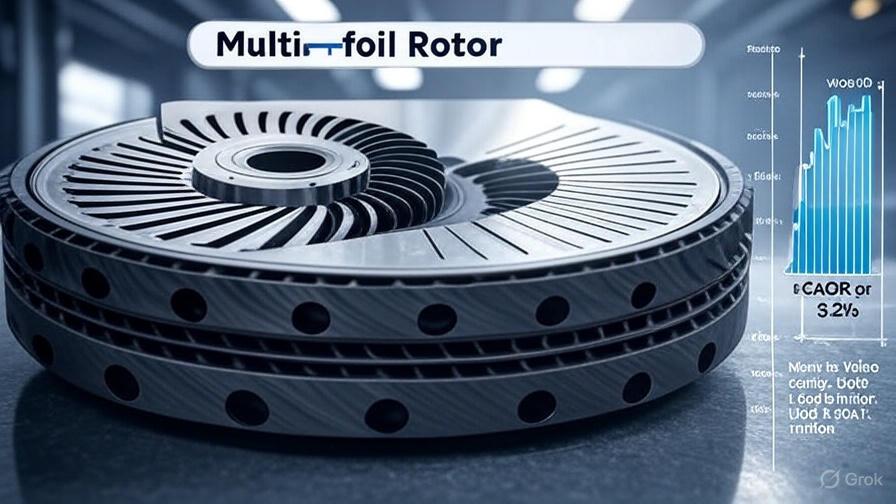

Multi-foil Rotor Market to Hit USD 2,204.1 million by 2035

The global multi-foil rotor market is entering a decade of consistent expansion, supported by rising industrial efficiency demands and breakthroughs in turbomachinery design. From an estimated USD 1,608.6 million in 2025, the market is projected to reach USD 2,204.1 million by 2035, marking an overall 37% growth at a CAGR of 3.2%. This steady rise reflects the critical role of multi-foil rotors in high-performance rotating equipment that powers industries across energy, manufacturing, food processing, and aerospace.

Full Market Report available for delivery. For purchase or customization, please request here: https://www.futuremarketinsights.com/reports/sample/rep-gb-25473

A Decade of Transformation

Between 2025 and 2030, the market is forecasted to expand by nearly USD 274.4 million, accounting for almost half of the decade’s total growth. This early phase will see industries accelerating the adoption of turbomachinery in power plants and automated facilities, with operators increasingly prioritizing precision and efficiency.

The second half of the forecast period, 2030 to 2035, will add another USD 321.2 million in market value, driven by new material innovations, advanced coatings, and the establishment of standardized rotor performance protocols across diverse sectors. This era is expected to highlight sustainability and advanced manufacturing, as both established giants and emerging players develop next-generation rotor systems.

Why the Market is Growing

Industrial automation, rising demand for efficiency, and expanding use of advanced bearing technologies are reshaping how industries approach turbomachinery. Even incremental improvements in rotor design yield significant energy savings, reduced downtime, and optimized performance. As industries navigate stricter operational requirements, manufacturers of multi-foil rotors are building precision-engineered solutions that align with global standards like ISO/EN and ANSI/ASME.

Companies are no longer just competing on cost—they are expected to deliver compliance, reliability, and technical excellence. This shift is positioning certified rotor manufacturers as essential partners in industrial modernization.

Segmental Insights

The standard-duty segment will capture around 40% of the market in 2025, owing to its versatility and cost-effectiveness in mainstream industrial settings. The medium-capacity/size class, holding 45% share, stands out as the most dominant category, offering balanced performance for both new installations and retrofits.

End-use analysis reveals the food and beverage industry leading with 14% market share, underscoring the importance of hygienic and contamination-free rotor systems in modern processing plants. On the compliance front, ISO/EN-certified solutions will dominate at 40%, reflecting the global move toward harmonized industrial standards.

Regional Dynamics

India leads global growth with a CAGR of 5.1% through 2035, fueled by rapid industrialization and government-backed infrastructure development. Mexico follows closely at 4.9%, driven by its expanding manufacturing base and automation adoption. Australia’s mining and energy sectors maintain a steady 3.6% growth trajectory, while Italy leverages precision engineering expertise at 3.0%. The United States grows at 2.9%, with emphasis on innovation and performance optimization.

In Japan, power generation applications will account for nearly 40% of demand by 2025, while petrochemicals and refining sectors remain key adopters. Europe continues to shine as an innovation hub, with Rolls-Royce, Honeywell Aerospace, Parker Aerospace, SKF, and TURBONIK GmbH setting benchmarks in rotor precision and high-speed applications.

Competitive Landscape

The competitive field reflects a blend of established global manufacturers and specialized innovators. Calnetix Technologies focuses on magnetic bearing systems and high-speed applications, while Capstone Green Energy integrates rotor solutions with distributed energy systems. Doosan Enerbility delivers industrial-scale rotor systems, and Honeywell Aerospace ensures aerospace-grade performance reliability.

Japanese leader Mitsubishi Heavy Industries embeds rotor solutions in industrial equipment operations, while Mohawk Innovative Technology specializes in foil-bearing systems. Parker Aerospace extends its footprint in both aerospace and industrial domains, with Rolls-Royce, SKF, and TURBONIK GmbH anchoring European innovation. These players are driving progress by investing in advanced materials, predictive maintenance systems, and sensor-based monitoring to optimize rotor performance.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness