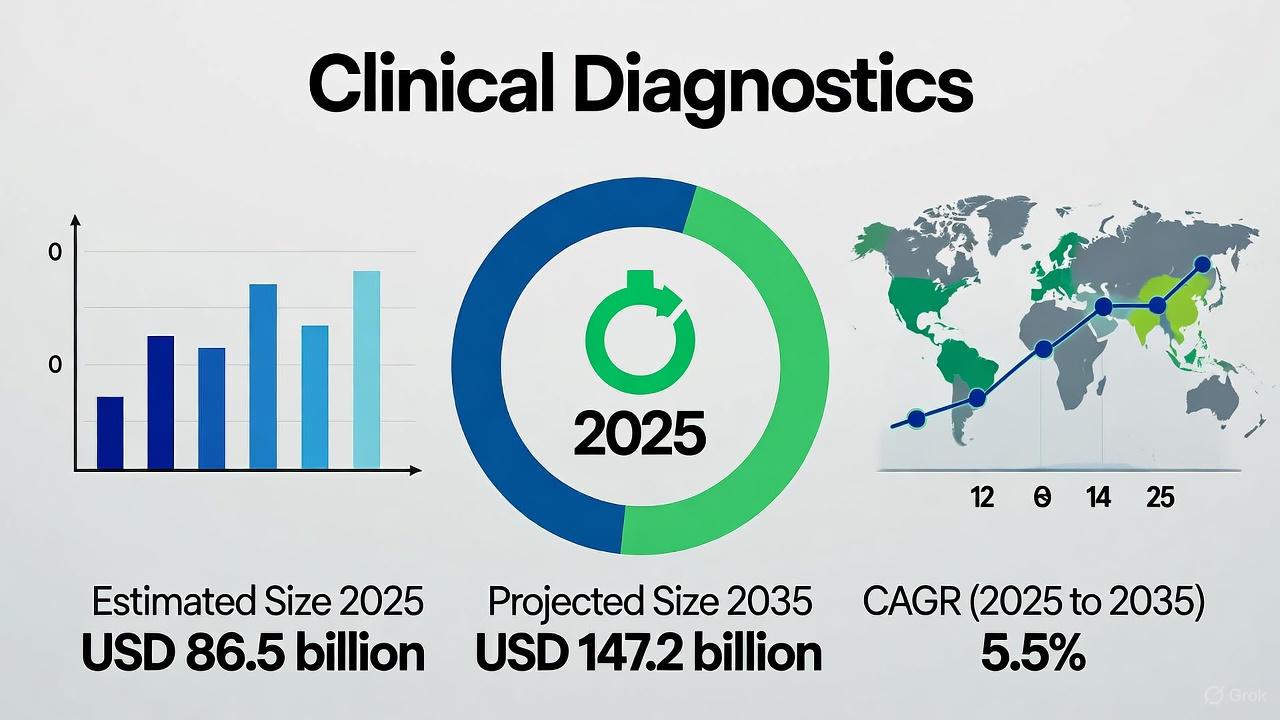

Clinical Diagnostics Market to Surpass USD 147.2 Billion by 2035

The global clinical diagnostics market is entering a decade of transformative growth, projected to expand from USD 86.5 billion in 2025 to USD 147.2 billion by 2035, at a CAGR of 5.5%. This expansion underscores the pivotal role diagnostics play in the evolving landscape of healthcare — where early disease detection, personalized medicine, and technology-led innovation are reshaping how the world approaches patient care.

The sector’s growth is propelled by the rising prevalence of chronic and infectious diseases, coupled with an aging population and advancements in molecular diagnostics and AI-driven tools. From routine testing to sophisticated genetic analysis, diagnostics are the cornerstone of modern healthcare systems.

Get this Report at $5000 Only (Report price) | Exclusive Discount Inside!: https://www.futuremarketinsights.com/reports/sample/rep-gb-15207

Market Dynamics: From Traditional Testing to Next-Generation Diagnostics

Over the past decade, the industry has transitioned from traditional laboratory testing toward automation, molecular diagnostics, and point-of-care (POC) systems. This shift has made diagnostics faster, more accurate, and more patient-centric. In particular, the adoption of AI algorithms and next-generation sequencing (NGS) is enabling clinicians to identify diseases earlier and personalize treatment plans.

The reagents and kits segment, which supports nearly every diagnostic process, is expected to dominate the market with a 63.3% revenue share in 2025. Similarly, infectious disease diagnostics—driven by global challenges such as tuberculosis, hepatitis, and antimicrobial resistance—will capture 38.6% of the market share, reaffirming their critical role in global health security.

Regional Outlook: The United States, Germany, China, and India Lead Expansion

Regionally, North America and Europe continue to dominate the global market due to established infrastructure, strong R&D investments, and the presence of industry leaders such as Roche Diagnostics, Abbott Laboratories, and Thermo Fisher Scientific.

The United States, with a CAGR of 3.4%, remains a powerhouse for diagnostic innovation, benefiting from extensive research networks and favorable reimbursement structures. Germany, growing at 3.9% CAGR, leads Europe’s diagnostics revolution with its advanced medical infrastructure and strong government support for R&D initiatives.

In Asia-Pacific, China and India are emerging as dynamic markets. China is projected to record 5.6% CAGR, driven by increasing healthcare spending and rapid technology adoption. India, the fastest-growing market at 6.0% CAGR, faces a surge in chronic diseases and an aging population, fueling demand for affordable, rapid diagnostic tools.

Key Growth Drivers: Aging Population and Technological Innovation

By 2050, the global population aged 60 and above is expected to nearly double, significantly increasing demand for diagnostic tests to detect and manage chronic conditions such as diabetes, cardiovascular disease, and cancer. This demographic shift places immense pressure on healthcare systems to adopt advanced and affordable testing technologies that enable early detection and preventive care.

Technological innovation remains the market’s backbone. Continuous breakthroughs in biomarker discovery, molecular diagnostics, and AI-based tools are enhancing testing precision and accessibility. Laboratory automation, liquid biopsy techniques, and portable home-testing devices are now defining the next phase of diagnostics evolution.

Industry Landscape: Established Leaders and New Entrants Driving Competition

The market is characterized by a balanced mix of global giants and emerging innovators. Tier 1 players, including Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, and Siemens Healthineers, collectively hold 55.4% of the global share. These companies leverage their extensive portfolios and R&D investments to expand into high-growth regions and launch new solutions.

Meanwhile, Tier 2 companies such as Danaher Corporation, Bio-Rad Laboratories, Becton, Dickinson and Company, Quest Diagnostics, and bioMérieux are focusing on niche markets, cost-effective technologies, and collaborative partnerships to strengthen their presence.

Smaller Tier 3 firms, operating regionally, bring agility and specialization to the market, often focusing on emerging diagnostic technologies and innovative product formats. Together, these companies form a competitive ecosystem that fosters continuous innovation.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness