Consumer Electronics Repair and Maintenance Market Overview- Industry Analysis and Forecast 2025-2033

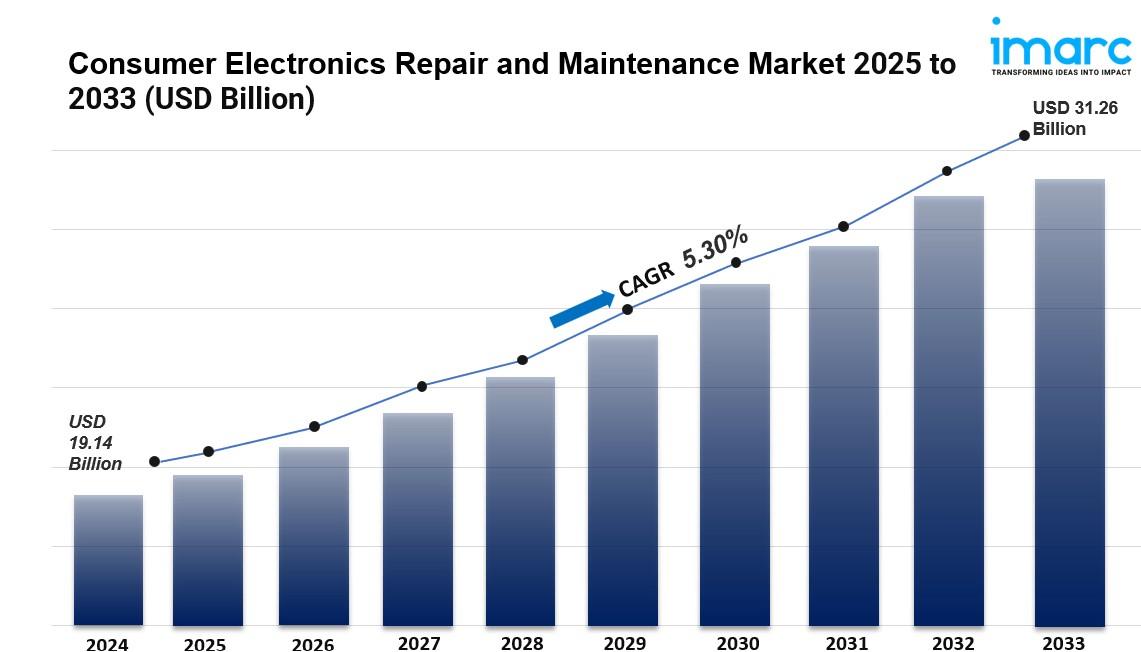

The global consumer electronics repair and maintenance market size was valued at USD 19.14 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 31.26 Billion by 2033, exhibiting a CAGR of 5.30% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 36.2% in 2024. The market is experiencing steady growth driven by the rising cost of new electronics making repairs more economical, increasing complexity of modern devices requiring specialized services, and growing environmental consciousness encouraging people to repair rather than replace their devices.

Key Stats for Consumer Electronics Repair and Maintenance Market:

- Consumer Electronics Repair and Maintenance Market Value (2024): USD 19.14 Billion

- Consumer Electronics Repair and Maintenance Market Value (2033): USD 31.26 Billion

- Consumer Electronics Repair and Maintenance Market Forecast CAGR: 5.30%

- Leading Segment in Consumer Electronics Repair and Maintenance Market in 2024: Home Appliances (52.3%)

- Key Regions in Consumer Electronics Repair and Maintenance Market: Asia Pacific, Europe, North America, Latin America, Middle East and Africa

- Top companies in Consumer Electronics Repair and Maintenance Market: Cordon Group, Ensure Services (Redington Group), ReWard Technologies, TVS Electronics, uBreakiFix, and Urban Company, etc.

Why is the Consumer Electronics Repair and Maintenance Market Growing?

The repair and maintenance market for consumer electronics is gaining momentum as more people realize that fixing a device often makes better financial sense than buying a new one. With smartphones costing upwards of USD 1,000 and laptops reaching similar price points, repair services offer a practical alternative that can save consumers hundreds of dollars. This economic reality is particularly compelling during times of inflation and economic uncertainty.

But it's not just about the money. Today's electronics have become incredibly sophisticated—packed with advanced sensors, intricate circuits, and complex software systems. When something goes wrong with these devices, it typically requires professional expertise to diagnose and fix the problem properly. This growing complexity is creating strong demand for skilled technicians who can handle everything from software glitches to hardware component replacements.

The environmental angle is also playing a bigger role than ever before. Electronic waste has become a serious global concern, with millions of tons of discarded devices ending up in landfills each year. More people are becoming aware of this problem and are actively choosing to extend the life of their electronics through repairs. This shift toward sustainability isn't just a consumer trend—it's being actively supported by government policies and industry initiatives worldwide.

The rise of digital platforms has made accessing repair services easier than ever. People can now book appointments online, track their repairs in real-time, and even get virtual diagnostics. This convenience factor, combined with expanding networks of authorized service centers and independent repair shops, means that quality repair services are more accessible to more people than ever before.

Request to Get the Sample Report: https://www.imarcgroup.com/consumer-electronics-repair-maintenance-market/requestsample

AI Impact on the Consumer Electronics Repair and Maintenance Market:

Artificial intelligence is fundamentally changing how electronics get repaired and maintained. AI-powered diagnostic tools can now analyze device problems with remarkable accuracy, often identifying issues that would take human technicians much longer to find. These systems examine error logs, performance data, and usage patterns to pinpoint exactly what's wrong and recommend the most effective solutions.

Predictive maintenance is another area where AI is making a real difference. By continuously monitoring device performance and analyzing operational data, AI systems can detect early warning signs of potential failures before they become serious problems. This means devices can be serviced proactively, preventing costly breakdowns and extending their useful life. For businesses managing large fleets of devices, this capability translates into significant cost savings and reduced downtime.

AI is also streamlining the repair process itself. Intelligent systems can automatically order replacement parts when a diagnosis is complete, schedule technician assignments based on skill level and location, and provide step-by-step repair guidance with visual aids. Some advanced systems even use computer vision to verify that repairs have been completed correctly, ensuring quality standards are consistently met.

The customer experience is being enhanced through AI-powered chatbots and virtual assistants that can handle initial troubleshooting, provide estimated repair times, and keep customers updated throughout the repair process. These tools operate around the clock, offering support whenever customers need it. Behind the scenes, AI analytics help service providers optimize their operations, predict demand patterns, and manage inventory more efficiently—ultimately leading to faster service and better outcomes for customers.

Segmental Analysis:

Analysis by Product:

- Home Appliances

- Mobile Phones

- Computers/Laptops

- Television/Gaming Consoles

- Cameras and Camcorders

- Others

Home appliances command the largest share of the market at 52.3% in 2024, encompassing essential household devices like refrigerators, washing machines, dishwashers, microwaves, and other kitchen equipment. The dominance of this segment makes sense when you consider how central these appliances are to daily life. When a refrigerator stops cooling or a washing machine breaks down, people need repairs fast—and they're often willing to pay for quality service to avoid the much higher cost of replacement.

The sophistication of modern appliances is another factor driving repair demand. Today's smart refrigerators, high-efficiency washers, and connected ovens contain advanced electronics and software that require specialized knowledge to service properly. Regular maintenance of these appliances isn't just about fixing problems—it's also about ensuring optimal energy efficiency, which can result in meaningful savings on utility bills over time.

Analysis by Service Provider:

- Authorized Service Centers

- Independent Repair Shops

Authorized service centers hold the dominant position with 67.2% market share in 2024. People trust these centers because they use genuine manufacturer parts, employ factory-trained technicians, and maintain repair standards that protect warranty coverage. When you're dealing with an expensive smartphone or a premium laptop, the peace of mind that comes from authorized service is often worth any additional cost.

These centers have access to proprietary diagnostic tools, detailed repair manuals, and direct support from manufacturers when unusual problems arise. For newer devices still under warranty, authorized centers are often the only option for repairs that won't void coverage. The relationship these centers maintain with device manufacturers also means they're typically first to receive information about known issues, software updates, and improved repair techniques.

Request Customization: https://www.imarcgroup.com/request?type=report&id=27660&flag=E

Analysis of Consumer Electronics Repair and Maintenance Market by Regions

North America

In North America, the United States represents a substantial 82.70% of the overall market share. The American market benefits from well-developed infrastructure, including an extensive network of both authorized service centers and independent repair shops. The country's strong e-commerce ecosystem is also playing a role—the U.S. e-commerce sector is forecast to reach USD 2,083.97 Billion by 2032, making it easier for consumers to find repair services, order parts, and schedule appointments online.

The "Right to Repair" movement has gained significant traction in the U.S., with several states passing legislation that requires manufacturers to make repair information and parts available to independent repair shops and consumers. This regulatory shift is democratizing access to repair services and making it easier and more affordable for people to maintain their electronics. In 2024, Encompass Supply Chain Solutions launched dedicated support for Beko appliance parts in the U.S., including a comprehensive website and toll-free hotline, demonstrating how companies are responding to increased demand for accessible repair solutions.

Europe

Europe's repair market is strongly influenced by progressive environmental regulations and a population that's highly conscious of sustainability issues. The European Union has been leading global efforts to combat electronic waste through policies that mandate better product design for repairability and establish recycling requirements. These regulations are creating an environment where repair services thrive.

The region's commitment to sustainability extends beyond policy to consumer behavior. European consumers are increasingly choosing to repair their devices as an ethical choice, not just an economic one. This cultural shift is supported by initiatives like KitchenAid's enhanced repair service launched in 2024 for UK customers, which partnered with Trojan Electronics to provide comprehensive repair support for both in-warranty and out-of-warranty appliances, including color-matching replacement parts to extend product lifespan.

Asia Pacific

Asia Pacific leads the global market with 36.2% share in 2024, driven by its position as a manufacturing powerhouse for consumer electronics. Countries like China, Japan, and South Korea serve as both production hubs and major markets for repair services. The region's large and growing middle class is rapidly adopting smartphones, tablets, home appliances, and wearable devices, creating enormous demand for maintenance and repair services.

Government initiatives are actively supporting market growth in the region. In 2024, India's Department of Consumer Affairs introduced the "Right to Repair Portal," providing consumers with access to product manuals, repair videos, and spare parts information. This initiative supports the government's circular economy objectives while empowering consumers to make informed decisions about repairs. Similarly, the Indian government announced plans to implement a "repairability index" for mobile devices and electronics by December, which will rate products based on factors like ease of disassembly and spare parts availability—helping consumers choose products that are designed to last.

Latin America

Latin America is experiencing growing demand for repair services as technology adoption accelerates across the region. E-commerce is expanding rapidly in the area, with Mexico's e-commerce market projected to grow at 12.40% between 2024 and 2032 according to IMARC Group data. This digital growth is making repair services more accessible, as local repair shops can reach wider customer bases through online platforms and offer competitive pricing.

The region's focus on cost-effective solutions aligns well with the repair market's value proposition. As more middle-income consumers invest in smartphones and electronics, the demand for affordable repair options that can extend device life continues to rise.

Middle East and Africa

The Middle East and Africa region is experiencing rapid growth as consumer electronics become increasingly essential for daily activities. According to The Mobile Economy Middle East and North Africa 2024 report by GSMA, mobile technologies are driving digital transformation, with 50% of mobile connections expected to have 5G capability by 2030. This technological advancement is creating demand for more sophisticated repair services, as advanced devices require specialized knowledge and equipment for proper maintenance.

Vodacom Tanzania's introduction of after-sales service repair centers in 2024 exemplifies how companies are expanding service networks to meet growing demand. These centers, established through partnerships with leading smartphone manufacturers, aim to enhance customer satisfaction while supporting broader digital inclusion goals and improving digital literacy across the region.

What are the Drivers, Restraints, and Key Trends of the Consumer Electronics Repair and Maintenance Market?

Market Drivers:

Several powerful forces are driving market expansion. The proliferation of smartphones and wearables means more people own multiple devices that need occasional servicing. Rising health consciousness and environmental awareness are making consumers more thoughtful about their consumption patterns, leading many to choose repair over replacement when possible.

The shift toward remote and hybrid work has increased reliance on personal electronics for professional purposes. When your laptop or smartphone is essential for your livelihood, ensuring it stays in good working order becomes a priority. Additionally, subscription-based warranty and service plans are making regular maintenance more affordable and predictable for consumers, encouraging proactive care of devices.

Economic factors also play a role. With device prices climbing and economic uncertainty affecting household budgets, the cost difference between repairing and replacing has become more significant. For many families, spending USD 150 to repair a phone makes much more sense than spending USD 800 on a replacement.

Market Restraints:

The market does face some challenges. Data privacy concerns remain significant—people are naturally cautious about handing over devices that contain personal information, photos, financial data, and work documents. Service providers need to establish strong security protocols and transparent privacy policies to build customer trust.

In developing regions, limited internet access and lower smartphone penetration can restrict market growth. Additionally, the intense competition between free diagnostic services and paid repairs, along with the availability of cheap replacement parts online, can pressure profit margins for professional repair services.

Safety concerns about DIY repairs also affect the market. Without proper training, people attempting their own repairs risk damaging devices further or even injuring themselves. This creates both a challenge and an opportunity for professional services to educate consumers about the value of expert repairs.

Market Key Trends:

The integration of AI and machine learning for diagnostics and repair recommendations represents the most significant technological trend. These systems are becoming increasingly sophisticated, capable of analyzing complex problems and suggesting optimal solutions in minutes rather than hours.

Hybrid service models combining remote diagnostics, video consultations, and in-person repairs are gaining popularity. This approach offers convenience while maintaining the quality assurance of professional service. Customers can start the process from home and only bring devices in when necessary.

Gamification and community features are being incorporated into service platforms to boost customer engagement. Loyalty programs reward customers for regular maintenance, while online communities share tips and experiences. Some service providers are also expanding into holistic device management, offering not just repairs but also trade-in programs, upgrade assistance, and device optimization services.

The circular economy concept is moving from theory to practice, with more companies offering certified refurbished devices alongside repair services. This approach extends product lifecycles while providing affordable options for budget-conscious consumers. In 2024, Fnac Darty introduced a Digital Passport for home appliances based on QR codes that tracks the complete lifecycle from production to recycling, promoting sustainable consumption and initially offered for refurbished devices with plans to expand.

Leading Players of Consumer Electronics Repair and Maintenance Market:

According to IMARC Group's latest analysis, prominent companies shaping the global consumer electronics repair and maintenance landscape include:

- Cordon Group

- Ensure Services (Redington Group)

- ReWard Technologies

- TVS Electronics

- uBreakiFix

- Urban Company

These leading providers are expanding their reach through strategic partnerships, enhanced training programs, and advanced diagnostic technologies. They're investing heavily in technician certification to ensure consistent, high-quality repairs that meet manufacturer standards. Many are also incorporating sustainable practices into their operations, offering eco-friendly repair solutions that align with growing environmental concerns.

Companies are differentiating themselves through comprehensive service offerings—including extended warranties, rapid turnaround times, mobile repair services, and customer satisfaction guarantees. The focus is increasingly on creating seamless customer experiences that build long-term loyalty rather than just completing one-time transactions.

Key Developments in Consumer Electronics Repair and Maintenance Market:

December 2024: Fnac Darty launched a Digital Passport for home appliances in partnership with the non-profit sector. This innovative tool uses QR codes to track appliances throughout their entire lifecycle—from manufacturing through recycling—promoting sustainable usage. Initially available for refurbished devices, the digital passport provides transparency about product history and will expand to additional products in 2025, supporting circular economy principles.

2024: Fixle, Inc. partnered with Sears Home Services to enhance home appliance repair, maintenance, and support services. This collaboration merges Fixle's technological platform with Sears' extensive network of skilled technicians, giving homeowners streamlined access to repair services and home warranties. The partnership aims to simplify homeownership by providing comprehensive solutions for appliance management and repairs through an integrated digital platform.

2024: Encompass Supply Chain Solutions introduced dedicated support for Beko appliance parts throughout the United States, including a new website and toll-free hotline. This initiative provides customers with convenient access to original equipment manufacturer (OEM) parts for Beko appliances, along with expert technical assistance. The move enhances customer experience and extends the lifecycle of Beko products in the U.S. market.

2024: KitchenAid expanded its repair services in the UK through a partnership with Trojan Electronics, offering comprehensive repair support for both in-warranty and out-of-warranty appliances. This service aims to extend appliance lifespan, reduce waste, and provide replacement components including color-matching options for casings. The initiative aligns with KitchenAid's sustainability commitments and promotes repairability to decrease electronic waste.

2024: Vodacom Tanzania established after-sales service repair centers to improve digital inclusion by offering accessible repair services nationwide. The initiative, developed in collaboration with leading smartphone manufacturers, seeks to enhance customer satisfaction and support the growing smartphone market. Vodacom plans to expand these centers to meet increasing demand and improve digital literacy across Tanzania.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=27660&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness