Automotive 48V System Market Trends Transforming Vehicle Electrification 2032

Global Automotive 48V System Market (2025–2032): Innovations Driving the Transition to Efficient Mobility

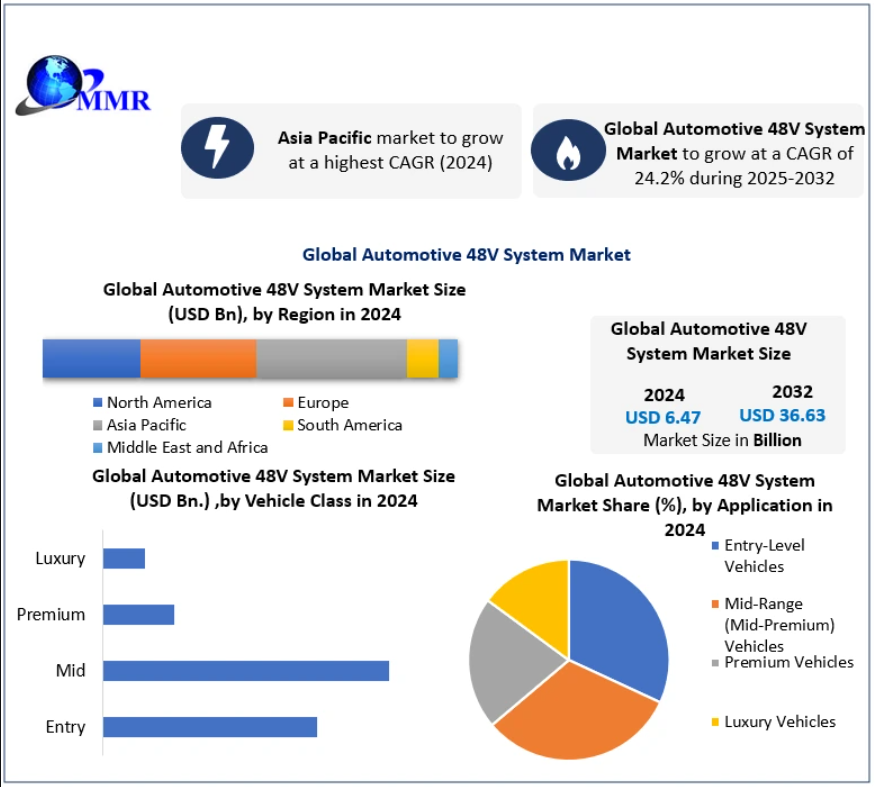

The Global Automotive 48V System Market, valued at USD 6.47 billion in 2024, is on track to reach nearly USD 36.63 billion by 2032, expanding at a strong CAGR of 24.2% during the forecast period. The accelerated shift toward low-emission mobility, regulatory pressure from governments, and mounting OEM commitment to hybridization are pushing 48V systems to the forefront of next-generation vehicle development.

Market Overview

The automotive 48V system represents an advanced vehicle electrical architecture that complements the conventional 12V system, enabling enhanced power delivery and improved efficiency without crossing the 60V safety threshold. This voltage architecture supports a range of high-demand automotive applications including:

- Integrated starter-generators

- Regenerative braking

- Electric compressors

- Active chassis systems

- Electrified turbochargers

- Electric water pumps and power steering

By enabling mild hybridization at a lower cost compared to full hybrids, 48V systems are emerging as the most commercially viable bridge between internal combustion engine (ICE) vehicles and fully electric models.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/190376/

Key Market Drivers

- Global Emission Regulations Fueling Adoption

Governments worldwide are tightening emission standards to curb CO₂ pollution.

- The European Commission is targeting a 37.5% reduction in emissions by 2030, compelling OEMs to adopt 48V solutions to enhance fuel economy.

- Automakers like Audi pioneered the integration of 48V systems with models such as the SQ7, leveraging electric turbos and 48V-powered active suspension systems.

- Rising Mild Hybrid Vehicle Deployment

48V systems are central to the rising adoption of mild hybrid electric vehicles (MHEVs).

Major suppliers—including Bosch, Continental, Delphi, Valeo, and Gustanski—are scaling production of 48V architectures. Vehicles such as the Mercedes-Benz GLE580 and Audi Q8 highlight industry-wide momentum.

- Electrification & Efficiency Demands

The trend toward high-efficiency, lightweight electrical architectures is accelerating:

- Tesla’s Cybertruck uses a 48V architecture to reduce wiring complexity and electrical losses.

- 48V systems allow thinner wiring, reduced vehicle weight, and enhanced power management for auxiliary systems.

- Growing Demand in Emerging Markets

In densely populated countries—particularly in Asia-Pacific—low-powered BEVs and hybrid systems are gaining popularity due to congested traffic environments and rising fuel prices.

Market Challenges

Despite strong growth prospects, the market faces several obstacles:

- High System Cost: Incorporating 48V components increases upfront vehicle costs.

- Complex Integration: Retrofitting 48V systems into existing ICE platforms requires substantial engineering expertise.

- Battery Limitations: Current 48V battery technology faces challenges related to energy density, charging time, and long-term durability.

- Limited 48V Infrastructure: Recycling facilities, service networks, and specialized repair ecosystem still need expansion.

Segment Analysis

By Architecture

- Belt-Driven (P0 Architecture) – 45% Share in 2024

The P0 (belt-driven) layout dominates due to its:

- Low cost

- Minimal vehicle architecture changes

- Ease of installation

This system behaves like a larger alternator and offers notable braking energy regeneration and efficient engine start performance.

Other architectures include:

- P1 (Crankshaft Mounted)

- P2 (Input Shaft of Transmission)

- P4 (Rear Axle Mounted)

By Vehicle Class

- Mid-segment vehicles hold the largest share (42%), as they offer the best balance between affordability and advanced electrical integration.

- Luxury and premium vehicles are rapidly adopting 48V systems for enhanced driving dynamics.

Regional Insights

Asia-Pacific – Market Leader with ~60% Share

Asia-Pacific dominates the market due to:

- Strong presence of automotive giants

- Rising EV and hybrid vehicle adoption

- Government support, subsidies, and emission goals

India’s EV adoption is rising sharply, with 1.16 million EVs sold in March 2023 alone. Subsidies such as ₹5000 per kWh (up to ₹1.5 lakh) in states like Maharashtra are boosting hybrid and electrification adoption.

Europe – 25% Market Share & Strong Growth Ahead

Europe remains a key innovation hub driven by:

- Stringent CO₂ reduction norms (95 g/km targets)

- Heavy investments in electrification R&D

- Collaborations such as the ADEPT 48V mild hybrid project, involving Ford, Ricardo, CPT, Faurecia, and the University of Nottingham.

North America, Middle East & Africa, South America

These regions are witnessing gradual uptake as automakers shift toward cleaner, more efficient vehicle portfolios.

To know the most attractive segments, click here for a free sample of the report:https://www.maximizemarketresearch.com/request-sample/190376/

Competitive Landscape

The market is moderately consolidated and features global leaders in automotive systems, semiconductors, batteries, and power electronics.

Recent Strategic Moves

- Peugeot (Stellantis) launched a 48V hybrid system offering 15% better fuel economy (Feb 2023).

- Infineon acquired GaN Systems for USD 830 million, boosting their power semiconductor portfolio (Oct 2023).

- General Motors, Ford, and Stellantis reduced EV prices to advance mass adoption (2023–2024).

- Mercedes-Benz is expanding its hybrid lineup with 2024 GLE variants using 48V architecture.

Key Companies

- Continental AG

- Robert Bosch GmbH

- Schaeffler AG

- MAHLE GmbH

- ZF Friedrichshafen AG

- Infineon Technologies AG

- BorgWarner

- Lear Corporation

- Denso Corporation

- Valeo SA

- Delphi Technologies

- Samsung SDI

- Aptiv PLC

…and more.

Conclusion

The Automotive 48V System Market is at the heart of the global transition to cleaner, more efficient mobility. As governments tighten regulations and OEMs strive for cost-effective hybridization solutions, 48V architecture is emerging as a strategic technology bridging today’s combustion engines and tomorrow’s electric future.

With rapid advancements in power electronics, battery systems, and lightweight component engineering, the market is set for exponential growth through 2032.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Musik

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness