating precision standards.

- Manufacturing efficiency mandates: Federal and state industrial modernization programs are expanding adoption of automated cutting systems.

- Quality compliance pressures: Automotive, aerospace, and electronics manufacturers are prioritizing precision tooling for better tolerance control.

- Retrofitting momentum: Large-scale manufacturing facilities are integrating modern slitting platforms without replacing entire systems.

Opportunity Pathways: Where Growth Will Concentrate

- Automation & Metal Processing (USD 18.7–28.3M opportunity): Scaling automated cutting in metal processing lines.

- Smart Manufacturing Integration (USD 15.2–23.0M): Demand for IoT-connected slitting systems.

- Precision Control Technologies (USD 12.8–19.4M): Advanced tooling to ensure uniform material quality.

- Modular, Scalable Platforms (USD 16.5–25.0M): Adoption of configurable slitting architectures.

- Industry-Specific Customizations (USD 11.3–17.1M): Tailored solutions for mission-critical applications.

- Service Networks & Support (USD 9.8–14.8M): Growing demand for lifecycle support, installation, and optimization.

Regional Dynamics: Midwest Leads Growth Momentum

The Midwest is set to dominate national demand with a 4.8% CAGR through 2035, driven by strong metal processing clusters and extensive manufacturing infrastructure. The West Coast follows at 4.6% CAGR due to its innovation ecosystem and technology-driven production base.

The South and Northeast continue expanding at 4.4% and 4.2% CAGR respectively, supported by new manufacturing investments, automotive operations, and diversified industrial capabilities.

Competitive Landscape: Technology Strength Defines Market Leaders

Key companies shaping the U.S. slitting machine sector include:

Fimi Group, GEORG, Burghardt+Schmidt GmbH, FAGOR ARRASATE, DELISH MACHINE, HCI Converting Equipment, Weitai Machinery, Wuxi Bangzhou Machinery Manufacturing, Wuxi Weihua Machinery, and Taiyuan Huaxincheng Electromechanical Equipment.

Top players are prioritizing automation integration, precision enhancement, modular solutions, and long-term service partnerships to strengthen market presence.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness