Why US CPA Firms Are Choosing to Hire Offshore CPA Firms in 2025

The accounting landscape in the US is undergoing a massive shift. Rising costs, talent shortages, and increasing client demands are putting CPA firms under pressure to deliver more value with fewer resources. To meet these challenges, many firms are turning to global solutions—specifically, choosing to hire offshore CPA firm partners in 2025.

But what makes this model so attractive, and why are more US CPA firms embracing offshore partnerships now than ever before? Let’s explore.

Why Offshore CPA Firms Are Gaining Popularity

The idea of outsourcing accounting services is not new. However, the need for efficiency and scalability has made offshore collaboration a mainstream strategy. A few key factors explain the rising popularity:

-

Talent Shortage in the US – Many CPA firms are struggling to find skilled accountants domestically. Offshore teams fill this gap.

-

Rising Operational Costs – Salaries, benefits, and overhead expenses continue to climb in the US. Offshore models significantly cut costs.

-

Seasonal Workloads – Tax season and year-end reporting create spikes in demand. Offshore partners help manage peak workloads smoothly.

-

Focus on Core Growth – With offshore support handling compliance and routine tasks, CPA firms can focus on client relationships and advisory services.

The Benefits of Hiring Offshore CPA Firms

1. Significant Cost Savings

One of the most obvious benefits is cost reduction. By outsourcing bookkeeping, tax preparation, or audit support to offshore professionals, CPA firms can reduce labor expenses by up to 50%. These savings can then be reinvested into client services or technology upgrades.

2. Access to Skilled Talent

Offshore CPA firms employ highly trained accountants familiar with US GAAP, IRS regulations, and accounting software such as QuickBooks, NetSuite, and Xero. This ensures US firms get the expertise they need without the ongoing struggle of local hiring.

3. Scalability and Flexibility

Whether a firm needs extra support during tax season or ongoing year-round help, offshore staffing provides flexible scaling. Firms can expand or reduce teams based on workload without long-term commitments.

4. Round-the-Clock Productivity

Time zone differences often work in favor of US CPA firms. Offshore teams can continue working after US offices close, resulting in faster turnaround times and improved client service.

5. Improved Client Focus

With routine and repetitive tasks handled offshore, CPA firms can dedicate more time to strategic advisory, tax planning, and financial consulting—services that clients value most.

What Services Can Be Outsourced to Offshore CPA Firms?

CPA firms don’t need to outsource everything. Instead, they can selectively offshore tasks that are time-consuming but essential. Common services include:

-

Bookkeeping and payroll processing

-

Tax preparation and compliance

-

Accounts payable and receivable management

-

Audit support services

-

Financial reporting and analysis

This approach ensures firms keep high-value, client-facing work in-house while leveraging offshore expertise for back-office efficiency.

Addressing Concerns About Offshore Hiring

Despite the clear benefits, some US CPA firms hesitate due to common concerns. Let’s address them:

1. Data Security

Concern: “Is client data safe offshore?”

Reality: Reputable offshore CPA firms follow strict data security protocols, use encrypted systems, and comply with international standards like GDPR and SOC 2.

2. Quality of Work

Concern: “Will offshore accountants meet US standards?”

Reality: Offshore teams are trained in US accounting regulations and undergo rigorous quality checks. Many hold US CPA certifications.

3. Communication Barriers

Concern: “What about language and cultural differences?”

Reality: Offshore CPA firms serving US clients are English-proficient and adapt to US work culture, ensuring smooth collaboration.

Why 2025 Is the Tipping Point

Several market trends make 2025 the perfect year for CPA firms to explore offshore models:

-

Remote Work Normalization – Since COVID-19, firms are comfortable managing distributed teams, making offshore integration seamless.

-

Advanced Cloud Technology – Platforms like QuickBooks Online, Xero, and NetSuite simplify collaboration between US and offshore teams.

-

Growing Client Expectations – Clients demand faster turnaround times and more advisory input, requiring firms to free up internal bandwidth.

-

Competitive Pressure – Firms that don’t adopt cost-effective models risk losing clients to those that do.

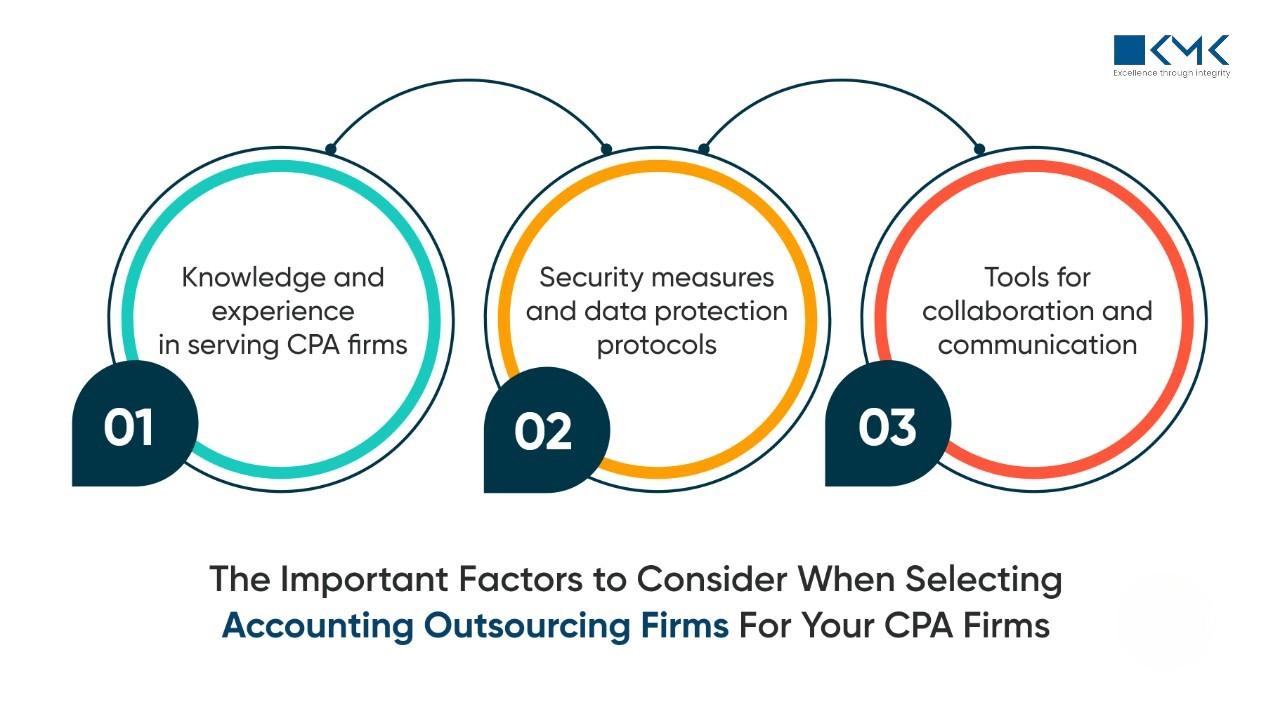

How to Successfully Hire Offshore CPA Firms

For US firms considering this move, success lies in preparation and choosing the right partner.

-

Define Needs Clearly – Identify which tasks to outsource and set expectations.

-

Choose a Reputable Partner – Look for offshore firms with proven experience serving US CPA firms.

-

Ensure Compliance – Verify that the offshore partner follows US data security and compliance standards.

-

Leverage Technology – Use secure cloud-based platforms for seamless collaboration.

-

Start Small, Scale Gradually – Begin with a few processes and expand once the partnership proves effective.

Future Outlook for Offshore CPA Partnerships

The offshore accounting industry will continue to grow as US CPA firms embrace globalization. Looking ahead:

-

AI and automation will combine with offshore expertise for even greater efficiency.

-

Hybrid models (a mix of local and offshore teams) will become the norm.

-

Client-centric services will expand as firms redirect resources from routine work to advisory roles.

By 2030, it’s expected that a majority of mid-sized CPA firms in the US will have at least part of their operations managed offshore.

Final Thoughts

For US CPA firms in 2025, the decision to hire offshore CPA firm partners is no longer just about cost savings—it’s about survival and growth. Offshore teams bring efficiency, scalability, and expertise that help firms stay competitive in a demanding market.

Firms that adopt offshore models now will enjoy improved profitability, stronger client relationships, and the agility to thrive in an ever-changing financial landscape. Those that resist may find themselves struggling to keep up.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness