Rising Digital Adoption and Financial Inclusion Drive Global Consumer Credit Growth 2025-2033

Consumer Credit Market Overview

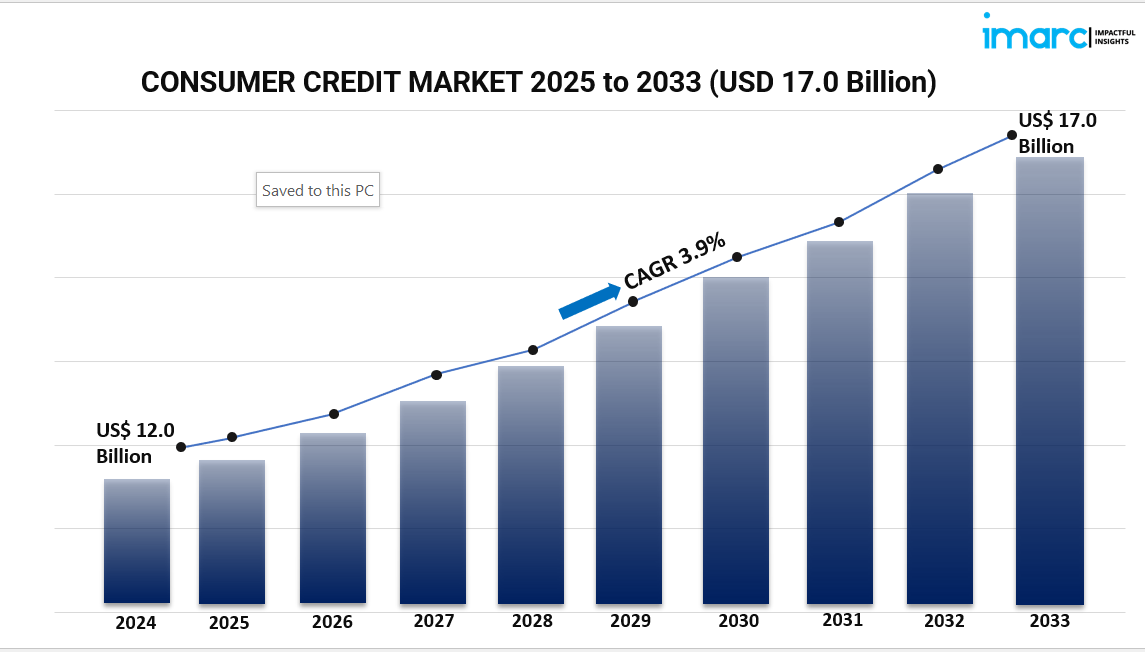

The global consumer credit market is experiencing significant growth, driven by rising disposable incomes, increased consumer spending, and the rapid adoption of digital financial services. According to IMARC Group, the market reached USD 12.0 billion in 2024 and is projected to attain USD 17.0 billion by 2033, growing at a CAGR of 3.9% during 2025-2033.

Key factors fueling this growth include the widespread adoption of credit cards and Buy Now, Pay Later (BNPL) services, easier access to credit via fintech platforms, evolving consumer lifestyles, and increasing demand for personal and home loans.

Request for a sample copy of this report: https://www.imarcgroup.com/consumer-credit-market/requestsample

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Years: 2025-2033

Consumer Credit Market Key Takeaways

- Market Size & Growth: Valued at USD 12.0 billion in 2024, projected to reach USD 17.0 billion by 2033, at a CAGR of 3.9%.

- Dominant Credit Type: Non-revolving credits lead the market, driven by fixed-term loans such as mortgages and auto loans.

- Leading Service Type: Credit services dominate, offering essential financial solutions for credit management.

- Primary Issuers: Banks and finance companies are the primary providers, offering diverse credit products and leveraging consumer trust.

- Preferred Payment Method: Debit cards are the most widely used method for everyday transactions.

- Regional Leader: North America accounted for over 35% of the global market in 2024, supported by a mature financial infrastructure.

- Emerging Trends: Integration of AI and blockchain is improving credit assessment and expanding access to credit services.

Market Growth Factors

Financial Services Technical Developments

Technological advancements are reshaping the consumer credit market. AI, blockchain, and digital credit systems are accelerating approval processes and enhancing access. Digital lending platforms utilize big data and machine learning to evaluate creditworthiness more accurately, reducing reliance on traditional ratings. AI predicts consumer behavior and credit risk, minimizing defaults, while blockchain increases security, transparency, and efficiency through smart contracts.

Rising Disposable Incomes and Economic Growth

Higher disposable incomes and economic expansion are driving global demand for consumer credit. With increased earnings, consumers are more willing to borrow, particularly for big-ticket items like real estate, vehicles, and education. Developing economies with a growing middle class are key contributors, supported by favorable economic conditions and higher consumer confidence.

Financial Inclusion and Digital Transformation

Digital financial services have greatly expanded access to consumer credit. With widespread internet and smartphone adoption, digital lending platforms offer quick, hassle-free access with minimal documentation. These services especially benefit underbanked populations, including rural communities. Mobile banking and digital payment solutions further strengthen credit accessibility and financial management.

Market Segmentation

By Credit Type

- Revolving Credits: Flexible credit lines such as credit cards.

- Non-revolving Credits: Fixed-term loans including mortgages and auto loans.

By Service Type

- Credit Services: Credit score monitoring, debt counseling, and related solutions.

- Software and IT Support Services: Tools and systems for credit operations management.

By Issuer

- Banks and Finance Companies: Traditional providers offering a wide range of credit products.

- Credit Unions: Member-owned cooperatives providing credit services.

- Others: Alternative providers including fintech companies and online lenders.

By Payment Method

- Direct Deposit: Electronic fund transfers into bank accounts.

- Debit Card: Payment option linked to checking accounts.

- Others: Mobile wallets and electronic transfers.

Breakup by Region

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Regional Insights

North America dominates the global consumer credit market, accounting for more than 35% of the share in 2024. This is due to a mature financial infrastructure, widespread adoption of credit services, rapid technological advancements, strong economic conditions, and supportive regulations.

Recent Developments & News

In November 2024, Visa introduced the Flexible Credential in collaboration with the Affirm Card. This feature allows consumers to seamlessly switch between debit and BNPL payment methods, reflecting the growing trend of integrating BNPL with traditional financial products.

Key Players

- Bank of America

- Barclays

- BNP Paribas

- China Construction Bank

- Citigroup

- Deutsche Bank

- HSBC

- Industrial and Commercial Bank of China (ICBC)

- JPMorgan Chase

- Mitsubishi UFJ Financial

- Wells Fargo

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for Customization: https://www.imarcgroup.com/request?type=report&id=2291&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness