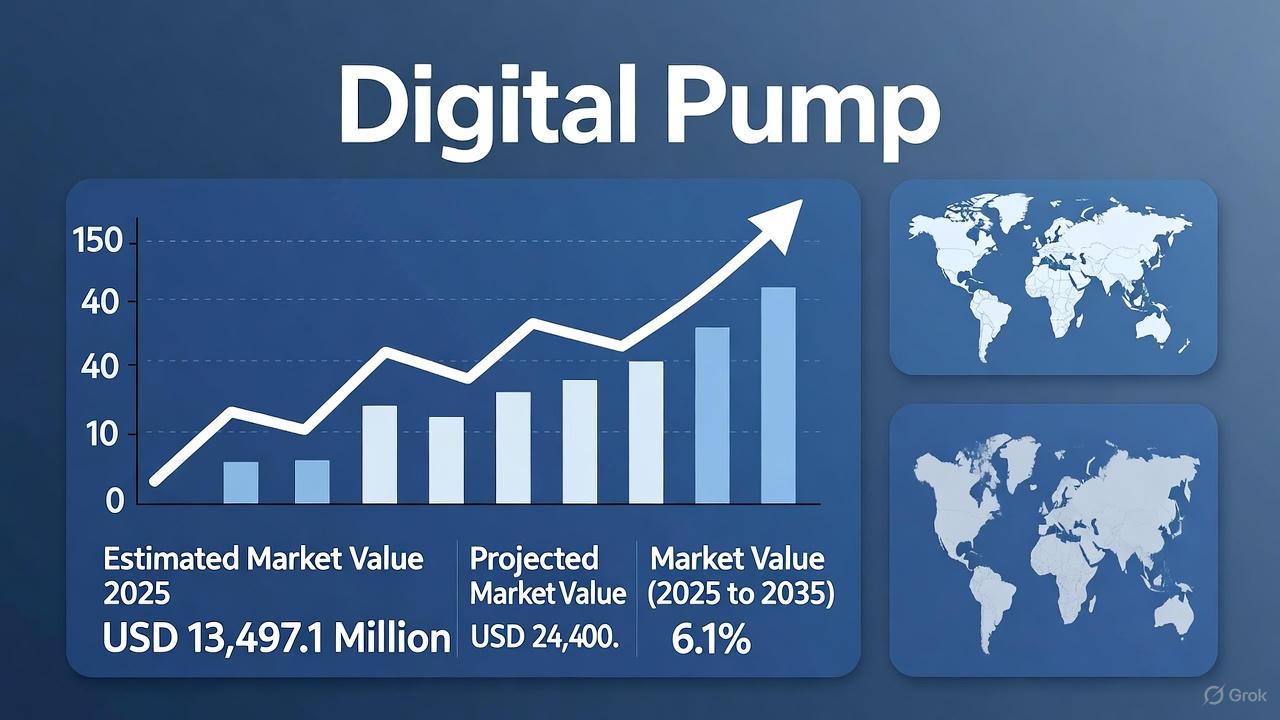

Digital Pump Market to Surpass USD 24.4 Billion by 2035

The global digital pump market is on a dynamic growth path, expected to rise from USD 13,497.1 million in 2025 to USD 24,400.3 million by 2035, marking a CAGR of 6.1%. The increasing demand across buildings, water treatment plants, automation, and power systems is fueling this momentum, positioning digital pumps as a core component of industrial modernization.

Driven by technological advancements, stricter energy-efficiency standards, and government support for smart infrastructure, the digital pump industry is becoming central to global sustainability and energy management goals. Both established manufacturers and emerging players are capitalizing on this growth, investing in innovation, and expanding their global reach.

Get this Report at $5000 Only (Report price) | Exclusive Discount Inside!: https://www.futuremarketinsights.com/reports/sample/rep-gb-14577

Energy Efficiency and Smart Integration Leading the Revolution

Energy savings and intelligent operations lie at the heart of digital pump adoption. Unlike conventional systems, digital pumps equipped with variable frequency drives (VFDs) and smart sensors can self-regulate speed and flow, aligning output with real-time demand. This not only lowers energy consumption but also extends equipment lifespan and reduces operational costs.

Companies like Grundfos, Flowserve, and Xylem are pioneering energy-efficient technologies that support sustainability goals while optimizing performance in sectors such as HVAC, oil & gas, and municipal water systems. Emerging manufacturers, particularly in Asia-Pacific and Latin America, are also leveraging IoT integration to develop cost-effective smart pumping solutions that cater to growing automation needs.

As industries worldwide prioritize decarbonization, the digital pump market’s role in achieving energy efficiency targets has become indispensable. The growing application of hybrid systems, including solar-powered pumps, further underscores the sector’s commitment to eco-friendly innovation.

IoT and Predictive Maintenance: Defining the Next-Gen Pumping Era

Digital pumps are increasingly connected through IoT ecosystems, enabling continuous monitoring, diagnostics, and control. This transformation allows operators to receive real-time data on flow rates, energy use, and system performance—empowering proactive maintenance and minimizing downtime.

For instance, Xylem’s Smart Pump Optimization System, launched in June 2024, combines advanced machine learning algorithms with real-time analytics to optimize performance and cut energy costs. Similarly, Flowserve’s Vanguard Digital Pump Series, introduced in May 2024, features automated diagnostics for industrial applications, enhancing reliability across sectors such as oil & gas and power generation.

These innovations not only enhance productivity but also ensure operational safety, especially in remote or hazardous environments. By reducing manual intervention and enabling predictive maintenance, digital pumps are redefining process reliability in critical infrastructure industries.

Market Dynamics and Growth Patterns

The semi-annual performance of the digital pump market highlights consistent growth. From 2024 to 2034, CAGR rose from 5.7% in the first half to 6.1% in the second. Between 2025 and 2035, the rate increases further, reaching 6.4% in H2. This progression reflects robust market expansion driven by rapid industrial automation and infrastructure investments.

While Tier 1 companies such as Grundfos, Sulzer, Wilo SE, and KSB Group dominate with a 50–60% market share, Tier 2 and emerging players are gaining momentum by addressing localized needs and niche segments like agriculture and residential water management. Their agility and innovation are helping democratize access to smart pumping solutions in developing markets.

Regional Insights: Global Adoption Gaining Pace

United States: Leadership in Smart Water Infrastructure

With a value share of 72.7% projected for 2035 in North America, the U.S. remains a powerhouse in digital pump innovation. Backed by automation initiatives and sustainability mandates, American manufacturers such as Xylem and Flowserve are investing in IoT-enabled water and energy systems. The expansion of clean water programs and energy optimization projects continues to boost adoption, supported by robust industrial automation in the automotive and chemical sectors.

Germany: Engineering Excellence and Smart Integration

Germany’s precision-driven industrial base is embracing digital transformation through advanced pump systems. Market leaders Wilo and KSB Group are pioneering IoT-based smart pumps tailored for HVAC, chemical, and water management applications. The nation’s Energiewende policy has further accelerated investments in energy-efficient solutions, cementing Germany’s leadership in the European market.

China: Rapid Industrial Growth and Urbanization Fuel Demand

China’s digital pump market, valued at nearly USD 900 million in 2020, is expected to experience double-digit growth through 2035. Massive industrialization, urban infrastructure projects, and government-led initiatives under “Made in China” are propelling adoption. Domestic manufacturers like Shanghai East Pump and Shijiazhuang Pump are leveraging smart city projects to develop advanced, efficient systems tailored for the local market.

Sectoral Performance and Technological Focus

Among key segments, mobile and remote digital pump controllers are expected to dominate, achieving a 6.4% CAGR by 2025. The rise of Industry 4.0 and the demand for remote access and monitoring capabilities are driving this segment forward.

Meanwhile, the manufacturing sector—holding a 28.1% share in 2025—continues to lead end-use applications. Industries such as chemical processing, automotive, and food & beverage are increasingly adopting digital pumps to streamline fluid management and enhance operational efficiency. These sectors benefit from predictive maintenance, reduced downtime, and sustainability compliance—all of which contribute to long-term cost optimization.

Competitive Outlook: Innovation at the Core

The digital pump market is witnessing intense competition as major players enhance their portfolios with advanced digital capabilities. Grundfos, Xylem, Sulzer, and Siemens Energy are leading the charge with high-performance, IoT-integrated systems that redefine pumping efficiency.

At the same time, smaller innovators in emerging markets are carving niches by offering cost-effective, smart, and modular solutions. Companies like ITM Power, McPhy Energy, and Enapter are investing in R&D to develop intelligent pumping systems that align with global sustainability goals.

Recent product launches highlight this momentum: Grundfos’s next-generation smart pumps, Flowserve’s digital diagnostics, and Xylem’s cloud-powered optimization systems exemplify the industry’s collective push toward connectivity and sustainability.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness