Japan Car Insurance Market Growth, Trends, Size and Forecast to 2033

Key Highlights of the Report:

Liability insurance and the aging of Japanese drivers are major factors determining the forces that shape car insurance demands in Japan currently.

The growth in the number of car accidents in Japan is a vital factor that justifies viable car insurance coverage in the country.

Insurance, Telematics, and AI Overhaul the Japanese Insurance Industry by Automating Claim Processing and Risk Assessment.

Japan has a mature insurance market, so the new expansion frontiers are usage-based insurance and rural expansion.

Traditional Japanese car insurers are facing the challenge of adapting to fierce competition and embracing digital transformation.

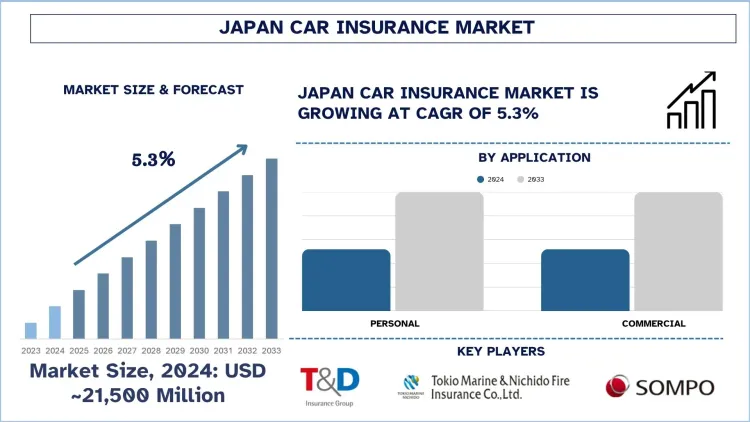

According to a new report by UnivDatos, the Japan Car Insurance Market is expected to reach USD million in 2033 by growing at a CAGR of 5.3% during the forecast period 2025-2033. The Japanese marketplace of car insurance is experiencing a massive transformation due to changing expectations of the consumers, changes in the population, and leaps in technology. There are three main dimensions in which insurers are getting innovative in the Japanese market, namely personalization, technology integration, and value-added services. Customers have gained interest in operating with flexible plans that include real-time support, risk assessment by AI, and online claims seamlessness. The advent of green-conscious consumers has prompted insurance firms to incorporate the benefits of green vehicles and paperless processes. Associations with telematics partners and the development of car technology companies are on the verge of creating smarter, safer, and more financially controllable insurance. The type of risk that future insurance will offer to urban commuters and the diverse, modern, and health-aware individuals who possess technology. The new standard is interactive dashboards, QR-based policy tracking, and mobile apps.

Segments that transform the industry

Based on coverage, the Japanese car insurance market is bifurcated into third-party liability coverage and collision/comprehensive/other optional coverage. Of these, third-party liability has held the major market share due to being mandatory in Japan for each vehicle. Driving without a third-party liability coverage can attract hefty fines, and the coverage is extensively checked by the authorities to avoid any discrepancies. Furthermore, with the growing vehicle fleet and awareness, and strict policies, people are vying more for collision and other coverage-based insurance, which would be conducive to the market expansion of the segment in the coming years.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/japan-car-insurance-market?popup=report-enquiry

According to the report, Mandatory Automobile Liability Insurance (CALI) has been identified as a key driver for market growth. Some of how this impact has been felt include:

Mandatory Automobile Liability Insurance (CALI) is a liability insurance required by all registered motor vehicles in the country and is referred to in Japan as Jibaiseki Hoken. CALI is a regulated policy by the government, and it is introduced to provide minimum compensation to the victims of traffic accidents. The policy covers bodily harm or death of third parties when they are injured in the accident. It is insured against property damage or injuries to the insured driver or passengers inside the vehicle. If it is not carried when driving, a penalty of one year of imprisonment or a fine of under USD 3,360 (¥500,000) will be imposed.

All vehicles have to be registered in the CALI system before they are legally allowed onto the public roads, and also take the required vehicle inspection (shaken). The nature of the policy is one to three years, and the premium is dependent on the kind of vehicle. In case the victim is affected, there are three payouts: in case of disability, injury, or death of the victim, the payout is (USD 8,000, 268,000, and 210,000, respectively.

· Although CALI offers vital legal protection, it is generally thought to be inadequate in most accident scenarios that might happen. Consequently, optional voluntary car insurance (Nin-I Hoken) is taken by most drivers to supplement CALI, paying the cost of repairing their vehicle, paying loss to property, and other costs of personal injury. Driving without CALI is also considered a crime, and it not only brings a serious number of fines, suspension of the license, or even imprisonment.

Related Reports:

Private Pension Insurance Market: Current Analysis and Forecast (2025-2033)

Private Pension Insurance Market: Current Analysis and Forecast (2025-2033)

Mexico Private Equity Market: Current Analysis and Forecast (2025-2033)

Insurance Rating Platform Market: Current Analysis and Forecast (2024-2032)

Insurtech Market: Current Analysis and Forecast (2024-2032)

Key Offerings of the Report

Market Size, Trends, & Forecast by Revenue | 2025−2033.

Market Dynamics – Leading Trends, Growth Drivers, Restraints, and Investment Opportunities

Market Segmentation – A detailed analysis By Coverage, BY Application, By Distribution Channel, By Region

Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Contact Us:

Email - contact@univdatos.com

Website - www.univdatos.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness