UAE Buy Now Pay Later Market Size, Growth & Trends Forecast 2025-2033

UAE Buy Now Pay Later Market Overview

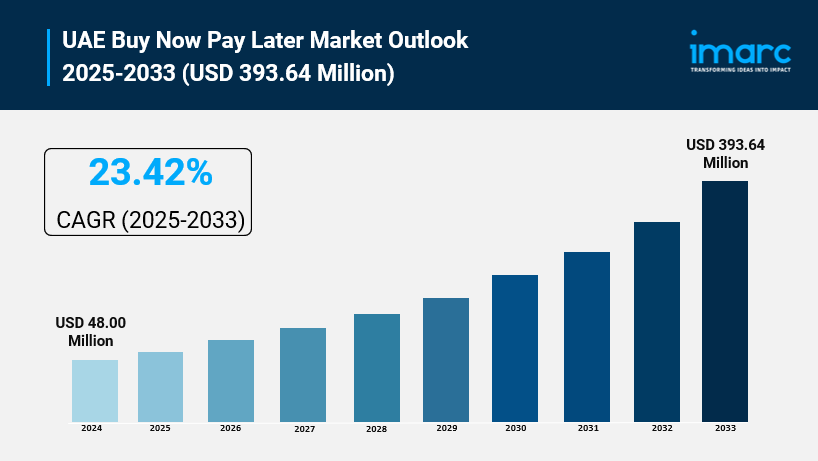

Market Size in 2024: USD 48.00 Million

Market Size in 2033: USD 393.64 Million

Market Growth Rate 2025-2033: 23.42%

According to IMARC Group's latest research publication, "UAE Buy Now Pay Later Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The UAE buy now pay later market size was valued at USD 48.00 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 393.64 Million by 2033, exhibiting a CAGR of 23.42% during 2025-2033.

How AI is Reshaping the Future of UAE Buy Now Pay Later Market

- Revolutionizing Credit Assessment: AI-powered algorithms analyze alternative data sources—transaction history, digital behavior patterns, and payment consistency—to instantly assess creditworthiness without traditional credit scores. This enables BNPL providers like Tabby and Tamara to approve customers in seconds while maintaining low default rates through sophisticated risk modeling.

- Enhancing Fraud Detection and Prevention: Machine learning systems monitor millions of transactions in real-time, identifying suspicious patterns and preventing fraudulent purchases before they occur. As Tabby processes transactions across thousands of merchants including Decathlon, GAP, Level Shoes, Apple, H&M, Sephora, and Zara, AI security protocols protect both consumers and retailers while maintaining seamless checkout experiences.

- Personalizing Payment Plans: AI analyzes individual customer financial behavior to recommend optimal payment schedules that match cash flow patterns. This personalization helps customers manage installments more effectively while reducing missed payments, creating win-win scenarios where consumers access flexible financing and BNPL providers maintain healthy repayment rates.

- Optimizing Merchant Partnerships: Natural language processing and predictive analytics help BNPL platforms identify which retailers and service providers would benefit most from installment payment options. This data-driven approach guides strategic partnerships like Tabby's collaboration with Arabian Automobiles for vehicle maintenance and Spotii's integration with Abu Dhabi Islamic Bank (ADIB).

- Automating Regulatory Compliance: As the UAE develops comprehensive BNPL regulations, AI-powered compliance systems automatically monitor transactions, flag potential issues, and generate regulatory reports. This technology helps fintech companies navigate evolving requirements while scaling operations across Dubai, Abu Dhabi, Sharjah, and other emirates.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-buy-now-pay-later-market/requestsample

UAE Buy Now Pay Later Market Trends & Drivers:

The UAE's BNPL sector is experiencing explosive growth driven by well-funded market leaders and aggressive expansion strategies. Tabby, the region's most valuable fintech, recently doubled its valuation to USD 3.3 billion after securing USD 160 million in funding, positioning itself for an IPO while expanding beyond traditional BNPL into a comprehensive financial services platform. The company previously secured USD 700 million in debt financing from JPMorgan, demonstrating institutional confidence in the sector's fundamentals. Tamara, Saudi Arabia's first fintech unicorn valued at USD 1 billion after raising USD 340 million in Series C funding, is expanding aggressively into the UAE market, bringing total equity funding to USD 500 million plus over USD 400 million in debt financing. These massive funding rounds reflect investor confidence in the sector's trajectory and enable rapid expansion across merchant networks. Postpay, co-founded in Dubai in 2019, has grown to 1.2 million monthly active customers with over 1,000 partnered retailers including Footlocker, Dermalogica, and The Entertainer, achieving a 40% return rate. The integration of BNPL solutions into major e-commerce platforms like Amazon and Noon has normalized installment payments for mainstream consumers. Retailers are embedding BNPL at checkout to boost conversion rates and reduce cart abandonment—a persistent e-commerce challenge.

BNPL services are breaking beyond retail boundaries, expanding into high-value sectors that create substantial new revenue opportunities. Tabby's September 2023 partnership with Arabian Automobiles extended installment payments to vehicle maintenance and repairs, signaling BNPL's evolution from shopping convenience to essential financial utility. Travel platforms, airlines, and tour operators embrace BNPL to encourage higher-ticket purchases, making international travel accessible through manageable payment plans. Healthcare providers—clinics, hospitals, and wellness centers—offer BNPL for elective procedures, dental care, and comprehensive wellness packages, addressing affordability concerns in the UAE's predominantly private healthcare system. Educational institutions and training centers enable students to spread tuition costs across manageable installments, increasing accessibility to higher education and professional development programs. This diversification transforms BNPL's market perception from a purely retail tool to a versatile financial enabler across the economy. Service-based businesses form strategic partnerships with BNPL providers, tailoring repayment models to fit longer payment cycles and higher-value transactions that differ fundamentally from consumer electronics or fashion purchases. Spotii's partnership with Abu Dhabi Islamic Bank (ADIB) demonstrates how BNPL platforms integrate with traditional banking infrastructure to deliver flexible payment options.

The UAE's unique cultural and regulatory environment shapes BNPL adoption in distinctive ways. Many BNPL providers offer Sharia-compliant structures that resonate with the region's consumer base, removing religious barriers to adoption while maintaining interest-free installment models. Tabby's partnerships with the Apparel Group provide installment options across both online and in-store transactions, creating omnichannel experiences where consumers seamlessly split payments regardless of shopping format. The growing focus on regulatory oversight is professionalizing the sector—authorities are developing comprehensive frameworks that protect consumers while enabling innovation. This regulatory maturation attracts institutional investors and traditional banks who previously viewed BNPL as risky fintech experimentation. The UAE's smartphone penetration and digital infrastructure make BNPL integration frictionless—consumers approve transactions with fingerprint authentication in seconds, while merchants receive guaranteed payments regardless of customer installment completion. Young consumers, particularly those early in their careers or managing budgets carefully, appreciate BNPL's transparency compared to credit card revolving balances with unclear interest calculations. The absence of hidden fees and straightforward installment terms build trust that drives repeat usage. As fintech-bank collaborations intensify and major retailers across fashion, electronics, lifestyle, healthcare, travel, and automotive sectors deploy BNPL solutions, the payment method is becoming embedded in the UAE's consumer finance ecosystem—no longer an alternative payment option but an expected feature of modern commerce.

UAE Buy Now Pay Later Industry Segmentation:

The report has segmented the market into the following categories:

Channel Insights:

- Online

- Point of Sale (POS)

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

End Use Insights:

- Consumer Electronics

- Fashion and Garment

- Healthcare

- Leisure and Entertainment

- Retail

- Others

Breakup by Region:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Buy Now Pay Later Market

- February 2025: Tabby doubled its valuation to USD 3.3 billion after securing USD 160 million in funding, becoming the most valuable fintech in MENA while expanding beyond traditional BNPL services into a comprehensive financial services platform and preparing for an IPO.

- September 2023: Tabby partnered with Arabian Automobiles to extend BNPL services to vehicle maintenance and repairs, marking a significant expansion beyond traditional retail into automotive services and demonstrating BNPL's evolution into essential financial utility across diverse sectors.

- December 2023: Tamara raised USD 340 million in Series C funding at a USD 1 billion valuation, becoming Saudi Arabia's first fintech unicorn while aggressively expanding operations in the UAE market, bringing total equity funding to USD 500 million plus over USD 400 million in debt financing.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Startseite

- Literature

- Musik

- Networking

- Andere

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness