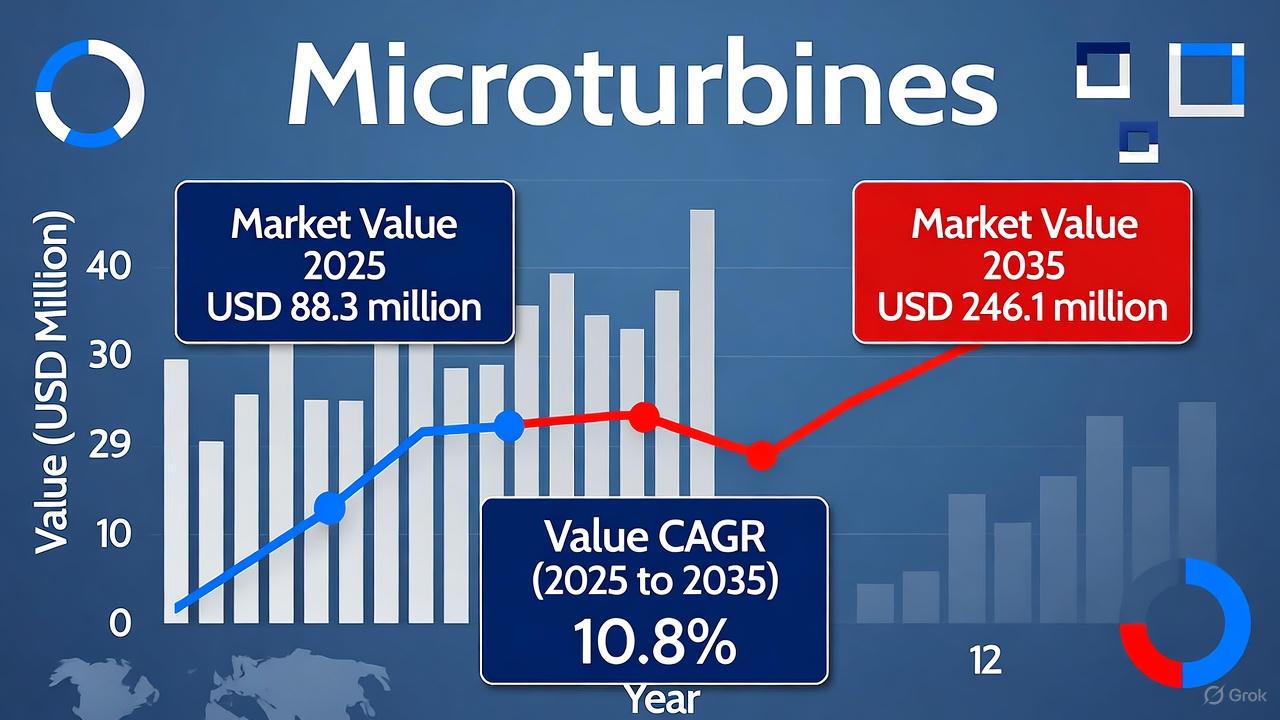

Microturbines Market to Surpass USD 246.1 Million by 2035

The global microturbines market is entering a transformative decade, marked by rapid technological innovation, sustainability goals, and expanding decentralized energy networks. According to projections, the market is valued at USD 88.3 million in 2025 and is expected to reach USD 246.1 million by 2035, growing at a robust CAGR of 10.8%. This growth represents an incremental opportunity worth USD 157.9 million, underscoring the accelerating shift toward distributed and environmentally responsible energy generation.

Microturbines—compact gas turbine power systems fueled by natural gas, biogas, or other renewable fuels—are becoming a cornerstone of clean, efficient energy. With power outputs ranging from 12 kW to 500 kW, they are especially suited for Combined Heat and Power (CHP) applications, enabling industries and commercial facilities to maximize energy efficiency and reduce emissions.

Get this Report at $5000 Only (Report price) | Exclusive Discount Inside!: https://www.futuremarketinsights.com/reports/sample/rep-gb-50

Industry Growth Driven by Efficiency and Resilience

As the world focuses on sustainability and resilience, microturbines are gaining prominence for their ability to deliver reliable power in areas with unstable grid access. These systems are increasingly vital to industrial facilities, data centers, and healthcare institutions, which rely on continuous power for mission-critical operations.

Microturbines’ ability to generate both electricity and thermal energy through CHP configurations is transforming energy management strategies. In regions where renewable energy integration and carbon neutrality are policy priorities, these systems are playing a central role in achieving sustainability goals.

50 kW–250 kW Microturbines: The Powerhouse Segment

Among all configurations, the 50 kW–250 kW power rating segment is projected to dominate the market, expanding at a CAGR of 9.3% through 2035 and capturing nearly 28.2% of total market share. This range offers the ideal balance between performance, efficiency, and affordability for mid-sized industrial and commercial users.

These microturbines are widely used for decentralized energy generation, offering thermal efficiencies of up to 85% in CHP systems. Their adaptability to fuels such as natural gas, biogas, and hydrogen enables users to comply with stringent environmental regulations while reducing operational costs. Manufacturers are enhancing designs with improved aerodynamics and advanced combustion systems to extend operational lifespans and reduce maintenance.

Industrial Sector Leads the Adoption Curve

The industrial sector remains the largest end-user, projected to command 36.6% of the total value share by 2035. Heavy industries, chemical processing plants, and manufacturing facilities are increasingly investing in microturbine installations to secure self-sufficient power generation and minimize reliance on traditional grids.

These industries favor the 250 kW–500 kW range for its scalability and fuel efficiency, providing the durability and resilience required for large-scale operations. Industrial applications account for nearly 60% of the market, reflecting their pivotal role in the global transition toward cleaner and more efficient energy systems.

Global Market Dynamics: Semi-Annual Performance Trends

The market’s semi-annual performance indicates a consistent upward trajectory. Between 2024 and 2034, microturbine sales are forecast to grow at 9.2% CAGR in H1 and 11.6% in H2. From 2025 to 2035, growth remains strong at 10.1% in H1 and 11.5% in H2, reflecting stable long-term momentum.

This steady growth reflects continuous advancements in turbine technology, favorable government policies, and the expanding use of renewable fuels across industries.

Hydrogen-Powered Microturbines: The Next Frontier

A major evolution in the microturbine market is the integration of hydrogen fuel. Manufacturers like Capstone Green Energy are pioneering hydrogen-compatible systems, with models such as the C65 and C200 already capable of operating on blends containing up to 30% hydrogen. This innovation supports the global transition to low-carbon energy systems while ensuring reliability and efficiency.

Similarly, Ansaldo Green Tech’s consortium project, supported by FILSE in Italy, is developing a zero-impact hydrogen microturbine prototype to serve future microgrids and energy communities. These advancements signal a clear move toward cleaner energy systems, reducing greenhouse gas emissions and enhancing energy independence.

Regional Insights: USA, China, and India Drive Growth

The United States continues to dominate the North American market with a 71.3% share through 2035, driven by extensive adoption of CHP systems across manufacturing, healthcare, and institutional facilities. Microturbines’ dual-generation capabilities provide both electricity and thermal energy, allowing industries to achieve significant cost savings and improved reliability.

In China, rising industrialization and a national focus on reducing carbon emissions are fueling demand for decentralized power generation. Microturbines are increasingly integrated into CHP systems to deliver stable, off-grid energy solutions.

Meanwhile, India’s expanding industrial base and rural electrification initiatives are opening new opportunities for microturbine deployment. These systems offer dependable on-site generation in regions with inconsistent grid access, making them ideal for both remote and urban industrial setups.

Competitive Landscape and Emerging Players

The global microturbines market is characterized by a blend of established leaders and emerging innovators. Tier 1 companies, such as Microturbine LLC, NewEnCo, Ansaldo Energia S.p.A, FlexEnergy, and Elliot Company Inc., collectively hold around 50–55% of market share, benefiting from technological expertise and wide regional coverage.

Tier 2 companies and smaller start-ups are increasingly entering niche markets, focusing on localized solutions and customized designs for specific industries. Their presence enhances competition and drives innovation, especially in hybrid and renewable-integrated microturbine systems.

In December 2024, Capstone Green Energy LLC announced the sale of four C65 microturbines to Black River Memorial Hospital in Wisconsin, emphasizing the growing healthcare sector adoption. Similarly, Ansaldo Green Tech’s 2024 hydrogen microturbine project marks a leap toward carbon-neutral innovation, underscoring the industry’s future direction.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness