Mexico Data Center Colocation Market Size & Forecast 2033

Market Overview 2025-2033

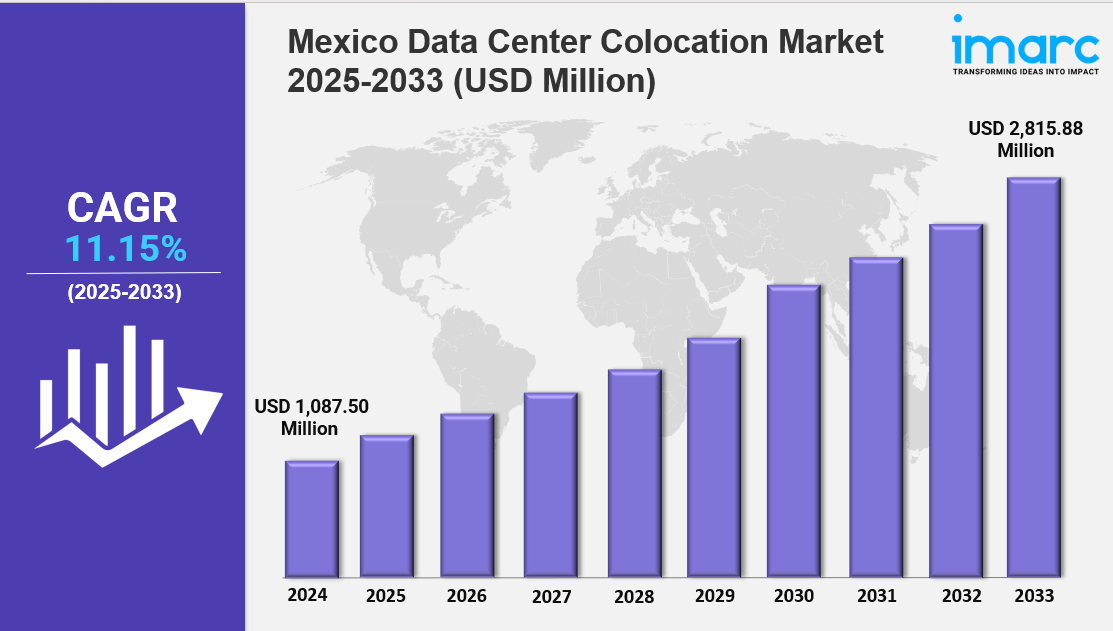

The Mexico data center colocation market size reached USD 1,087.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,815.88 Million by 2033, exhibiting a growth rate (CAGR) of 11.15% during 2025-2033. The market is expanding due to rapid digital transformation, rising cloud adoption, and nearshoring trends. Growth is driven by wholesale and retail colocation demand, 5G integration, and major hyperscaler investments, making the sector more scalable, efficient, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by rising digital transformation and demand for scalable IT infrastructure

✔️ Increasing adoption among enterprises and cloud service providers for cost-effective data management

✔️ Expanding investments in energy-efficient facilities and strategic locations to enhance connectivity and uptime

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-data-center-colocation-market/requestsample

Mexico Data Center Colocation Market Trends and Drivers:

The Mexico data center colocation market is growing at a remarkable pace as the country strengthens its position as a nearshoring hub for global technology and manufacturing companies. With many organizations relocating latency-sensitive workloads from Asia to North America, Mexico data center colocation market demand surged by nearly 60% year-over-year.

Major cloud providers such as AWS, Microsoft, and Oracle are leading investments exceeding $2 billion to build and expand data centers near the U.S. border. These facilities maintain low-latency, sub-15 millisecond connections to major financial hubs, enabling faster data transmission and more reliable cross-border operations. Oracle’s modular data centers in Tijuana and Ciudad Juárez, along with KIO Networks’ 40MW Querétaro expansion featuring liquid cooling for AI workloads, reflect the rapid modernization sweeping the industry.

However, the market’s expansion also faces infrastructure challenges. Limited transmission capacity from Mexico’s Federal Electricity Commission (CFE) has delayed several new projects. Additionally, new data sovereignty regulations require local storage of Mexican user data, driving compliance-driven colocation demand up by over 300%, even as operational costs rise compared to U.S. facilities.

Sustainability and Renewable Power Transforming Market Practices

Sustainability has become a defining element of Mexico data center colocation market trends. Global clients now expect their colocation partners to meet strict carbon-reduction goals, including Scope 3 emission targets. To address these expectations, Mexico introduced new clean energy rules in 2024—mandating that data centers above 10MW use at least 65% renewable power.

This shift has sparked major investments in solar farms, wind projects, and battery storage solutions. Today, more than 70% of Mexico’s colocation capacity includes on-site renewable systems and biogas-powered backups. Companies like Enel and Engie are helping operators deploy renewable microgrids to reduce dependency on the national grid. Despite progress, facilities in drought-prone regions such as Nuevo León face higher construction costs due to water-saving cooling technologies, impacting profitability even with strong occupancy rates.

Edge Computing and 5G Fuel Regional Growth

The rollout of América Móvil’s 5G network has accelerated Mexico data center colocation market growth, particularly in edge computing. Over 1,200 micro colocation nodes have been deployed across 45 smaller cities, supporting smart manufacturing, logistics, and IoT-driven industries.

In regions like Guanajuato’s Bajío corridor, automotive manufacturers are leasing modular edge data centers to enable real-time analytics and improve operational efficiency. Collaborations such as the 2024 partnership between Equinix and Grupo Carso—installing AI-ready micro data centers in nearly 100 Oxxo stores—are creating distributed, high-performance networks that improve connectivity across the country.

However, reliability remains an issue for some facilities, especially those lacking Tier III redundancy. Fiber cuts and infrastructure sabotage in certain regions also pose operational risks.

Workforce, Regulations, and Technological Evolution

As private 5G and hybrid infrastructure models become more common, the demand for skilled technicians continues to rise. Hiring for specialized data center roles can now take up to 18 months, creating a talent gap that could slow expansion.

At the same time, Mexico data center colocation market trends show a growing emphasis on compliance and data protection. With stricter cross-border regulations, providers offering bilingual compliance teams and NAFTA 2.0-aligned frameworks are gaining a competitive edge.

A significant share of new colocation capacity now comes from repurposed industrial buildings, which often have strong existing power infrastructure. Companies like KIO Networks are introducing “Sovereign Cloud Vaults” with advanced biometric access systems to meet stricter government data-handling standards.

Technological advancements are also shaping the Mexico data center colocation market outlook. Tools such as AIOps are being adopted to optimize energy use and minimize waste, while major players like IBM are piloting quantum computing facilities in Monterrey—setting the foundation for Mexico’s next phase of digital infrastructure innovation.

Mexico Data Center Colocation Market Outlook

Looking ahead, the Mexico data center colocation market outlook remains highly optimistic. Continued investment from global cloud providers, growing regional connectivity, and the country’s nearshoring advantages will sustain momentum in the years to come.

As trade tensions between the U.S. and China persist, cloud giants like Tencent and Alibaba are choosing Mexico as a strategic gateway to the Americas, committing over $800 million to hyperscale developments near Lázaro Cárdenas.

Ultimately, Mexico data center colocation market demand will be driven by three key pillars: performance, sustainability, and regulatory compliance. With these factors aligning, Mexico is rapidly emerging as one of the most dynamic and competitive data center hubs in the Western Hemisphere.

Mexico Data Center Colocation Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

-

Retail Colocation

-

Wholesale Colocation

Breakup by Organization Size:

-

Small and Medium Enterprises

-

Large Enterprises

Breakup by End Use Industry:

-

BFSI

-

Manufacturing

-

IT and Telecom

-

Energy

-

Healthcare

-

Government

-

Retail

-

Education

-

Entertainment and Media

-

Others

Breakup by Region:

-

Northern Mexico

-

Central Mexico

-

Southern Mexico

-

Others

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness