Saudi Arabia Cold Chain Warehousing Market Growth, Share, and Trends Report 2025-2033

Saudi Arabia Cold Chain Warehousing Market Overview

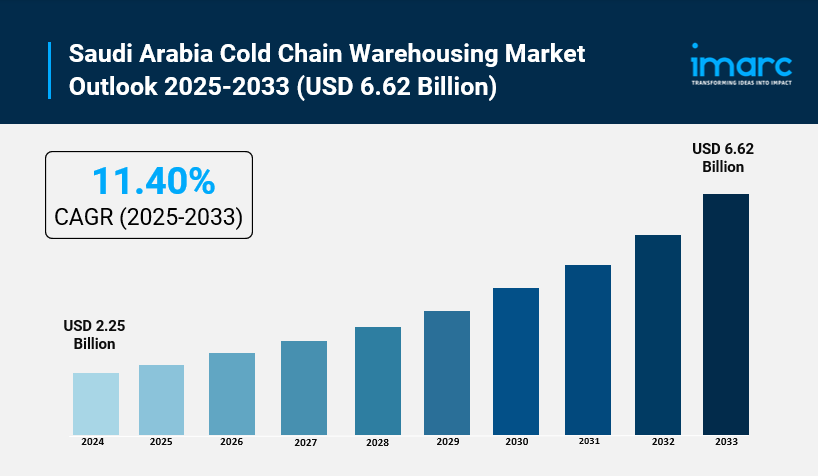

Market Size in 2024: USD 2.25 Billion

Market Size in 2033: USD 6.62 Billion

Market Growth Rate 2025-2033: 11.40%

According to IMARC Group's latest research publication, "Saudi Arabia Cold Chain Warehousing Market Size, Share, Trends and Forecast by Type of Storage, Temperature Range, Ownership, End Use Industry, and Region, 2025-2033", The Saudi Arabia cold chain warehousing market size reached USD 2.25 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.62 Billion by 2033, exhibiting a growth rate (CAGR) of 11.40% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-cold-chain-warehousing-market/requestsample

How Digital Technology Reshaping the Future of Saudi Arabia Cold Chain Warehousing Market

- AI-driven automation is speeding up cold chain operations in Saudi warehouses, reducing errors and cutting handling times, which boosts efficiency and scales operations smoothly.

- Real-time AI and IoT systems help monitor storage conditions continuously, preventing spoilage and saving up to 20% on energy costs during hot climate operations.

- Government programs like the National AI Strategy 2030 support AI adoption in logistics, providing infrastructure and training to modernize Saudi cold chain warehousing.

- Firms like HUMAIN partner with global tech leaders to deploy cutting-edge AI and cloud computing, enabling smart automation and data processing in cold storage facilities.

- Predictive AI analytics optimize inventory and delivery routes, cutting waste and enhancing reliability, especially during busy seasons such as Ramadan and Hajj.

Saudi Arabia Cold Chain Warehousing Market Trends & Drivers:

Three key factors currently driving Saudi Arabia's cold chain warehousing growth include robust government investment, rising demand for imported perishables, and technological advances in logistics. The government's Vision 2030 initiative channels substantial funds toward building logistics hubs, refrigerated transport, and modern ports, encouraging private sector involvement and innovation. Regulatory bodies like the Saudi Food and Drug Authority (SFDA) have implemented stringent safety and quality rules, further boosting market confidence. These efforts underpin expansion across food, pharmaceutical, and retail sectors, evidenced by firms like Starlinks unveiling state-of-the-art refrigerated warehouses spanning tens of thousands of square meters, equipped for multi-temperature storage and automation to meet booming demand.

Saudi Arabia’s heavy reliance on imports—fruits, dairy, seafood, and vegetables—is a major growth accelerator for cold chain warehousing. With limited local agriculture, the country depends on smooth cold logistics to preserve freshness over long transit distances. Consumer tastes are shifting toward premium, organic, and imported perishables, driving investments in sophisticated temperature-controlled storage. For example, Starlinks’ Polaris facility boasts 44,000 multi-temperature pallets and advanced technology enabling seamless cold storage at temperatures ranging from -25°C to +23°C. Ensuring these products arrive in prime condition is critical, as spoilage leads to substantial financial losses, motivating continuous infrastructure upgrades.

Technological innovation is another strong growth pillar, with AI and automation enhancing cold chain efficiency, sustainability, and cost-effectiveness. Saudi companies are deploying machine learning to forecast demand spikes and optimize inventory, cutting waste and boosting freshness. The government's collaborations with tech leaders like Qualcomm help position the Kingdom as a hub for AI-powered logistics. Energy optimization pilots show potential savings up to 20%, aligning with national sustainability goals. Additionally, specialized cold warehouses, such as AJEX’s newly opened GMP-GxP certified depot in Riyadh, enhance pharma supply chains with rigorous temperature controls, addressing rising healthcare demands.

Saudi Arabia Cold Chain Warehousing Industry Segmentation:

The report has segmented the market into the following categories:

Type of Storage Insights:

- Frozen Storage

- Chilled Storage

Temperature Range Insights:

- Ambient

- Refrigerated

- Frozen

- Deep-Frozen

Ownership Insights:

- Private Warehouses

- Public Warehouses

- Bonded Warehouses

End Use Industry Insights:

- Fruits and Vegetables

- Meat and Fish

- Dairy Products

- Pharmaceuticals and Healthcare Products

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Cold Chain Warehousing Market

- October 2025: AJEX launched Saudi Arabia's first GMP-GxP compliant cold storage facility, enhancing pharmaceutical safety with advanced temperature controls and automation.

- October 2025: HUMAIN partnered with Qualcomm to deploy AI infrastructure, boosting cold chain automation and predictive maintenance, reducing energy consumption by up to 20%.

- August 2025: Starlinks unveiled the Polaris cold chain warehouse in Riyadh, featuring 44,000 multi-temperature pallets and AI-powered inventory management for improved efficiency.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness