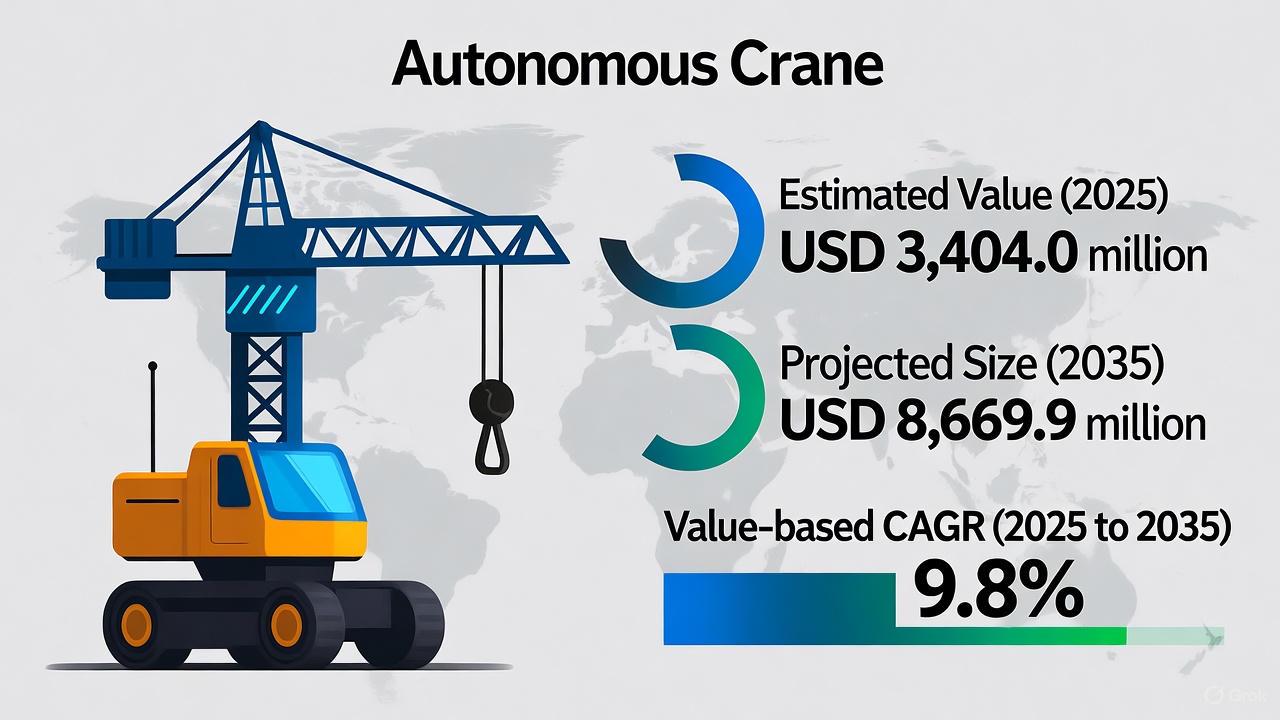

Autonomous Crane Market to Surpass USD 8,669.9 million by 2035

The global Autonomous Crane Market is entering a dynamic growth phase, supported by rapid industrial automation, sustainable infrastructure projects, and electrification trends. Valued at USD 3,404.0 million in 2025, the market is projected to reach USD 8,669.9 million by 2035, advancing at a CAGR of 9.8% during the forecast period. This remarkable expansion reflects the increasing global preference for smart, energy-efficient lifting solutions across construction, marine, and mining industries.

Get this Report at $5000 Only (Report price) | Exclusive Discount Inside!: https://www.futuremarketinsights.com/reports/sample/rep-gb-16121

Electrification and Sustainability Driving Growth

The market’s growth trajectory is strongly influenced by the global shift toward sustainability. Electric and hybrid cranes are gaining traction due to their low operational costs, quiet performance, and minimal emissions. Governments and private organizations worldwide are investing heavily in smart infrastructure and green construction initiatives, fostering demand for cranes that align with these objectives. This aligns perfectly with the rising adoption of eco-friendly machinery in ports, urban infrastructure, and renewable energy projects.

In the marine and offshore sector, autonomous cranes play a crucial role in managing high-precision lifting under challenging conditions. Offshore wind farm installations in the North Sea and port automation projects such as Hamburg Port’s smart terminal are prime examples of how the integration of AI and IoT is transforming operational efficiency and safety standards.

AI and IoT Revolutionizing Crane Operations

Technological advancements are reshaping the autonomous crane landscape. AI-driven navigation systems, IoT-enabled sensors, and predictive maintenance are making cranes more intelligent, reliable, and productive. These innovations minimize downtime and enhance load precision, reducing human intervention while improving safety. For instance, AI-powered tower cranes in Singapore have improved project delivery rates and safety compliance in high-rise construction.

Companies like Liebherr Group, Konecranes, and Manitowoc are pioneering smart automation by embedding IoT-based monitoring and analytics into their crane systems. The rise of AI-integrated cranes is expected to redefine material handling, offering unprecedented control and efficiency to industrial operations worldwide.

Marine and Construction Sectors Fueling Demand

Among end users, the marine and offshore segment dominates the market, contributing approximately 32.4% of total demand in 2025. These industries rely heavily on autonomous cranes for precision-driven lifting in extreme conditions. Meanwhile, the below 50-ton payload segment, holding a 30.2% share, is favored for its versatility and adaptability in urban construction and port applications. Compact and energy-efficient designs are particularly suitable for confined spaces and sustainable building environments.

The trend toward smaller, high-performance cranes has gained momentum in Southeast Asia, where rapid urbanization and metro expansions are fueling adoption. Similarly, electric and hybrid cranes are increasingly deployed across European ports such as Rotterdam and Hamburg, emphasizing energy-efficient operations and reduced carbon footprints.

Emerging Markets Creating New Opportunities

Emerging economies in Asia-Pacific and Africa are becoming the focal points of expansion for global crane manufacturers. Rapid urbanization, industrialization, and government-backed infrastructure programs such as India’s Make in India and Indonesia’s capital relocation project are accelerating demand for automated lifting systems. Additionally, Africa’s large-scale renewable energy projects—such as Egypt’s solar parks—are creating fresh opportunities for suppliers.

Manufacturers are increasingly collaborating with local industries to introduce affordable models, training programs, and rental solutions that make autonomous cranes accessible to smaller enterprises. These initiatives are bridging the gap for SMEs that previously found automation financially out of reach.

Competitive Landscape and Technological Leadership

The global autonomous crane industry remains moderately consolidated, with Tier-1 manufacturers like Liebherr Group and Konecranes holding about 55–60% market share, while Tier-2 players such as Palfinger AG, Hiab (Cargotec), and Tadano Ltd. account for the rest. These companies are expanding their portfolios with hybrid-powered cranes, real-time monitoring systems, and AI-based automation to meet the evolving demands of marine and construction sectors.

Recent developments underline the pace of innovation. In October 2023, PALFINGER partnered with Aker BP to develop five autonomous offshore cranes, marking a milestone in automated lifting for the energy sector. Similarly, ANDRITZ unveiled the world’s first AI-powered logyard crane at LIGNA 2023, showcasing zero-emission and low-noise operations—proof of the industry’s steady march toward sustainability.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness