UAE Vegan Cosmetics Market Size, Growth & Trends Forecast 2025-2033

UAE Vegan Cosmetics Market Overview

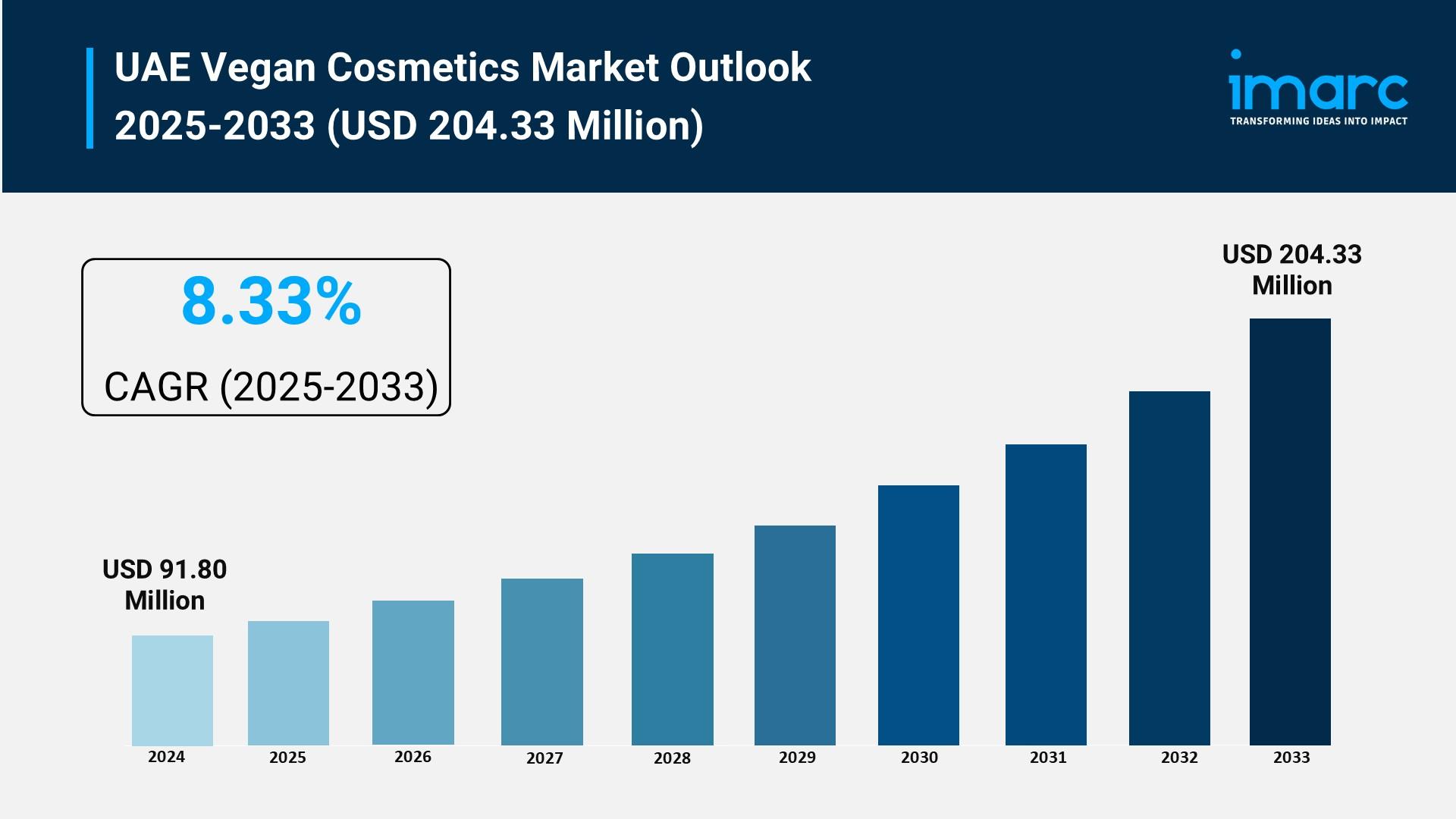

Market Size in 2024: USD 91.80 Million

Market Size in 2033: USD 204.33 Million

Market Growth Rate 2025-2033: 8.33%

According to IMARC Group's latest research publication, "UAE Vegan Cosmetics Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The UAE vegan cosmetics market size reached USD 91.80 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 204.33 Million by 2033, exhibiting a growth rate of 8.33% during 2025-2033.

How Ethical Beauty is Reshaping the Future of UAE Vegan Cosmetics Market

- Halal-Certified Vegan Products Gain Traction: Dubai and Abu Dhabi consumers are embracing plant-based formulations that meet both halal standards and vegan requirements, creating a unique market positioned at the intersection of religious compliance and ethical beauty.

- Desert Climate Drives Hybrid Innovation: Multi-functional vegan products combining SPF protection with botanical ingredients like aloe vera and plant oils are gaining popularity, with formulations specifically designed to withstand the UAE's intense heat and humidity.

- Digital-First Shopping Revolution: Instagram and TikTok beauty influencers in Dubai are driving awareness of vegan cosmetics through tutorials and reviews, while e-commerce platforms like Noon.com and specialty retailers are making halal-certified vegan brands more accessible than ever.

- Homegrown Brands Lead the Charge: UAE-based vegan cosmetics brands like Glossic and MÄNN Skincare are expanding their presence, offering budget-friendly and premium options that cater to the Emirates' multicultural, fashion-conscious population.

- Government Support for Green Beauty: The UAE's newly launched Green Innovation District at Expo City Dubai and Green License initiative are attracting vegan cosmetics companies focused on sustainability and circular economy principles, reinforcing the country's commitment to clean beauty.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-vegan-cosmetics-market/requestsample

UAE Vegan Cosmetics Market Trends & Drivers:

The UAE's vegan cosmetics market is thriving as ethical beauty becomes mainstream across the Emirates. What's driving this shift is the convergence of religious values and modern consumer consciousness—halal certification bodies in the UAE are now certifying vegan cosmetics, which naturally avoid animal-derived ingredients. The Emirates Authority for Standardization and Metrology actively supports halal beauty standards, giving consumers confidence that vegan products align with Islamic principles. Women in the GCC spend around 63 dollars monthly on makeup and 52 dollars on skincare, showing strong purchasing power. This spending is fueling demand for vegan alternatives that deliver both performance and peace of mind, particularly among the 35 percent of GCC beauty consumers who now prioritize non-toxic, environmentally friendly ingredients in their purchasing decisions.

The UAE's position as a global beauty hub is accelerating vegan cosmetics adoption in unexpected ways. Dubai welcomed over 16.7 million visitors between January and November of recent years, and tourist zones generate significantly higher beauty retail revenue per square foot compared to residential areas. International travelers discover vegan beauty brands at duty-free zones across Abu Dhabi, Dubai, Sharjah, Ras Al Khaimah, and Fujairah airports, then continue purchasing online after returning home. The introduction of the world's first VAT refund system for e-commerce tourist purchases enhances this experience further. Meanwhile, the clean beauty segment across the Middle East is heading toward a valuation surpassing 2.6 billion dollars, with vegan formulations capturing substantial market share. Trade events like Beautyworld Middle East have expanded dedicated sections for vegan and sustainable beauty, connecting local distributors with global brands that offer halal-certified, plant-based options.

Climate and lifestyle factors unique to the Gulf region are shaping product innovation in vegan cosmetics. The harsh desert environment—characterized by intense sun, heat, and dry air—demands specialized formulations that traditional vegan products from temperate markets can't always address. This has sparked demand for hybrid products like tinted moisturizers with high SPF, antioxidant serums with light pigmentation, and sweat-resistant makeup that maintains halal compliance. Younger consumers, especially Gen Z and millennials who make up a significant portion of the UAE's population, are driving this trend toward multi-functional clean beauty. They're influenced by local beauty bloggers and Instagram creators who demonstrate how vegan cosmetics perform in real Gulf conditions. The result is a market that's not just importing Western vegan trends but actively reshaping them for regional needs, creating opportunities for brands that understand the unique demands of this climate and consumer base.

UAE Vegan Cosmetics Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Breakup by Region:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Vegan Cosmetics Market

- February 2025: Dubai-based vegan beauty brand Glossic expanded its retail footprint across the Emirates, launching at multiple Debenhams locations in Dubai and Abu Dhabi, offering cruelty-free, budget-friendly makeup designed to meet Gulf climate demands.

- March 2025: L'Oréal and Unilever jointly invested 34 crore rupees (approximately 4.1 million dollars) in Arata, a natural haircare brand, signaling major players' commitment to capturing the growing Asian and Middle Eastern vegan beauty markets through strategic partnerships.

- June 2025: The Ministry of Economy and Tourism launched the UAE's first Green Innovation District at Expo City Dubai, offering Green Licenses to attract vegan cosmetics companies focused on circular economy models and sustainable production, with incentives for clean beauty startups.

- August 2025: Cartier expanded its sustainable fragrance initiative across its entire line, featuring formulations with 100 percent plant-based alcohol and packaging with 50 percent less glass weight, targeting the UAE's luxury vegan beauty consumers who value both ethics and elegance.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201-456-2121

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness