GCC Electric Car Market Growth, Size & Trends Forecast 2025-2033

GCC Electric Car Market Overview

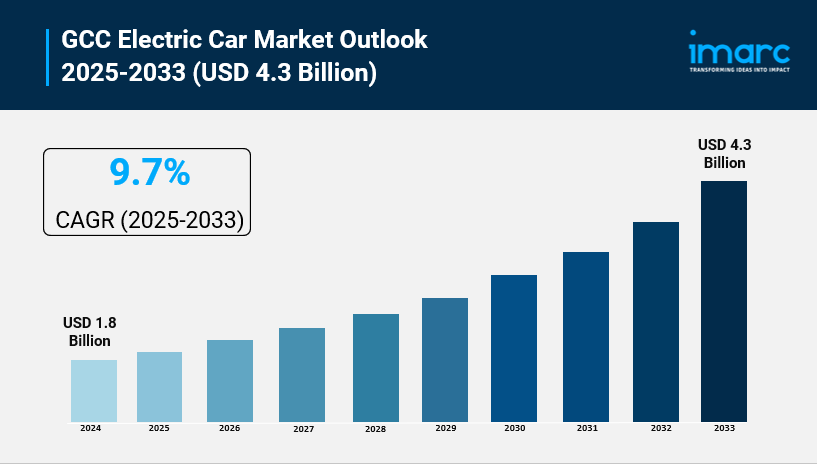

Market Size in 2024: USD 1.8 Billion

Market Size in 2033: USD 4.3 Billion

Market Growth Rate 2025-2033: 9.7%

According to IMARC Group's latest research publication, "GCC Electric Car Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The GCC electric car market size reached USD 1.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.3 Billion by 2033, exhibiting a growth rate (CAGR) of 9.7% during 2025-2033.

How AI is Reshaping the Future of GCC Electric Car Market

- Revolutionizing Vehicle Intelligence: Ceer's partnership with Foxconn is embedding AI-powered infotainment and autonomous driving technologies into Saudi Arabia's first indigenous electric vehicles, with production starting in late 2026.

- Enabling Urban Air Mobility: The UAE is pioneering AI-integrated eVTOL air taxis with commercial operations launching in Abu Dhabi and Dubai, connecting electric ground vehicles to aerial transport through intelligent digital grids.

- Optimizing Charging Networks: Dubai Electricity and Water Authority's AI-driven Green Charger Initiative uses smart QR-enabled systems across 382 charging stations, with expansion targeting 1,000 stations throughout Dubai.

- Accelerating Manufacturing Efficiency: Ceer Manufacturing Complex deploys AI-enhanced press shop automation and component technology from BMW, establishing the MENA region's most advanced EV production facility at King Abdullah Economic City.

- Transforming Fleet Management: Ride-hailing services like Careem and Uber are leveraging AI-powered route optimization and predictive maintenance for their expanding electric vehicle fleets across major GCC cities.

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-electric-car-market/requestsample

GCC Electric Car Market Trends & Drivers:

The GCC region is experiencing a major transformation in its automotive sector, driven by ambitious government initiatives aligned with sustainability goals. Saudi Arabia stands out with Ceer, the Kingdom's first electric vehicle brand—a joint venture between the Public Investment Fund and Foxconn—set to roll its first vehicles off production lines in late 2026. The company has secured partnerships worth SAR 12.1 billion ($3.2 billion) with over 250 local and international companies, including a SAR 8.2 billion contract with Hyundai Transys for EV drive systems. Ceer's $1.3 billion manufacturing facility at King Abdullah Economic City will produce 240,000 vehicles annually at full capacity, creating 30,000 direct and indirect jobs while contributing $8 billion to Saudi Arabia's GDP. The UAE has pledged that 10% of all vehicles will be electric, with Dubai targeting 42,000 EVs on its roads and the emirate's taxi fleet converting to 100% eco-friendly vehicles by 2027. This government-led push is providing the policy framework and financial incentives—including tax exemptions, reduced registration fees, and subsidies—that are making electric cars increasingly attractive to GCC consumers.

Infrastructure development is accelerating at an impressive pace across the region, addressing one of the biggest barriers to EV adoption. Dubai has over 620 charging stations currently operational, with the Dubai Electricity and Water Authority expanding its Green Charger network toward a target of 1,000 stations. Abu Dhabi is going even bigger—ADNOC Distribution and Abu Dhabi National Energy Company have partnered through their E2GO joint venture to build and operate 70,000 charging points throughout the emirate by 2030. In Dubai alone, nearly 39,000 EVs were on the road by the end of Q1 2025, showing over 5% year-on-year growth and supporting the Green Mobility Strategy 2030. The UAE now has over 147,000 electric and hybrid vehicles, with EV registrations jumping more than 25% year-on-year. This expansion in charging infrastructure is strategic—ultra-fast chargers are being deployed that can recharge vehicles in minutes, and stations are strategically located in malls, airports, hotels, residential complexes, and along major highways. The Sharjah Roads and Transport Authority is working with sustainable technology group BEEAH to deploy hundreds of EV chargers across the emirate, while Qatar aims to transform 25% of its public transportation to electric energy, with plans for 100% electrification by 2030 under the Qatar Public Transportation Plan.

Consumer preferences are shifting rapidly, driven by environmental awareness and economic benefits. EVs made up 13% of total car sales in the UAE in 2023, a dramatic jump from just 3.2% in 2022 and 0.7% in 2021. Battery electric vehicles dominate the market due to significantly reduced running costs and the rapid development of Level 1 and Level 2 charging infrastructure that has eased range anxiety among buyers. Hybrid and plug-in hybrid vehicles are serving as stepping stones for consumers transitioning from conventional fuel to fully electric, operating with combinations of traditional engines and electric batteries. The mid-priced segment accounts for the largest market share, making EVs more accessible to a broader consumer base, while the luxury segment is growing as affluent GCC residents embrace high-end electric models from Tesla, Porsche, and Lucid. Chinese EV manufacturers like BYD are expanding rapidly throughout the region—showrooms have opened in Riyadh, Jeddah, Dubai, Abu Dhabi, Sharjah, Doha, Muscat, and Kuwait—offering competitive pricing that's making electric vehicles mainstream. The UAE government has already transitioned about 20% of its official fleet to EVs, setting an example for the private sector. Companies across the region are investing heavily—CYVN Holdings invested $1.1 billion in Chinese EV maker NIO, while the UAE Ministry of Energy and Infrastructure partnered with Swedish electric trucking company Einride to supply 2,000 electric trucks and 200 autonomous trucks for sustainable freight operations.

GCC Electric Car Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle

Vehicle Class Insights:

- Mid-Priced

- Luxury

Vehicle Drive Type Insights:

- Front Wheel Drive

- Rear Wheel Drive

- All-Wheel Drive

Breakup by Country:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in GCC Electric Car Market

- February 2025: Ceer announced 11 new partnerships worth SAR 5.5 billion ($1.5 billion) at the Public Investment Fund Forum, bringing total partnerships to over SAR 12.1 billion with more than 250 companies, positioning Saudi Arabia as a regional EV manufacturing hub.

- February 2025: Ceer partnered with Italian firm Isoclima to develop the world's largest windshield for its flagship electric sedans and SUVs, alongside a SAR 543 million ($145 million) collaboration with Sabelt for high-performance sports seats trusted by Ferrari and McLaren.

- September 2025: Ceer unveiled its bold bilingual Arabic-English brand identity on Saudi National Day, marking the world's first automotive bilingual logotype while reaching 1,500 employees across EV specialties and finalizing flagship designs for upcoming global debut.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness