Automotive Collision Repair Market Report 2025: Size, Share, Latest News, Key Players and Forecast by 2033

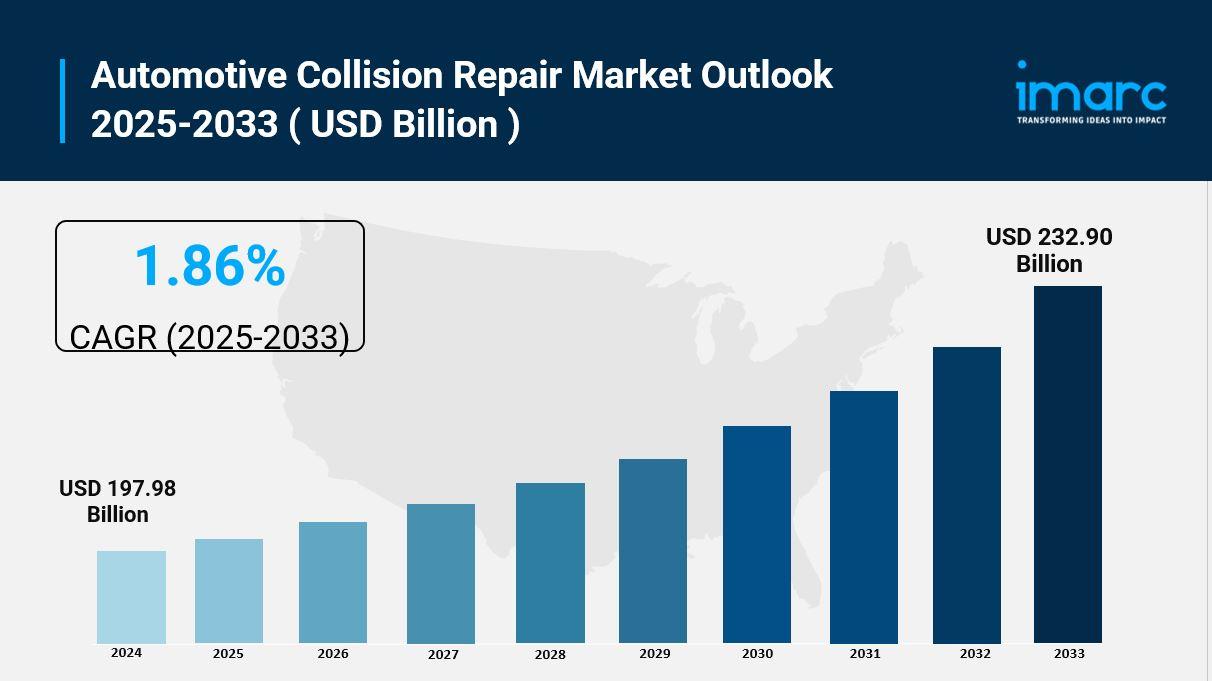

The global automotive collision repair market size was valued at USD 197.98 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 232.90 Billion by 2033, exhibiting a CAGR of 1.86% from 2025-2033. Europe currently dominates the market, holding a market share of 42.0% in 2024. The dominance is owing to the well-established automotive industry, high adoption of advanced repair technologies, strong regulatory standards promoting safety, the presence of skilled workforce, expanding vehicle parc, and increasing preference for quality repair solutions.

Key Stats for Automotive Collision Repair Market:

- Automotive Collision Repair Market Value (2024): USD 197.98 Billion

- Automotive Collision Repair Market Value (2033): USD 232.90 Billion

- Automotive Collision Repair Market Forecast CAGR: 1.86%

- Leading Segment in Automotive Collision Repair Market in 2024: Spare Parts (65.1% by Product Type)

- Key Regions in Automotive Collision Repair Market: Europe, North America, Asia Pacific, Latin America, Middle East and Africa

- Top companies in Automotive Collision Repair Market: 3M Company, Automotive Technology Products LLC, Caliber Collision, Continental AG, Denso Corporation, DuPont de Nemours Inc., Eastman Chemical Company, Faurecia SE, Honeywell International Inc., IAC Group, Magna International Inc., Robert Bosch GmbH, Tenneco Inc., etc.

Request for a sample copy of this report: https://www.imarcgroup.com/automotive-collision-repair-market/requestsample

Why is the Automotive Collision Repair Market Growing?

The automotive collision repair market is experiencing steady growth as roads become more congested and vehicle ownership continues its upward trajectory worldwide. This isn't just about fixing bent fenders and broken bumpers—it's about maintaining a massive global vehicle fleet that's becoming more technologically sophisticated while dealing with the inevitable reality that accidents happen.

Global vehicle ownership keeps climbing, and with more cars, trucks, and motorcycles sharing limited road space, collision risks naturally increase. Urban congestion in particular creates environments where accidents are almost unavoidable—parking lot scrapes, intersection fender-benders, lane-change miscalculations. Even in rural areas, higher traffic volumes on roads not designed for current traffic levels lead to more incidents. This fundamental dynamic guarantees steady demand for collision repair services that shows no signs of slowing.

The human cost of road accidents paints a sobering picture. The World Health Organization reports that approximately 1.19 million people lose their lives each year due to road traffic accidents. Beyond this tragic toll, countless more accidents result in vehicle damage without fatalities—minor collisions, single-vehicle incidents, weather-related crashes, parking accidents. Each damaged vehicle represents potential business for the collision repair industry, creating a consistent stream of work that sustains shops, employs technicians, and drives demand for parts and materials.

The automotive industry's overall expansion creates momentum for the collision repair market. As manufacturers produce and sell more vehicles—passenger cars, commercial vehicles, hybrid and electric models—the total vehicle population grows. The International Energy Agency projects that worldwide electric vehicle sales will increase by 25% by the conclusion of 2025, reflecting rapid adoption of eco-friendly transportation. Every new vehicle on the road is a potential future collision repair customer. The growing vehicle fleet for business operations, logistics, and personal transportation amplifies this effect, with fleet operators requiring quick, reliable repairs to minimize downtime.

AI Impact on the Automotive Collision Repair Market:

Artificial intelligence is beginning to reshape collision repair in ways that address longstanding industry challenges around estimating accuracy, repair quality, and operational efficiency. While adoption is still in relatively early stages, the applications emerging show real potential to transform how damage is assessed, repairs are planned, and quality is verified.

Damage assessment represents AI's most immediate practical application. Traditional estimating relies heavily on human expertise—experienced estimators visually inspect vehicles, identify damage, determine repair procedures, and calculate costs. This process is time-intensive and subjective, with estimates varying between estimators and sometimes missing hidden damage discovered only after repairs begin. AI-powered image recognition systems can analyze photos of damaged vehicles, automatically identifying damage patterns, classifying damage severity, and suggesting appropriate repair procedures. These systems learn from thousands of repair scenarios, essentially codifying expert knowledge into algorithms that provide consistent, thorough assessments.

Some advanced systems use machine learning to compare damage photos against databases of previous repairs with similar damage patterns. They can predict repair costs based on historical data about similar repairs, reducing estimation time from hours to minutes while improving accuracy. This speed and consistency benefits everyone—customers get faster service, shops can process more estimates, and insurers can settle claims more efficiently.

Computer vision technology is advancing paint matching and color verification. AI systems analyze vehicle colors under various lighting conditions, accounting for paint fade, metallic or pearl effects, and manufacturer color variations. They can recommend precise paint formulas that match original colors perfectly, reducing the trial-and-error that sometimes plagues color matching. After painting, AI-powered cameras can verify color match accuracy before vehicle delivery, catching subtle mismatches that might escape human inspection.

Predictive analytics help shops optimize inventory management—a perennial challenge given the vast array of parts potentially needed. AI algorithms analyze historical repair data, seasonal patterns, local accident statistics, and vehicle population demographics to predict which parts shops will likely need. This predictive capability reduces inventory costs while ensuring commonly needed parts are available, minimizing repair delays. For parts that can't be stocked, AI systems can identify optimal suppliers, predict delivery times, and even suggest alternative parts that might work equally well.

Segmental Analysis:

Analysis by Product Type:

- Paints and Coatings

- Consumables

- Spare Parts

Spare parts dominated the market in 2024 with a substantial 65.1% share, reflecting their essential function in maintaining vehicle performance, safety, and durability post-repair. The steady need for high-quality replacement parts supports this segment's dominance, as vehicle owners and service providers emphasize reliability and performance. Manufacturers and distributors focus on providing broad selections of components customized for various vehicle types, improving accessibility and customer satisfaction.

The availability of authentic components, combined with continual enhancements in material quality and design, reinforces spare parts' market position. Insurance-covered repairs drive consistent demand, as coverage generally requires replacement with authorized components that meet manufacturer specifications. Parts ranging from simple items like bumper covers and mirrors to complex components like sensors, cameras, and control modules all fall within this segment.

Ongoing advancements in manufacturing processes, efficient distribution systems, and increasing focus on sustainable and recyclable materials boost spare parts' attractiveness. Their crucial role in returning vehicles to original specifications secures their top status. The rise of online parts marketplaces, improved supply chain logistics, and growing aftermarket options provide customers with more choices while maintaining quality standards.

Paints and coatings represent a vital segment ensuring vehicles look as good as they performed before collisions. Modern automotive paints are sophisticated systems—primers, basecoats, clearcoats—each serving specific purposes. Advances in paint technology including waterborne formulations, fast-curing systems, and sustainable options are driving innovation. The introduction of recycled-content coatings demonstrates how sustainability concerns are being addressed without compromising performance.

Consumables include the myriad materials used during repairs—sandpaper, masking materials, adhesives, sealants, cleaning agents, polishing compounds. While individually inexpensive, consumables are essential for every repair and represent steady recurring revenue for suppliers. Improvements in consumable quality and efficiency help shops work faster and achieve better results.

Analysis by Service Channel:

- OEMs

- Aftermarket

- Others

OEMs (Original Equipment Manufacturers) represented the largest segment in 2024, accounting for 55.6% market share, driven by robust brand trust, superior technical expertise, and guaranteed quality standards. OEMs offer customers authentic components, specialized equipment, and highly skilled technicians, guaranteeing accuracy, reliability, and more durable repair results. Their well-established dealership and service networks provide broad accessibility, boosting customer trust and loyalty.

OEMs invest heavily in research and development, allowing them to incorporate cutting-edge repair technologies and digital solutions into service offerings. Robust partnerships with insurance companies enhance their market position, ensuring smooth repair processes and customer convenience. OEMs also focus on complying with stringent safety and regulatory standards, making certain repair services meet or exceed industry criteria. Their emphasis on innovation, customer satisfaction, and sustainability strengthens their leadership position.

The advantage of OEM repairs includes access to manufacturer repair procedures, specialized tools designed for specific vehicles, and technicians trained directly by manufacturers. For complex modern vehicles with sophisticated electronics and safety systems, these advantages are increasingly important. OEM facilities typically have direct relationships with parts suppliers, ensuring genuine parts availability and reducing repair delays.

Aftermarket service channels provide competition through competitive pricing, convenient locations, and personalized service. Independent repair shops, franchise chains, and specialty facilities serve customers seeking alternatives to dealer service. Many aftermarket facilities achieve certifications demonstrating capabilities comparable to OEM facilities while offering cost advantages. The aftermarket benefits from flexibility—shops can source parts from multiple suppliers, adopt new technologies at their own pace, and differentiate through exceptional customer service.

The choice between OEM and aftermarket often depends on factors like vehicle age, warranty status, insurance requirements, and customer preferences. Newer vehicles under warranty typically go to OEM facilities, while older vehicles may be repaired through aftermarket channels. Insurance companies negotiate relationships with both OEM and aftermarket facilities, giving customers options while managing costs.

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two Wheelers

Light commercial vehicles led the market in 2024 with 68.5% market share, attributed to their widespread use in logistics, transportation, and business operations, leading to increased repair and maintenance demands. Rising adoption among small and medium businesses, along with explosive growth in e-commerce and last-mile delivery services, drives need for reliable, quick repair solutions that minimize vehicle downtime.

LCVs benefit from robust insurance coverage, guaranteeing repair services are readily available and financially supported. Improvements in repair technologies, access to premium spare parts, and strong networks of expert service providers enhance LCVs' segment prevalence. Fleet owners and operators emphasize prompt maintenance and repairs to ensure efficiency and operational reliability, creating steady demand. The combination of intensive usage, increasing business reliance, and focus on maintaining vehicle performance guarantees LCVs remain prominent.

The delivery economy's explosion—food delivery, package delivery, service vehicles—has dramatically increased LCV utilization and, consequently, collision repair needs. These vehicles often operate in congested urban environments, increasing accident likelihood. Commercial operators need fast repairs with guaranteed quality, creating demand for efficient, reliable repair services.

Passenger cars represent a substantial segment with different dynamics. Personal vehicle owners often have more flexibility about repair timing and may prioritize cost over speed. However, the sheer volume of passenger cars globally ensures this segment generates enormous repair demand. Rising safety consciousness and desire to maintain vehicle values encourage comprehensive, quality repairs rather than minimal cosmetic fixes.

Heavy commercial vehicles require specialized repair capabilities due to their size, structural designs, and heavy-duty components. Fewer shops can handle these vehicles, but those that do often enjoy less price competition and steady relationships with fleet operators who value reliability. Two-wheelers represent a large-volume segment particularly in Asia-Pacific, with repair needs ranging from cosmetic touch-ups to major structural work after accidents.

Analysis by Region:

- Europe

- North America

- Asia Pacific

- Latin America

- Middle East and Africa

Europe dominated the global market in 2024 with 42.0% market share, owing to its robust automotive manufacturing foundation, sophisticated technological infrastructure, and well-established service ecosystem guaranteeing superior repair quality. The region has a substantial and aging vehicle fleet, ensuring steady demand for maintenance and repair services across diverse vehicle types.

Strong regulatory frameworks focusing on road safety and vehicle efficiency lead to increased acceptance of approved repair methods. European regulations often require specific repair certifications, use of certain materials and methods, and documentation of repair procedures—requirements that professionalize the industry and ensure quality. The availability of well-trained technicians and ongoing investment in training initiatives boost service effectiveness and precision.

What are the Drivers, Restraints, and Key Trends of the Automotive Collision Repair Market?

Market Drivers:

The automotive collision repair market benefits from several interconnected drivers creating sustained momentum. Rising global vehicle ownership provides fundamental demand—more vehicles inevitably means more collisions requiring repair. This relationship is straightforward but powerful, particularly as developing economies experience rapid motorization.

Increasing road congestion amplifies collision risks beyond what vehicle numbers alone would suggest. Congested urban environments create stress, reduce reaction times, and increase accident likelihood. The relationship between congestion and collision rates is well-documented, and as cities worldwide struggle with traffic management, collision repair demand remains robust.

Regulatory requirements around vehicle safety and insurance create frameworks that channel damaged vehicles toward professional repair rather than informal fixes or abandonment. Mandatory insurance in many jurisdictions ensures repair costs are covered, removing financial barriers to professional service. Safety inspections in some markets prevent damaged vehicles from remaining on roads unrepaired.

Market Restraints:

Despite strong fundamentals, the market faces constraints that moderate growth. Economic sensitivity means that during recessions, people may defer non-essential repairs, opt for cheaper fixes, or leave cosmetic damage unrepaired. While safety-critical repairs generally proceed regardless of economic conditions, discretionary repair spending fluctuates with economic confidence.

Labor shortage is emerging as significant constraint. Collision repair requires skilled technicians with broad capabilities—metalworking, painting, electronics, diagnostics. Training takes years, and many developed markets face technician shortages as experienced workers retire faster than new ones enter field. This shortage drives up labor costs and can constrain shop capacity even when demand is strong.

Parts availability issues occasionally constrain market. Supply chain disruptions, whether from natural disasters, trade disputes, or manufacturing issues, can delay repairs while awaiting parts. For newer vehicle models or less common vehicles, parts availability can be particularly problematic. Shops carrying extensive inventory face capital costs, while those operating lean inventory face repair delays.

Market Key Trends:

Several dynamic trends are reshaping the collision repair landscape. Electric vehicle proliferation is perhaps the most transformative trend. EVs require specialized knowledge about high-voltage systems, battery construction, unique materials, and specific repair procedures. Shops investing in EV capabilities are positioning for future growth, while those not adapting risk obsolescence. The skills gap around EV repair is creating opportunities for shops that train technicians and acquire appropriate equipment.

Sustainability integration is accelerating across the industry. Beyond recycled-content paints and coatings, shops are adopting waterborne paint systems, energy-efficient booth technologies, waste recycling programs, and sustainable business practices. These changes respond to regulatory requirements, customer preferences, and cost-saving opportunities while positioning collision repair as environmentally responsible industry.

Digital integration is transforming operations. From AI-powered estimating to digital workflow management to customer communication apps, technology is making shops more efficient and customer-friendly. Cloud-based management systems allow multi-location operators to standardize processes and share best practices. Mobile apps keep customers informed about repair progress, reducing phone calls and improving satisfaction.

Leading Players of Automotive Collision Repair Market:

According to IMARC Group's latest analysis, prominent companies shaping the global automotive collision repair landscape include:

- 3M Company

- Automotive Technology Products LLC

- Caliber Collision

- Continental AG

- Denso Corporation

- DuPont de Nemours Inc.

- Eastman Chemical Company

- Faurecia SE

- Honeywell International Inc.

- IAC Group

- Magna International Inc.

- Robert Bosch GmbH

- Tenneco Inc.

These leading providers are focusing on strategic efforts to enhance efficiency, service quality, and customer satisfaction. They're investing in cutting-edge repair technologies, digital systems, and automated solutions to streamline processes and minimize turnaround times. Ongoing efforts strengthen supply chain networks, guaranteeing access to high-quality components and materials. Collaborations with insurers and workshops are being reinforced to deliver integrated services and enhanced value to customers.

Focus on training initiatives enhances employee competencies, ensuring technicians can handle increasingly complex vehicles and repair procedures. Companies are adopting sustainable practices to comply with environmental regulations while reducing operating costs. These combined efforts bolster market positions and establish these players as industry leaders driving innovation and setting standards that shape market evolution.

Key Developments in Automotive Collision Repair Market:

- 2025: CARSTAR opened CARSTAR Village Collision Center in Dearborn, Michigan, expanding its collision repair network. The facility services all vehicle makes and models and is working toward I-CAR Gold Class and OEM certifications. The center supports several local community organizations, demonstrating commitment to community engagement alongside business expansion. This opening reflects ongoing network expansion strategies by major collision repair chains seeking to increase market presence and service coverage.

- 2025: I-CAR launched a national Registered Apprenticeship Program (RAP) for the collision repair industry, addressing technician shortage. The program offers two years of paid on-the-job learning and technical instruction, leading to US Department of Labor certification. This initiative represents significant industry investment in workforce development, recognizing that technician availability is critical constraint on market growth. The program creates pathways for new workers to enter industry with recognized credentials.

- 2024: Steer Automotive Group launched Steer Electric, its first purpose-built EV repair center in Eastleigh, Hampshire. The 14,000 sq ft facility was equipped with advanced EV technology and aluminum structural repair capabilities. This positions the group to meet growing demand for specialized EV repair services. The investment demonstrates how forward-thinking operators are preparing for electrification transition by building dedicated facilities with appropriate equipment and training.

- 2024: BASF Coatings unveiled new sustainable clearcoats at Automechanika Frankfurt, produced using recycled tires through ChemCycling technology. These Ccycled® products, marketed under Glasurit and R-M brands, reduce waste and CO₂ emissions while offering faster drying times that lower energy usage. This innovation demonstrates how sustainability can align with performance and efficiency improvements, benefiting environment and shop operations simultaneously.

- 2024: Auto Additive launched OEM-grade 3D printed parts, tools, and jigs for the collision repair industry. The company focused on sustainability by using additive manufacturing to reduce waste and carbon footprints. Collaboration with industry leaders like HP and GM drives innovation. This development points toward future where some parts and tools are manufactured on-demand rather than stocked, potentially transforming parts logistics and availability.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=4452&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness