Family Offices Market Size, Share, Growth & Forecast 2025-2033

Market Overview:

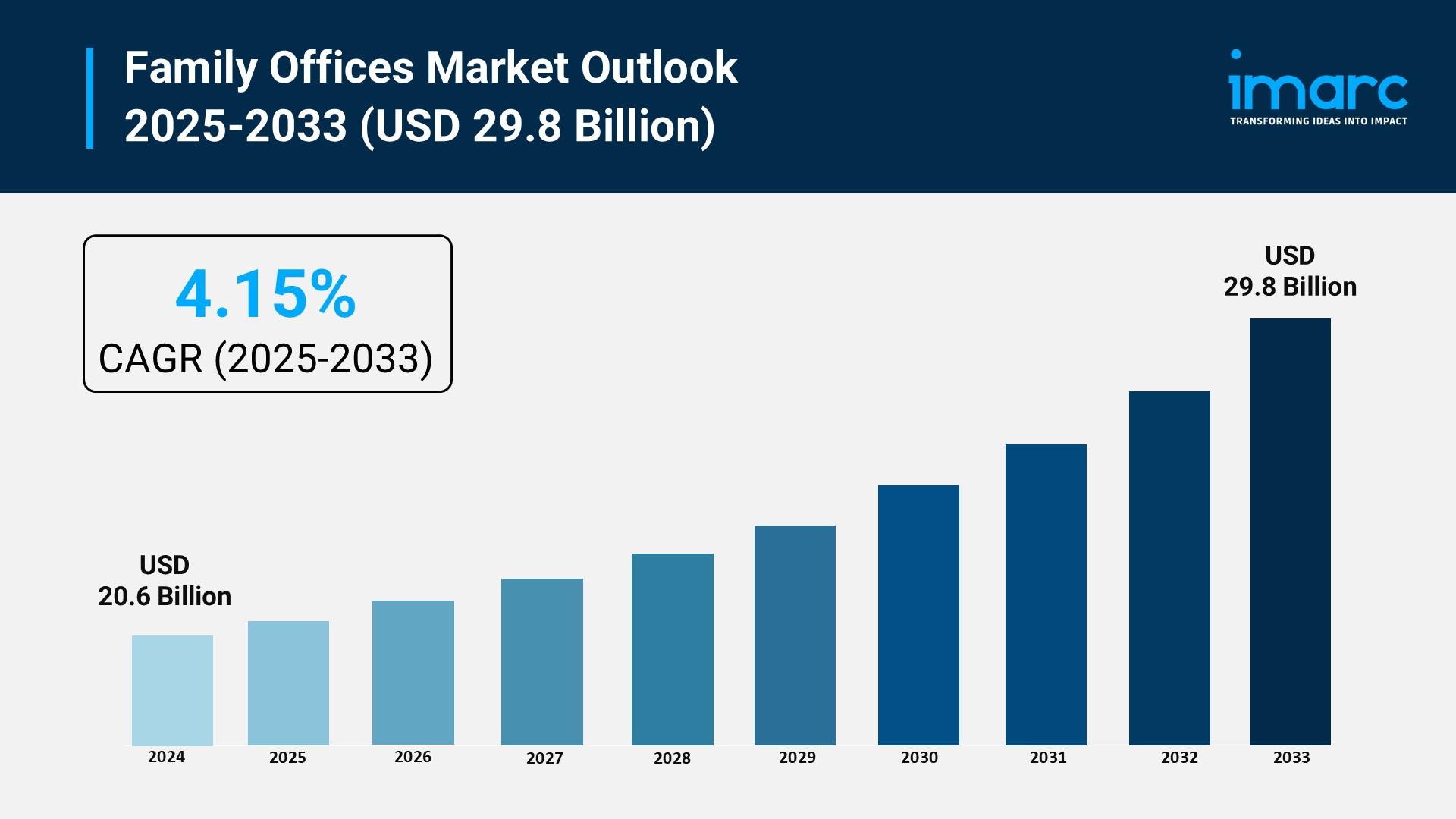

The family offices market is experiencing rapid growth, driven by the rise of ultra-high-net-worth individuals, intergenerational wealth transfer, and increased demand for alternative investments. According to IMARC Group's latest research publication, "Family Offices Market Size, Share, Trends, and Forecast by Type, Office Type, Asset Class, Service Type, and Region 2025-2033", The global family offices market size was valued at USD 20.6 Billion in 2024. Looking forward, the market is projected to reach USD 29.8 Billion by 2033, exhibiting a CAGR of 4.15% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/family-offices-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Family Offices Market

- Rise of Ultra-High-Net-Worth Individuals

The continuous and rapid creation of new wealth globally is the primary propellant for the Family Offices market. The worldwide population of High-Net-Worth Individuals (HNWIs) continues to expand, translating directly into a larger potential client base requiring dedicated, private wealth management structures. This growth is particularly notable in regions like Asia-Pacific, which is home to some of the world's most rapidly expanding economies and entrepreneurial successes. As this wealth accumulation continues at a substantial pace, it necessitates the creation of new family offices—with hundreds of new offices being established globally in recent years—to ensure effective stewardship, privacy, and long-term financial security for these affluent families. The concentration of significant family fortunes ensures a consistent demand for bespoke financial entities.

- Intergenerational Wealth Transfer

A major demographic driver of market growth is the large-scale transfer of wealth from older generations to the next, particularly from Baby Boomers to Generations X and Millennial heirs. This monumental handover of assets, estimated to involve trillions of dollars globally, is pushing families to formalize their wealth structures. Younger beneficiaries often have distinct priorities, including a desire for greater transparency, professional governance, and alignment of investments with personal values. Consequently, family offices are being established or reformed to manage this transition, focusing on succession planning, family education, and developing comprehensive governance frameworks, with a significant majority of family offices now serving first, second, or third-generation families, illustrating this recent institutionalization of generational wealth.

- Increased Demand for Alternative Investments

Family offices are increasingly favoring sophisticated, non-traditional asset classes to achieve superior, uncorrelated returns and diversify their substantial portfolios. Data shows a significant allocation to alternative investments, such as private equity, venture capital, and real estate, which often collectively constitute a substantial portion of family office portfolios. This preference for direct investment—where a high percentage of family offices are actively engaged—allows for greater control and access to exclusive deal flow that is not available to conventional investors. Jurisdictions are also competing to attract this capital; for example, specific financial hubs have created favorable regulatory environments and tax incentives, positioning themselves as competitive alternatives to offshore structures and further encouraging the influx of specialized family office investment vehicles.

Key Trends in the Family Offices Market

- Institutionalization and Professionalization

The global market is witnessing a profound shift as family offices adopt a more corporate and institutionalized approach to their operations, moving away from informal, personal setups. This trend is characterized by the implementation of rigorous governance structures, including establishing formal boards with a blend of family members and independent, external professionals. The drive for professionalism extends to staffing, where offices compete intensely for top-tier talent, such as Chief Investment Officers (CIOs) and operational specialists, to manage increasingly complex global portfolios. This move ensures greater regulatory compliance, enhances operational efficiency, and positions the family office as a sophisticated financial institution capable of preserving and expanding generational wealth over the long term.

- Focus on Impact and ESG Investing

There is a powerful emerging trend of family offices actively aligning their investment strategies with environmental, social, and governance (ESG) criteria and pursuing impact investing opportunities. This is largely driven by the younger generations, who demand that their wealth reflects their personal values and contributes to a positive societal or environmental outcome alongside financial returns. For instance, a notable percentage of family offices globally now engage in impact investments, with many expecting this portion of their portfolio to grow significantly. Concrete applications include direct investments in sustainable technologies, renewable energy projects, and healthcare ventures, illustrating a deliberate move to integrate ethical considerations into the core investment thesis.

- Technology Integration and Cybersecurity

Family offices are rapidly adopting advanced technology to enhance their operational efficiency, reporting capabilities, and security posture. The integration of cutting-edge tools, including artificial intelligence (AI) and machine learning, is being deployed for advanced investment analytics, real-time performance tracking of complex, multi-asset portfolios, and automating back-office functions. Concurrently, with the increasing digitization of sensitive financial data, there is a heightened focus on robust cybersecurity measures. Firms are actively deploying comprehensive risk management frameworks to protect against cyber threats, recognizing that the integrity and confidentiality of the family’s information are paramount. This technological upgrade not only streamlines processes but also meets the next generation's expectation for transparent and digitally accessible financial management.

Leading Companies Operating in the Global Family Offices Industry:

- BMO Financial Group

- Cambridge Associates LLC

- Citigroup Inc.

- HSBC Private Banking (HSBC Holdings plc)

- Northern Trust Corporation

- Silvercrest Asset Management Group Inc.

- Stonehage Fleming Family & Partners Limited

- The Bank of New York Mellon Corporation

- The Bessemer Group Incorporated

- The Glenmede Corporation

- UBS Group AG

- Wells Fargo & Company

Family Offices Market Report Segmentation:

By Type:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

Single family offices represent the largest segment in 2024, holding 53.2% of the market, driven by personalized financial management and centralized wealth focus for individual families.

By Office Type:

- Founders’ Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

Founders’ offices lead with approximately 21.5% market share, catering to the wealth management needs of business founders through customized solutions and decision-making involvement.

By Asset Class:

- Bonds

- Equities

- Alternative Investments

- Commodities

- Cash or Cash Equivalents

Alternative investments dominate with around 40.8% market share, driven by the desire for uncorrelated returns, portfolio diversification, and protection against market volatility.

By Service Type:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

Financial planning holds a significant 66.6% market share, fueled by the comprehensive need for budgeting, risk management, and alignment with family goals for financial stability.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America accounts for over 40.9% of the market share in 2024, supported by a robust financial infrastructure, concentration of wealth, and a growing number of high-net-worth individuals.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Inicio

- Literature

- Music

- Networking

- Otro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness