GCC Electric Car Market Growth, Size & Trends Forecast 2025-2033

GCC Electric Car Market Overview

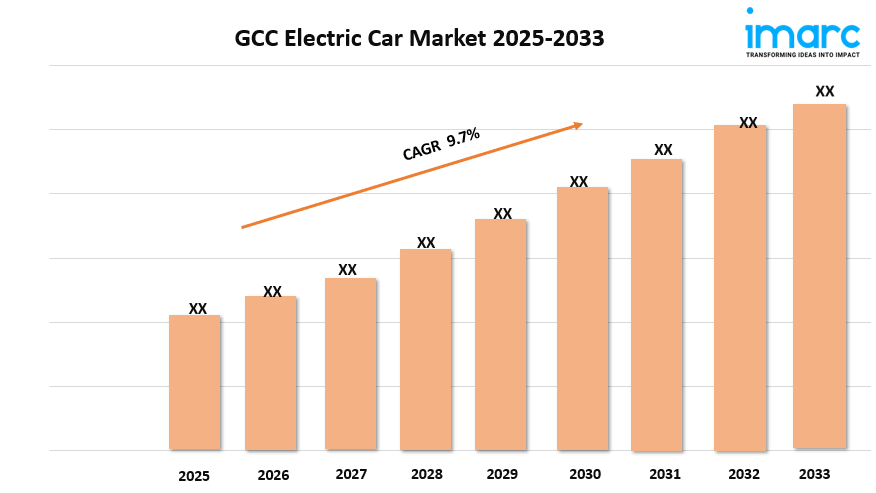

Market Size in 2024: USD 1.8 Billion

Market Size in 2033: USD 4.3 Billion

Market Growth Rate 2025-2033: 9.7%

According to IMARC Group's latest research publication, "GCC Electric Car Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The GCC electric car market size was valued at USD 1.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.3 Billion by 2033, exhibiting a CAGR of 9.7% during 2025-2033.

How AI is Reshaping the Future of GCC Electric Car Market

- Optimizing Battery Management: AI algorithms are revolutionizing battery performance in electric cars across the GCC. Lucid Motors' Saudi facility, producing up to 155,000 vehicles annually by 2026, integrates AI-driven battery management systems that extend range and improve charging efficiency by analyzing real-time data patterns.

- Smart Charging Infrastructure: The UAE leads with 261 EV charging stations, where AI optimizes grid integration and predicts peak demand. Dubai's Green Mobility Strategy targets having 10% of vehicles electric by 2030, with AI coordinating charging networks to prevent grid overload during high-usage periods.

- Predictive Maintenance Systems: AI-powered diagnostics reduce maintenance costs, a key selling point in the GCC market. Electric cars now use machine learning to predict component failures before they occur, cutting downtime by up to 30% and making ownership more attractive to consumers.

- Autonomous Driving Integration: The GCC's push toward smart cities is accelerating AI-driven autonomous features in electric vehicles. Saudi Arabia's investment of $3.4 billion over 15 years in Lucid Motors includes advanced driver assistance systems that leverage AI for safer roads and reduced accidents.

- Energy Consumption Analytics: AI helps drivers maximize efficiency by analyzing routes, weather, and driving habits. This technology is particularly valuable in the GCC's hot climate, where AI adjusts cooling systems and battery usage to maintain optimal performance even in extreme temperatures.

Grab a sample PDF of this report: https://www.imarcgroup.com/gcc-electric-car-market/requestsample

GCC Electric Car Market Trends & Drivers:

The GCC electric car market is experiencing rapid transformation, driven by ambitious government initiatives that are reshaping the automotive landscape. Saudi Arabia stands out with its plan to purchase up to 100,000 Lucid vehicles over the next decade, while simultaneously building the Kingdom's first domestic EV manufacturing plant at King Abdullah Economic City. This facility will produce 155,000 zero-emission vehicles annually by 2026, with around 85% earmarked for export. The UAE is matching this momentum through its Dubai Green Mobility Strategy, which sets a clear target of making 10% of all vehicles on the road electric by 2030. These aren't just policy statements—they're backed by substantial financial commitments, including tax exemptions, reduced registration fees, and free charging infrastructure that's making electric cars financially competitive with conventional vehicles.

Charging infrastructure development is no longer a bottleneck—it's becoming a competitive advantage for the GCC region. The UAE closed 2024 with 261 EV charging stations, while Saudi Arabia had 101 stations and is rapidly expanding its network through partnerships like Lucid's collaboration with EVIQ to develop high-speed charging capabilities. In July 2025, Lucid Motors signed an agreement with the Eastern Province Municipality to further expand charging infrastructure, addressing the previous gap on the crucial 900-kilometer highway between Riyadh and Mecca. The region's charging infrastructure market itself is valued at over $5.5 billion, reflecting the scale of investment pouring into this essential ecosystem. This aggressive buildout is eliminating range anxiety, one of the primary barriers to EV adoption, and making electric cars a practical choice for both city driving and longer journeys across the Gulf.

Growing environmental awareness coupled with rising fuel efficiency expectations is driving consumer demand for electric cars in the GCC. Despite the region's historical association with oil wealth, there's a noticeable shift in consumer mindset toward sustainability and reduced carbon footprints. Battery electric vehicles dominate the market, representing the largest segment, as they offer zero local emissions and significantly lower operating costs compared to traditional internal combustion engines. The mid-priced vehicle segment accounts for the largest market share, making electric cars accessible to a broader range of consumers beyond the luxury market. Front-wheel drive configurations lead in popularity, offering practical performance for the region's predominantly urban and highway driving conditions. This combination of environmental consciousness and economic pragmatism is creating a sustainable foundation for long-term market growth.

GCC Electric Car Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle

Vehicle Class Insights:

- Mid-Priced

- Luxury

Vehicle Drive Type Insights:

- Front Wheel Drive

- Rear Wheel Drive

- All-Wheel Drive

Breakup by Country:

- Saudi Arabia

- UAE

- Qatar

- Bahrain

- Kuwait

- Oman

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in GCC Electric Car Market

- April 2025: Tesla announced plans to begin Cybertruck deliveries in the UAE by late 2025, marking a significant expansion of the company's presence in the GCC market and offering consumers a new high-profile electric vehicle option.

- May 2024: The UAE Ministry of Energy and Infrastructure and Etihad Water and Electricity unveiled new initiatives to accelerate EV adoption, including enhanced subsidies and expanded charging networks as part of the nation's sustainability goals.

- July 2025: Lucid Motors signed a memorandum of understanding with the Eastern Province Municipality in Saudi Arabia to expand electric vehicle charging infrastructure, particularly targeting areas that previously lacked adequate charging facilities.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jocuri

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Alte

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness