Cooking Oil Market 2025-2033: Industry Size, Share, Growth, Key Players and Forecast Report

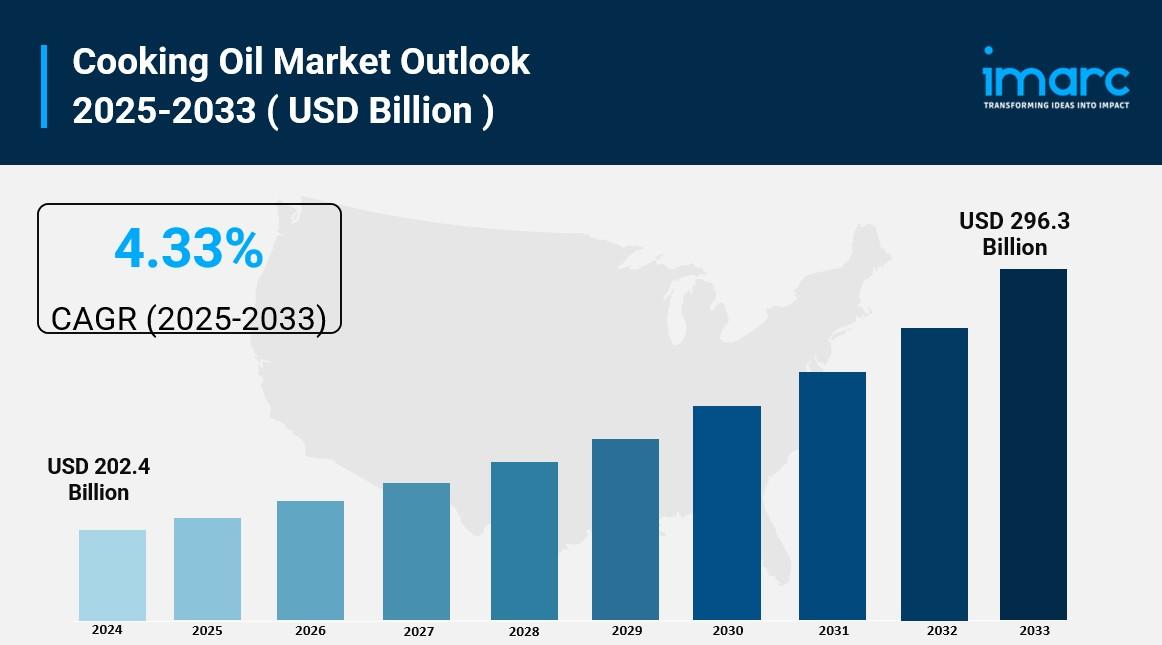

The global cooking oil market size was valued at USD 202.4 Billion in 2024 and is expected to reach USD 296.3 Billion by 2033, expanding at a CAGR of 4.33% from 2025 to 2033. Growth is driven by rising health and wellness awareness, changing dietary preferences, and increased emphasis on sustainability and certified sourcing. Asia Pacific dominates the market as of 2024.

The global Cooking Oil Market Share indicates steady growth driven by rising consumption of edible oils, expanding food processing industries, and growing awareness of healthier cooking alternatives. Urbanization, increasing disposable incomes, and shifting dietary preferences toward vegetable-based oils continue to support market expansion. Additionally, manufacturers are introducing fortified and cold-pressed oils to meet the demand for nutritious and premium-quality products. The rapid growth of the hospitality sector and the surge in packaged and convenience food production further contribute to rising oil usage worldwide. With ongoing innovations in extraction technologies and sustainability-focused production practices, the cooking oil market is expected to witness strong and consistent growth over the forecast period.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Cooking Oil Market Key Takeaways

- Current Market Size: USD 202.4 Billion in 2024

- CAGR: 4.33% from 2025 to 2033

- Forecast Period: 2025-2033

- Asia Pacific currently leads the cooking oil market, influencing global trends.

- Rising consumer awareness about health and wellness propels growth.

- Increasing popularity of plant-based diets escalates demand for seed, nut, and vegetable oils.

- The expansion of branded and quality cooking oil purchases is growing due to rising disposable incomes and urbanization.

- Innovations in oil processing and fortified oils enriched with vitamins support health-conscious consumers.

- Expanding food service industry and convenience food demand sustain market growth.

Get your free sample here: https://www.imarcgroup.com/cooking-oil-market/requestsample

Market Growth Factors

The cooking oil market is witnessing strong growth propelled by increasing consumer awareness about health and wellness. The global health and wellness market reached USD 3,670.4 billion in 2023, which influences dietary choices shifting from saturated to healthier oils like olive, avocado, and coconut oils containing beneficial antioxidants and monounsaturated fats. Consumers seek oils that support cardiovascular health, with omega-3 fatty acids contributing to positive market outlook.

Changing dietary preferences, such as ketogenic, plant-based, and gluten-free diets, are driving cooking oil demand. Plant-based diets favor oils derived from plants like avocados and nuts, while ketogenic diets prefer fats like coconut and olive oils. Minimal processing and additive-free oils are increasingly preferred, with innovation focused on oils tolerant to high temperatures, neutral in flavor, or containing special health benefits.

Sustainability is a critical driver, with heightened consumer interest in sourcing transparency and environmental impact disclosures. In 2024, the clean-label ingredient market reached USD 52.9 Billion globally. Brands emphasize certified sustainable portfolios, such as palm oils with traceability guarantees. For instance, in October 2023, KTC Edibles launched 'Planet Palm' in the UK, a sustainable certified palm oil brand targeting food manufacturers. Such initiatives promote a shift toward sustainable oil consumption.

Market Segmentation

- By Type:

- Palm Oil

- Soy Oil

- Sunflower Oil

- Peanut Oil

- Olive Oil

- Rapeseed Oil

- Others

Palm oil is the leading type with a 28.7% share in 2024 due to its low cost, high yield per hectare, and functional properties like high melting point and heat stability, making it favored for large-scale production and use in food products.

- By Distribution Channel:

- Hypermarket and Supermarket

- Independent Retail Stores

- Business to Business

- Online Sales Channel

Hypermarkets and supermarkets lead with 45.7% market share, offering a wide selection of cooking oils and promoting bulk buying with discounts and convenient shopping experiences including parking and extended hours.

- By End User:

- Residential

- Food Services

- Food Processing

- Others

The residential segment dominates with a 69.8% share, fueled by diverse cooking techniques and preferences for multiple oil types including traditional and health-focused oils, highlighting consumers' interest in flavor experimentation and health-conscious choices.

- By Region:

- Asia Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

Key countries include the United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico.

Regional Insights

In 2024, Asia Pacific leads the global cooking oil market driven by urbanization, growing middle-class incomes, and varied culinary cultures influencing consumption patterns. The region benefits from easy availability of affordable palm oil and increasing consumer health awareness favoring oils like olive and canola. Major industrial expansions and advanced monitoring projects, such as Dabeeo's AI farm monitoring in Indonesia, also support market growth.

Recent Developments & News

- August 2024: Spotlight Foods launched an algae-based cooking oil certified by the Seed Oil Free Alliance, notable for high monounsaturated fats, low environmental impact, high-heat suitability, and neutral flavor.

- July 2024: Louis Dreyfus Company relaunched its edible oil brand Vibhor in India, expanding offerings enriched with vitamins A and D and targeting rural and urban consumers with plans to expand by 2026.

- May 2024: Adani Wilmar introduced Fortune Pehli Dhaar's first-pressed mustard oil in India, positioning it as a premium product emphasizing taste, purity, and tradition.

Key Players

- ACH Food Companies Inc. (Associated British Foods plc)

- American Vegetable Oils Inc.

- Archer-Daniels-Midland Company

- Bunge Limited

- Cargill Incorporated

- CJ CheilJedang Corp.

- Fuji oil Holding Inc.

- Indofood Agri Resources Ltd.

- J-Oils Mills Inc.

- Louis Dreyfus Company B.V.

- Marico Limited

- Modi Naturals Ltd.

- Ottogi Co. Ltd.

- Wilmar International Limited.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=8447&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness