UAE Fintech Market Trends, Growth, and Demand Forecast 2025-2033

UAE Fintech Market Overview

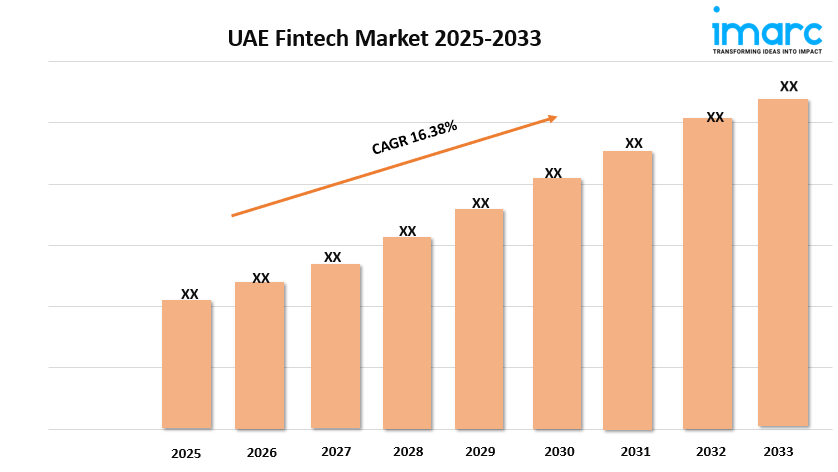

Market Size in 2024: USD 1.09 Billion

Market Size in 2033: USD 4.99 Billion

Market Growth Rate 2025-2033: 16.38%

According to IMARC Group's latest research publication, "UAE Fintech Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the UAE fintech market size reached USD 1.09 Billion in 2024. The market is projected to reach USD 4.99 Billion by 2033, exhibiting a growth rate (CAGR) of 16.38% during 2025-2033.

How AI is Reshaping the Future of UAE Fintech Market

- Revolutionizing Banking Operations: AI-powered solutions are transforming traditional banking with First Abu Dhabi Bank (FAB) collaborating with Microsoft to create AI Innovation Hubs for enhanced retail, corporate, and investment banking services.

- Enhancing Digital Payment Systems: AI-driven fraud detection and risk assessment algorithms are securing UAE's push toward a cashless economy, with advanced machine learning models processing millions of transactions daily.

- Powering Robo-Advisory Services: AI-based investment platforms and automated financial advisory services are democratizing wealth management, making sophisticated investment strategies accessible to retail investors across the UAE.

- Streamlining Regulatory Compliance: AI-powered RegTech solutions are helping UAE fintech companies navigate complex regulatory frameworks, with automated compliance monitoring reducing operational costs by up to 40%.

- Personalizing Customer Experience: Machine learning algorithms are enabling hyper-personalized financial products and services, with AI chatbots and virtual assistants handling over 70% of customer inquiries in major UAE banks.

Grab a sample PDF of this report: https://www.imarcgroup.com/uae-fintech-market/requestsample

UAE Fintech Market Trends & Drivers:

The UAE fintech market is experiencing unprecedented growth, driven by the government's ambitious Vision 2071 and the UAE Strategy for the Fourth Industrial Revolution. The country's strategic position as a global financial hub, combined with world-class infrastructure and regulatory frameworks from the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM), has attracted international fintech companies. The Central Bank of the UAE's regulatory sandbox initiatives have enabled innovative startups to test cutting-edge solutions, while initiatives like the FinTech Hive accelerator program have fostered a thriving ecosystem of financial technology companies.

The UAE's young, tech-savvy population, with 99% internet penetration and 95% smartphone adoption, is driving massive demand for digital financial services. The country's diverse expatriate population, representing over 80% of residents, creates unique opportunities for cross-border payment solutions, remittances, and multi-currency digital wallets. Government initiatives promoting a cashless society have accelerated the adoption of contactless payments, QR code transactions, and mobile banking platforms. The rise of super apps integrating financial services with lifestyle platforms has transformed how consumers interact with financial products.

The UAE's position as a regional hub for Islamic finance is spurring innovation in Shariah-compliant fintech solutions. Digital Islamic banking platforms, Sukuk tokenization, and Halal investment robo-advisors are gaining traction among Muslim consumers. The integration of blockchain technology for transparent Islamic finance transactions and smart contracts for Murabaha financing is revolutionizing traditional Islamic banking. Meanwhile, the growing startup ecosystem, supported by government-backed accelerators and substantial venture capital funding, is fostering breakthrough innovations in payments, lending, insurtech, and wealth management technologies.

We explore the factors driving the growth of the market, including technological advancements, consumer behaviors, and regulatory changes, along with emerging UAE fintech market trends.

UAE Fintech Industry Segmentation:

Deployment Mode Insights:

- On-Premises

- Cloud-Based

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

End User Insights:

- Banking

- Insurance

- Securities

- Others

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in UAE Fintech Market

- June 2025: Abu Dhabi Global Market (ADGM) introduced new regulatory frameworks for cryptocurrency exchanges and DeFi platforms, attracting 8 major international blockchain companies to establish regional headquarters in the emirate.

- April 2025: The Central Bank of the UAE announced the successful pilot testing of its Central Bank Digital Currency (CBDC), with plans for full-scale implementation by Q4 2025, positioning the UAE as a leader in digital currency adoption.

- May 2025: Mashreq Bank partnered with Google Cloud to develop quantum-resistant encryption for its digital payment infrastructure, enhancing security for over 2 million daily transactions across its fintech ecosystem.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Παιχνίδια

- Gardening

- Health

- Κεντρική Σελίδα

- Literature

- Music

- Networking

- άλλο

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness