How Offshore Staffing Enables Advisory-Focused US CPA Firms

In today’s rapidly changing accounting landscape, U.S. CPA firms are shifting focus. Instead of relying solely on compliance-based services like audits and tax filings, many firms are evolving into strategic advisors offering real business insights. But to make this shift work, firms need more time, talent, and flexibility — without ballooning costs.

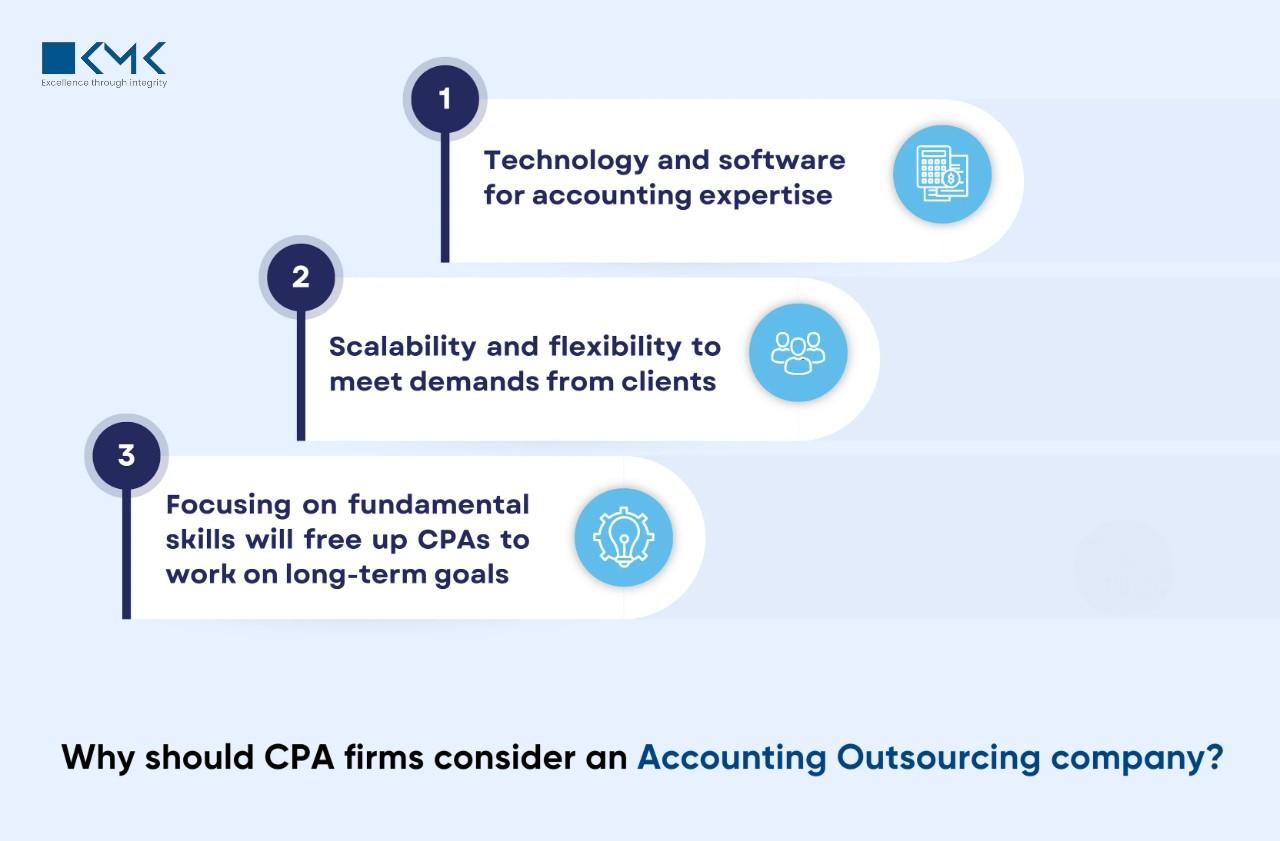

That’s where offshore staffing for accounting firm solutions are proving to be a game-changer. Offshore staffing empowers CPA firms to delegate transactional tasks to specialized offshore teams, freeing up local professionals to focus on advisory services that add greater value to clients.

Let’s explore how this model benefits U.S. CPA firms, what challenges to avoid, and how to build a sustainable offshore staffing strategy.

Why Offshore Staffing Has Become Essential for US CPA Firms

The accounting industry in the U.S. faces several structural challenges:

-

Talent shortages: Many firms struggle to hire qualified accountants domestically, especially during tax season.

-

Cost pressures: Rising wages and overheads make local hiring expensive.

-

Client demands: Businesses now expect proactive insights, not just compliance.

-

Scalability: Firms must ramp up or down quickly depending on workload.

Offshore staffing addresses these issues by creating access to a skilled, cost-efficient workforce abroad — allowing firms to operate lean while maintaining quality.

Key Benefits of Offshore Staffing for Advisory-Focused Firms

1. Cost Savings Without Compromising Quality

Offshore staffing can cut labor costs by up to 60%, freeing up resources for client acquisition, technology investment, or employee training. With dedicated offshore teams handling data entry, payroll, and bookkeeping, U.S. firms can keep more of their budget focused on strategic growth.

2. Access to a Global Talent Pool

Countries like India and the Philippines have accounting professionals trained in U.S. GAAP, tax codes, and cloud-based tools such as QuickBooks, Xero, and NetSuite. This gives firms immediate access to specialized skills that would otherwise take months to hire and train domestically.

3. Enhanced Scalability and Flexibility

Need ten extra accountants during tax season? Offshore staffing allows firms to scale teams up or down easily, matching workforce size with workload without the constraints of long-term hiring.

4. Around-the-Clock Productivity

Time zone differences enable a “follow-the-sun” workflow. While U.S. offices sleep, offshore teams can complete reconciliations, reports, and prep work—so local teams start their day with updated files ready for review.

5. Strategic Focus on Advisory Services

With routine tasks handled offshore, CPA firms can pivot their U.S. teams toward higher-value services:

-

Financial forecasting and planning

-

M&A advisory

-

Cash flow analysis

-

Client consulting and strategy

This not only strengthens client relationships but also enhances revenue per client.

Common Challenges — and How to Avoid Them

While offshore staffing offers major benefits, CPA firms must handle it strategically.

1. Communication and Cultural Differences

Different time zones or communication styles can cause minor friction. The solution? Regular check-ins, clear documentation, and shared project management platforms like Slack, Teams, or Asana.

2. Data Security Concerns

Accounting data is highly sensitive. Choose an offshore partner that complies with SOC 2, ISO 27001, or GDPR standards. Ensure NDAs, encryption, and access controls are part of the agreement.

3. Quality and Process Control

Without structured oversight, deliverables may vary in quality. To prevent this:

-

Establish clear KPIs and review procedures.

-

Conduct monthly performance evaluations.

-

Maintain a U.S.-based quality assurance lead for every offshore team.

4. Hidden Costs and Misalignment

Some firms jump into offshore staffing without detailed scoping. Always define:

-

Work responsibilities and reporting lines

-

SLAs (Service Level Agreements)

-

Escalation procedures for quality issues

This ensures smooth collaboration and avoids unpleasant surprises.

Best Practices for a Successful Offshore Staffing Model

To make offshore staffing a success, CPA firms should adopt these proven steps:

1. Start Small and Scale Gradually

Begin with non-core or repetitive tasks — bookkeeping, AP/AR processing, or tax preparation. Once processes stabilize, expand to complex roles like financial analysis or management reporting.

2. Document Every Process

Process documentation is the backbone of offshoring success. Create SOPs, templates, and workflows that ensure consistency across onshore and offshore teams.

3. Choose the Right Offshore Partner

Your offshore provider should understand U.S. accounting standards, have experience serving CPA firms, and demonstrate strong data security practices.

4. Foster Collaboration and Culture

Encourage offshore teams to be an extension of your local firm — not just a third party. Use virtual town halls, shared goals, and consistent recognition to build belonging and accountability.

5. Measure and Improve

Use metrics such as turnaround time, accuracy rate, and client satisfaction to evaluate offshore performance. Continuous improvement keeps both teams aligned with firm goals.

Offshore Staffing in Action: A Real-World Perspective

Consider a mid-sized CPA firm in Texas struggling with year-round workload spikes. By outsourcing bookkeeping and tax preparation to an offshore team, they:

-

Reduced costs by 45%

-

Cut project turnaround time by 30%

-

Reallocated senior staff to advisory and client consulting

-

Increased profit margins by 20% within a year

The result? The firm became more profitable, more strategic, and better able to compete in a crowded market.

The Strategic Impact: Moving Toward Advisory Excellence

The future of accounting isn’t just about compliance — it’s about insight. Offshore staffing allows firms to:

-

Free up time for advisory work

-

Increase profitability

-

Retain clients through higher engagement

-

Innovate and adopt new technologies faster

By shifting operational workloads offshore, U.S. CPA firms are transforming into modern, advisory-focused practices ready to meet client expectations in 2025 and beyond.

Final Thoughts

Offshore staffing is not just about saving money — it’s about building a smarter, more scalable, and more client-focused accounting practice. When implemented strategically, it becomes the foundation for a hybrid model that combines efficiency, flexibility, and growth.

For U.S. CPA firms aiming to elevate from compliance to consulting, offshore staffing is the key that unlocks capacity, capability, and competitiveness.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness