Mexico Electric Vehicle Battery Market Size, Share, Industry Overview, Trends and Forecast 2025-2033

IMARC Group has recently released a new research study titled “Mexico Electric Vehicle Battery Market Size, Share, Trends and Forecast by Battery Type, Propulsion Type, Vehicle Type, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

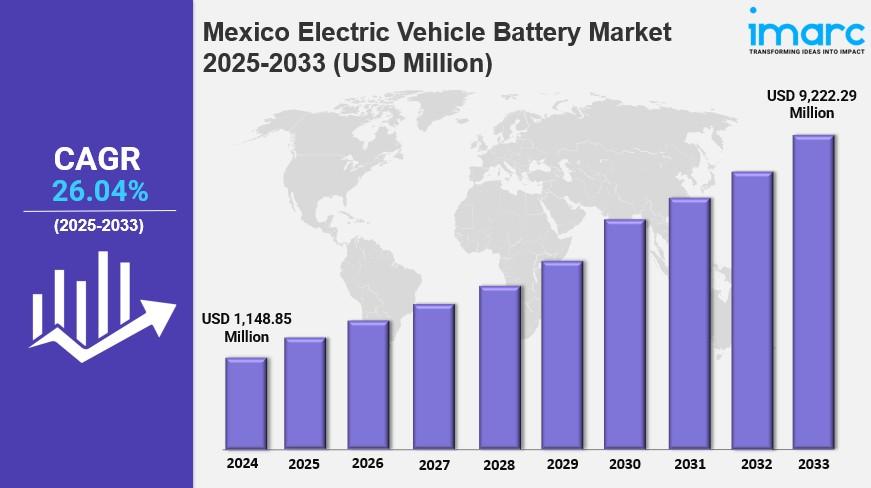

The Mexico electric vehicle battery market size was valued at USD 1,148.85 Million in 2024 and is projected to reach USD 9,222.29 Million by 2033, growing at a CAGR of 26.04% from 2025 to 2033. Market growth is driven by supportive government policies, climate-aligned investment incentives, and increasing focus on localized production and supply chains for EV components such as lithium.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

Mexico Electric Vehicle Battery Market Key Takeaways

● Current Market Size: USD 1,148.85 Million in 2024

● CAGR: 26.04% (2025-2033)

● Forecast Period: 2025-2033

● Government incentives, tax regulations, and climate goals are accelerating EV battery sector growth in Mexico.

● Localization of supply chains is reducing import dependence and promoting domestic manufacturing of lithium and cathode materials.

● Mexico developed affordable domestic EVs, "Olinia," to compete with foreign low-cost models, emphasizing local component production.

● Significant investment in EV infrastructure and renewable energy is supporting market expansion.

Sample Request Link: https://www.imarcgroup.com/mexico-electric-vehicle-battery-market/requestsample

Market Growth Factors

Government policies for sustainable transport, such as tax reductions, clearly defined operating standards, and various incentives for domestic and foreign investment in battery production facilities and charging stations in Mexico, have helped drive the Mexico electric vehicle battery market growth. In conjunction with international climate action targets, the emissions reductions commitments form a favorable environment for the Mexico EV market. Trade agreements with other countries further tie Mexico's role in the global supply chain for electric vehicles, as does public funding for EV charging infrastructure and renewable energy incentives. An example of this is a 2025 award to Nuvve Holding Corp to help support zero emission vehicle goals and infrastructure.

Through the current transition to domestic EV production, Mexico hopes to localize supply chains to reduce import dependence and make production more competitive, potentially localizing battery production and the extraction of lithium, nickel and cobalt produced by Mexico directly through local suppliers. Increasing domestic capacity lowers production costs and supports energy security and economic stability. Other complementary national policies target expanding industrial innovation, increasing job creation and stimulating consistent investment throughout the EV industry. Indigenous resources with technological advancements enable Mexico to compete in the global EV market.

This local approach also encourages that people produce local battery technology. It makes EV adoption feasible plus attractive to various consumer groups across the country. The "Olinia" budget EV came out in 2024. This showed that Mexico was not just happy to compete against cheaper imports. Mexico was developing prototypes and ensuring local supplies for key EV components like lithium. Expanding infrastructure, increasing industrial output, and continuing development of the EV battery market signal Mexico's important role in sustainable transportation.

To get more information on this market Request Sample

Market Segmentation

Battery Type:

● Lithium-Ion Battery: The market includes lithium-ion batteries, recognized for their high energy density and widespread use in EVs.

● Nickel-Metal Hydride Battery: These batteries are analyzed for their historic use and presence in EV formulations.

● Lead-Acid Battery: The report evaluates lead-acid batteries as a segment with distinct market share.

● Others: Includes all other battery types used in electric vehicles.

Propulsion Type:

● Battery Electric Vehicles: Fully electric vehicles powered solely by batteries.

● Plug-in Hybrid Electric Vehicles: Vehicles that combine battery power with a combustion engine and can be plugged in for charging.

● Hybrid Electric Vehicles: Conventional hybrids using both engine and battery for propulsion.

Vehicle Type:

● Passenger Car: Electric vehicle batteries used in personal passenger vehicles.

● Commercial Vehicles: EV batteries deployed in buses, trucks, and other commercial transport.

● Two-Wheeler: Batteries used in electric motorcycles and scooters.

Regional Insights

The report segments the market by regions including Northern Mexico, Central Mexico, Southern Mexico, and others. Specific market share or CAGR details per region are not provided explicitly in the source. Thus, the dominant region or related statistics are: Not provided in source.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=33024&flag=C

Recent Developments & News

In December 2024, Audi announced the construction of its first battery assembly plant outside Germany in Puebla, Mexico, producing over 300 high-voltage battery packs daily for the Audi Q8 e-tron with energy-saving and heat recovery technologies.

In October 2024, BMW revealed an $800 million expansion of its San Luis Potosí plant to commence lithium battery production by the end of 2025, targeting 140,000 battery packs annually and supporting EV production with sustainability goals of an 80% reduction in CO2 emissions per vehicle by 2030.

Key Players

● Audi

● BMW

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness