North America Data Center Server Market Size, Share, In-Depth Analysis, Opportunity and Forecast 2025-2033

IMARC Group has recently released a new research study titled “North America Data Center Server Market Size, Share, Trends and Forecast by Product, Application, and Country, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

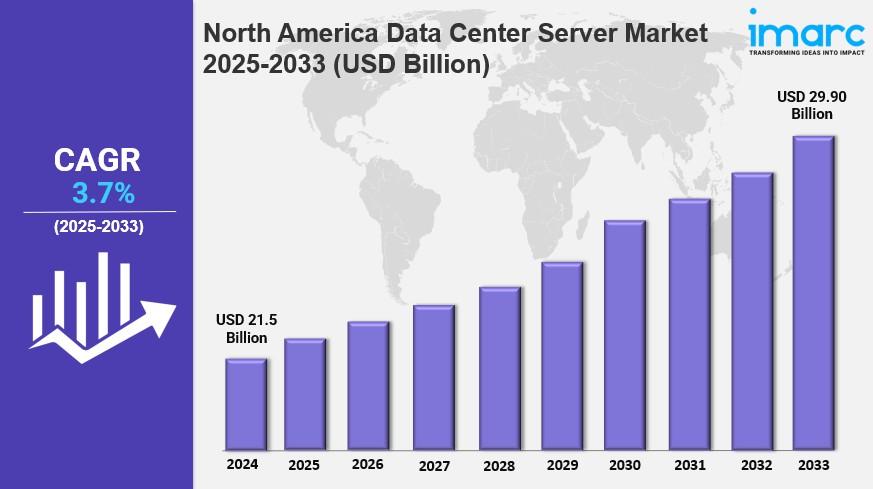

The North America data center server market size was valued at USD 21.5 Billion in 2024 and is projected to reach USD 29.90 Billion by 2033, growing at a CAGR of 3.7% during the forecast period 2025-2033. Growth is driven by accelerated cloud adoption, AI and ML demand, energy-efficient technologies, and a need for scalable and secure infrastructure.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

North America Data Center Server Market Key Takeaways

● Current Market Size: USD 21.5 Billion in 2024

● CAGR: 3.7% (2025-2033)

● Forecast Period: 2025-2033

● The U.S. leads the market in North America due to robust IT infrastructure and substantial investments in cloud computing and data centers.

● Market growth is fueled by increasing cloud adoption, AI, ML applications, energy-efficient technologies, and demand for scalable infrastructure.

● Rack servers dominate the product segment owing to high density, scalability, and cost-effectiveness.

● Commercial applications lead market demand driven by digital transformation and rising data processing needs.

● Expansion of edge data centers and advancements in liquid cooling technologies support market growth.

● Strong government initiatives and AI infrastructure investments in North America bolster the server market.

Sample Request Link: https://www.imarcgroup.com/north-america-data-center-server-market/requestsample

Market Growth Factors

The accelerating need for high-performance computing alongside the widespread adoption of cloud services is significantly driving North America data center server market demand across enterprise and hyperscale infrastructure segments. Organizations increasingly migrate workloads to cloud-based infrastructures which require scalable, energy-efficient, and high-speed servers. Hyperscale cloud providers and large enterprises are investing heavily in advanced server architectures to support their cloud ecosystems. This is complemented by hybrid and multi-cloud strategies and an emphasis on software-defined infrastructure, edge computing, and colocation facilities, fueling server deployments across sectors.

Artificial intelligence and machine learning applications are major growth drivers, leading businesses to deploy high-density computing solutions such as GPUs and custom-built processors specifically optimized for AI workloads. The advent of 5G networks, Internet of Things (IoT) applications, and real-time data analytics further heighten the need for low-latency, high-performance servers able to process large volumes of data swiftly. Notable innovations like NVIDIA’s Blackwell platform enable real-time generative AI with significantly reduced cost and energy consumption, showcasing technological advances that stimulate market growth.

Energy efficiency concerns and sustainability initiatives also strongly influence market dynamics. Governments and enterprises prioritize ecofriendly data center infrastructures through adoption of liquid cooling, energy-efficient processors, and modular server designs that consume less power. Organizations implement AI-driven workload management to optimize power utilization and reduce environmental impact. For example, Microsoft’s launch of the Azure Boost DPU with four times better performance and three times lower power consumption exemplifies the push toward greener, efficient server technology. Moreover, stringent security and compliance demands drive procurement of secure, trusted server architectures to counteract rising cyber threats, ensuring data integrity and operational continuity.

To get more information on this market Request Sample

Market Segmentation

Analysis by Product:

● Rack Servers: High density, scalability, and efficiency make rack servers dominant. Suitable for large IT infrastructures, they optimize space with a modular design, offering cost-effectiveness and easy expansion for growing workloads in telecom, cloud computing, and e-commerce.

● Blade Servers

● Micro Servers

● Tower Servers

Analysis by Application:

● Industrial

● Commercial: Commercial sector leads demand driven by digital transformation and extensive use of cloud, big data analytics, and AI. Businesses require scalable IT solutions for operational efficiency, customer experience, and cost savings amid growing e-commerce and online services.

Regional Insights

The United States dominates the North America data center server market, driven by its advanced IT infrastructure, significant investments in cloud computing, and a high concentration of hyperscale cloud providers. U.S. enterprises extensively deploy data center servers to support AI, ML, big data analytics, and digital transformation across retail, finance, healthcare, and manufacturing. Government initiatives and the expansion of 5G and IoT networks further amplify server adoption. This leadership positioning underlines the U.S. as the key market within the region.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=1803&flag=C

Recent Developments & News

● October 2024: AMD launched 5th Gen EPYC processors with "Zen 5" core architecture, delivering up to 2.7X better performance for AI, cloud, and enterprise workloads with up to 192 cores and 5GHz boost frequencies.

● September 2024: NVIDIA prepared to introduce its next-generation AI chip, Blackwell, designed for data centers, offering significant performance improvements in AI training and inference.

● September 2024: Microsoft, along with BlackRock, Global Infrastructure Partners, and MGX, launched the Global AI Infrastructure Investment Partnership to invest up to $100 billion in U.S. data centers and power infrastructure.

● June 2024: Intel launched Sierra Forest Xeon processors with up to 288 E-cores optimized for AI, infrastructure, and 5G workloads, aligned with its "AI Everywhere" vision. Granite Rapids-D, for edge computing, expected in 2025 with enhanced vRAN Boost features.

Key Players

● AMD

● NVIDIA

● Microsoft

● Intel

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness