UAE Ice Cream Market Report 2025 | Growth, Size, and Trends Forecast by 2033

UAE Ice Cream Market Overview

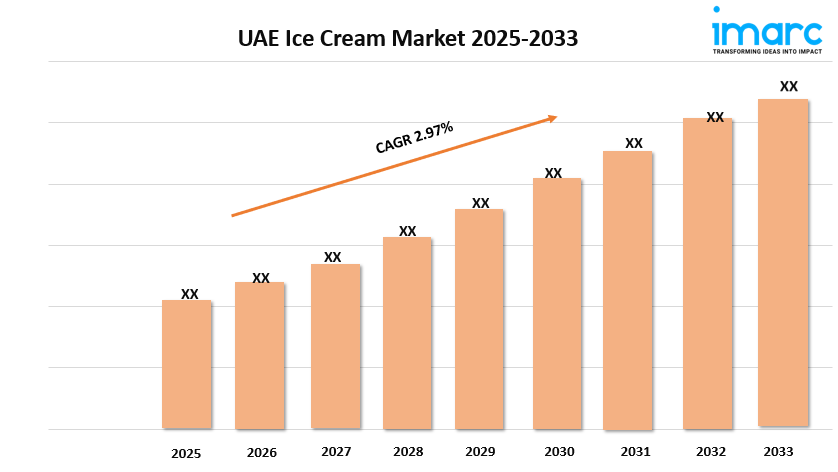

Market Size in 2024: USD 379.11 Million

Market Size in 2033: USD 493.36 Million

Market Growth Rate 2025-2033: 2.97%

According to IMARC Group’s latest research publication, “UAE Ice Cream Market Size, Share, Trends and Forecast by Flavor, Category, Product, Distribution Channel, and Region, 2025-2033", the UAE ice cream market size reached USD 379.11 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 493.36 Million by 2033, exhibiting a growth rate (CAGR) of 2.97% during 2025-2033.

How AI is Reshaping the Future of UAE Ice Cream Market

- AI-powered analytics help UAE ice cream brands spot what flavors people want in real-time, leading to up to 30% faster launches of new, crowd-pleasing products.

- Government-driven smart retail programs enable AI-driven inventory tracking, which cuts wastage by about 20% and helps shops keep everyone’s favorites in stock.

- With AI, ice cream giants customize digital ads, driving online sales growth by nearly 18% as more customers discover special deals tailored to their tastes.

- Robotics and AI-led automation are speeding up ice cream production lines, boosting daily output by an average of 25% and improving workplace efficiency.

- AI chatbots and smart kiosks now assist over 40% of UAE ice cream buyers during ordering, making shopping smoother, quicker, and much more engaging.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-ice-cream-market/requestsample

UAE Ice Cream Market Trends & Drivers:

The UAE ice cream market is being driven strongly by a surge in demand for innovative and premium product offerings. Consumers are gravitating toward unique and exciting flavors, ranging from local Arabian-inspired blends to exotic fruits like mango and passion fruit. Brands are responding by creating diverse formats, such as popsicles, ice cream sandwiches, and dessert bars, which appeal to consumers seeking new taste experiences. The increase in tourism and expatriate population further boosts demand for varied ice cream options. This dynamic has prompted companies to expand local production, with new factories enhancing freshness and meeting market needs more efficiently, fueling growth in the sector.

Another major growth driver is the rise of e-commerce and advanced logistics in the UAE’s ice cream market. Although offline retail remains dominant, there is a noticeable shift toward online purchasing fueled by consumer preferences for convenience and fast delivery. Ice cream brands are investing heavily in cold chain logistics, real-time tracking, and temperature-controlled delivery to maintain product quality during transit. This evolution in sales channels allows companies to reach a broader customer base rapidly and capitalize on digital retail trends, supporting market expansion and competitive differentiation among industry players.

Government initiatives and sustainability efforts are playing an increasing role in supporting the UAE ice cream sector’s growth. With schemes focused on boosting food security and industrial development, the government offers financing and incentives that encourage private investments in manufacturing and innovation. For instance, Pure Ice Cream’s new AED 80 million factory in Dubai aims for large-scale production along with sustainable practices like biodegradable packaging and solar energy usage. This governmental encouragement not only strengthens food safety and quality but also supports the UAE’s ambitions of becoming a resilient, global food hub while creating local employment.

UAE Ice Cream Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest UAE ice cream market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

The report has segmented the market into the following categories:

Flavor Insights:

- Vanilla

- Chocolate

- Fruit

- Others

Category Insights:

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

Product Insights:

- Cup

- Stick

- Cone

- Brick

- Tub

- Others

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Ice Cream Parlors

- Online Stores

- Others

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Ice Cream Market

- May 2025: Pure Ice Cream kicked off construction of its AED 80 million, AI-powered production facility at Dubai Industrial City. This ultra-modern plant will boost annual capacity to 50 million liters and use advanced automation, x-ray detection, and biodegradable packaging. The initiative includes solar power integration for carbon neutrality, and Pure Ice Cream has signed a deal to start producing Baskin-Robbins ice cream locally—highlighting a major shift toward technology-driven, sustainable local manufacturing.

- April 2025: The new Nutri-Mark nutrition label is set to launch, requiring manufacturers to rate ice cream products from A to E according to nutritional value. This rule, pushed by Abu Dhabi authorities, compels brands to reformulate recipes, adopt better quality controls, and invest in transparent labeling technology. Companies are preparing for increased operational costs and see this as both a challenge and a chance to improve health standards and win consumer trust in a highly competitive market.

- September 2024: The Brooklyn Creamery introduced keto-friendly Caramel Pecan Crunch ice cream in the UAE, cramming in just 1g net carbs and 132 calories per serving. This new launch taps into the surging demand for healthier, low-carb treats and signals that brands are doubling down on recipe innovation. The trend is amplified by producers reworking classic ice creams with plant-based or lower-sugar formulations as UAE shoppers shift their focus toward wellness and guilt-free indulgence.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness