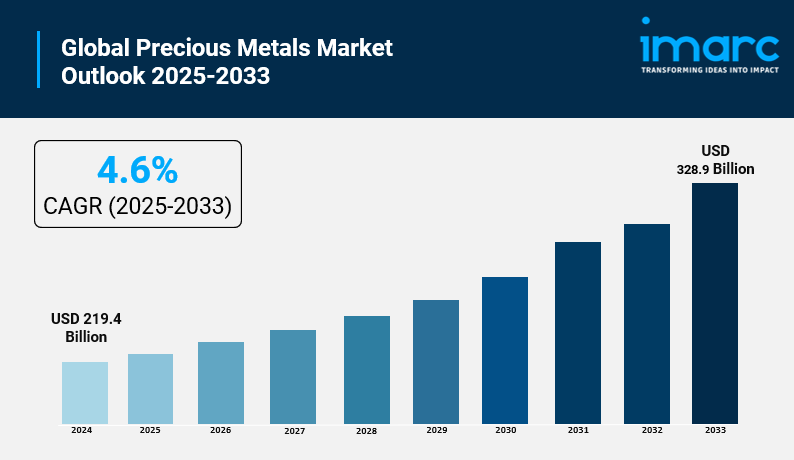

Precious Metals Market is Projected to Reach USD 328.9 Billion by 2033

The global precious metals market was valued at USD 219.4 Billion in 2024 and is projected to reach USD 328.9 Billion by 2033. The market is expected to grow at a CAGR of 4.6% during the forecast period 2025-2033. Asia Pacific leads the market due to increased investments, broad industrial applications, and strong demand for minting coins.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Precious Metals Market Key Takeaways

- Current Market Size: USD 219.4 Billion in 2024

- CAGR: 4.6% from 2025-2033

- Forecast Period: 2025-2033

- The Asia Pacific region currently dominates the precious metals market share driven by jewelry, investment, and industrial applications demand.

- Investment demand increases as precious metals are favored safe-haven assets amid economic uncertainty.

- Gold leads the market, supported by ETFs and central bank reserves.

- Jewelry industry growth is fueled by cultural significance and increased disposable incomes, especially in emerging economies.

- Industrial consumption of precious metals has risen in electronics, automobile, and renewable energy sectors.

Get your Sample of Market Insights for Free: https://www.imarcgroup.com/precious-metals-market/requestsample

Market Growth Factors

The precious metals market is largely driven by the rising investment demand, particularly during times of economic uncertainty. Precious metals such as gold and silver are considered as safe-haven assets due to the fears of inflation, currency devaluation, and world instability. The instability of traditional markets makes investors turn to these metals, which is further encouraged by the popularity of exchange-traded funds (ETFs) and other financial instruments that provide easier access to these metals.

Inflated investments in precious metals, including gold and silver, can be attributed to their limited supply and ability to retain value over a long period. This is further fueled by the use of gold as a store of value by the major investors during times of geopolitical tensions and economic uncertainties. For instance, Barrick Gold extended the life of its Tongon project mine from 2021 to 2026 due to positive exploration and mining results.

One of the great contributors to the increase in demand for precious metals is the use of the metals in the manufacture of jewelry and decorative items. Their beauty and durability make them perfect for rings, bracelets, and necklaces. Transition in consumers' preference towards modern styles, increase in disposable incomes in the developing economies, and new advanced jewelry by the leading market players are some of the factors that support this demand. According to the U.S. Census Bureau, the imports of precious metals have surged sharply, and alloys of gold and silver are indispensable in the plated jewelry for corrosion resistance.

Market Segmentation

By Metal Type:

- Gold: Jewelry, Investment, Technology, Others

- Platinum: Auto-catalyst, Jewelry, Chemical, Petroleum, Medical, Others

- Silver: Industrial Application, Jewelry, Coins and Bars, Silverware, Others

- Palladium: Auto-catalyst, Electrical, Dental, Chemical, Jewelry, Others

By Application:

- Jewelry

- Investment

- Electricals

- Automotive

- Chemicals

- Others

Regional Insights

Asia Pacific leads the precious metals market in 2024, contributing to the largest market share. The leadership of the region is due to strong demand in the areas of jewelry, investment, and industrial applications. The major consumers like China and India show high consumption through cultural affinity and increasing disposable incomes. The rising middle class in APAC is investing heavily in precious metals as a safe measure against economic instability. Besides that, the industrial sectors such as electronics, automotive, and renewable energy are also contributing to the rising demand. The central banks in APAC are also accumulating gold reserves, which is strengthening the region's dominant position.

Recent Developments & News

- In December 2024, Delaware Depository expanded operations by opening a new facility in Pennsylvania to enhance precious metals custody services.

- In March 2024, the World Gold Council highlighted March as pivotal for gold due to the FOMC meeting and Iranian elections affecting U.S. interest rates.

- In November 2023, Sibanye-Stillwater signed an agreement to acquire Reldan, a Pennsylvania-based metal recycler focused on recovering platinum and palladium.

- In October 2023, Anglo-American partnered with BMW Group South Africa and Sasol South Africa Limited to support hydrogen fuel-cell electric vehicle development, supplying platinum group metals.

Key Players

- Anglo American Platinum Limited

- AngloGold Ashanti

- Barrick Mining Corporation

- First Majestic Silver Corp

- Freeport-McMoRan

- Fresnillo Plc

- Gold Fields Limited

- Harmony Gold Mining Company Limited

- Kinross Gold Corporation

- Newmont Corporation

- Pan American Silver Corp.

- PJSC Polyus

- Randgold & Exploration Company Limited

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask Our Expert & Browse Full Report with TOC & List of Figures:https://www.imarcgroup.com/request?type=report&id=2351&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness