UAE Residential Real Estate Market Trends, Growth, and Forecast 2025-2033

UAE Residential Real Estate Market Overview

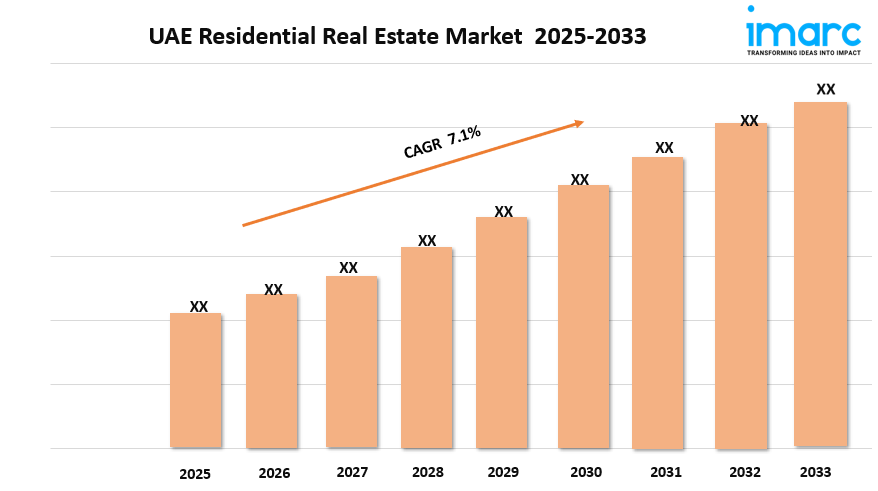

Market Size in 2024: USD 18.3 Billion

Market Size in 2033: USD 35.4 Billion

Market Growth Rate 2025-2033: 7.1%

According to IMARC Group's latest research publication, "UAE Residential Real Estate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the UAE residential real estate market size was valued at USD 18.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 35.4 Billion by 2033, exhibiting a CAGR of 7.1% during 2025-2033.

How AI is Reshaping the Future of UAE Residential Real Estate Market

- Revolutionizing Property Viewings: AI-powered virtual tours drive 25% annual growth in virtual property viewings through 2025, with Dubai leading digital property exploration initiatives.

- Smart City Integration: Dubai and Abu Dhabi's smart city projects utilize AI-driven urban planning and IoT integration, creating demand for tech-enabled residential properties.

- Enhanced Property Management: AI-driven property management tools optimize maintenance schedules and tenant services, improving operational efficiency for residential complexes across the UAE.

- Predictive Market Analytics: Machine learning algorithms help developers and investors predict market trends, with AI-powered platforms analyzing buyer preferences and pricing patterns.

- Blockchain-Enabled Transactions: Digital transformation initiatives incorporate blockchain technology for transparent property transactions, reducing processing time and increasing buyer confidence.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-residential-real-estate-market/requestsample

UAE Residential Real Estate Market Trends & Drivers:

The UAE residential real estate market is experiencing robust growth, driven by the government's strategic vision and policy reforms. Long-term residency visas, including the innovative Blue Residency program launched in May 2024, attract foreign investment and bolster market confidence. The 10-year Blue Residency visa for environmental contributors exemplifies the UAE's commitment to sustainability while encouraging property investment. These initiatives, combined with expatriate property ownership rights and attractive financing options, create a favorable environment for residential real estate growth.

Rapid population growth and urbanization in key cities like Dubai and Abu Dhabi fuel unprecedented demand for residential properties. According to the United Nations Development Programme, the urban population in the GCC region is projected to reach 84.3% by 2030, with the UAE leading this transformation. The strategic location of the UAE as a global business hub, coupled with political stability and economic diversification efforts, continues to attract international residents and investors, driving sustained demand for quality residential properties.

The integration of smart city technologies and sustainable development practices is reshaping the residential landscape. Dubai's smart city initiatives and Abu Dhabi's AI-driven urban planning create demand for technologically advanced residential properties. These developments align with the UAE's broader digital transformation goals, making smart homes and sustainable communities increasingly attractive to modern buyers and renters.

We explore the factors propelling the UAE residential real estate market growth, including technological advancements, consumer behaviors, and regulatory changes.

UAE Residential Real Estate Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Condominiums and Apartments

- Villas and Landed Houses

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Residential Real Estate Market

- January 2025: Dubai's real estate market forecast predicts 5-8% annual price growth with 7% average rental yields, driven by a 34% surge in transaction values and 60% of sales from off-plan properties.

- March 2025: Major upcoming mega projects, including Dubai Creek Tower and Burj Binghatt,i are reshaping the luxury residential landscape, attracting international investors and residents.

- April 2025: Smart cities integration accelerates with AI-powered living solutions in Dubai, featuring autonomous public transport planning and robotic city services for residential communities.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness