Saudi Arabia Meat Market Size, Share, Growth & Research Report, 2033 | UnivDatos

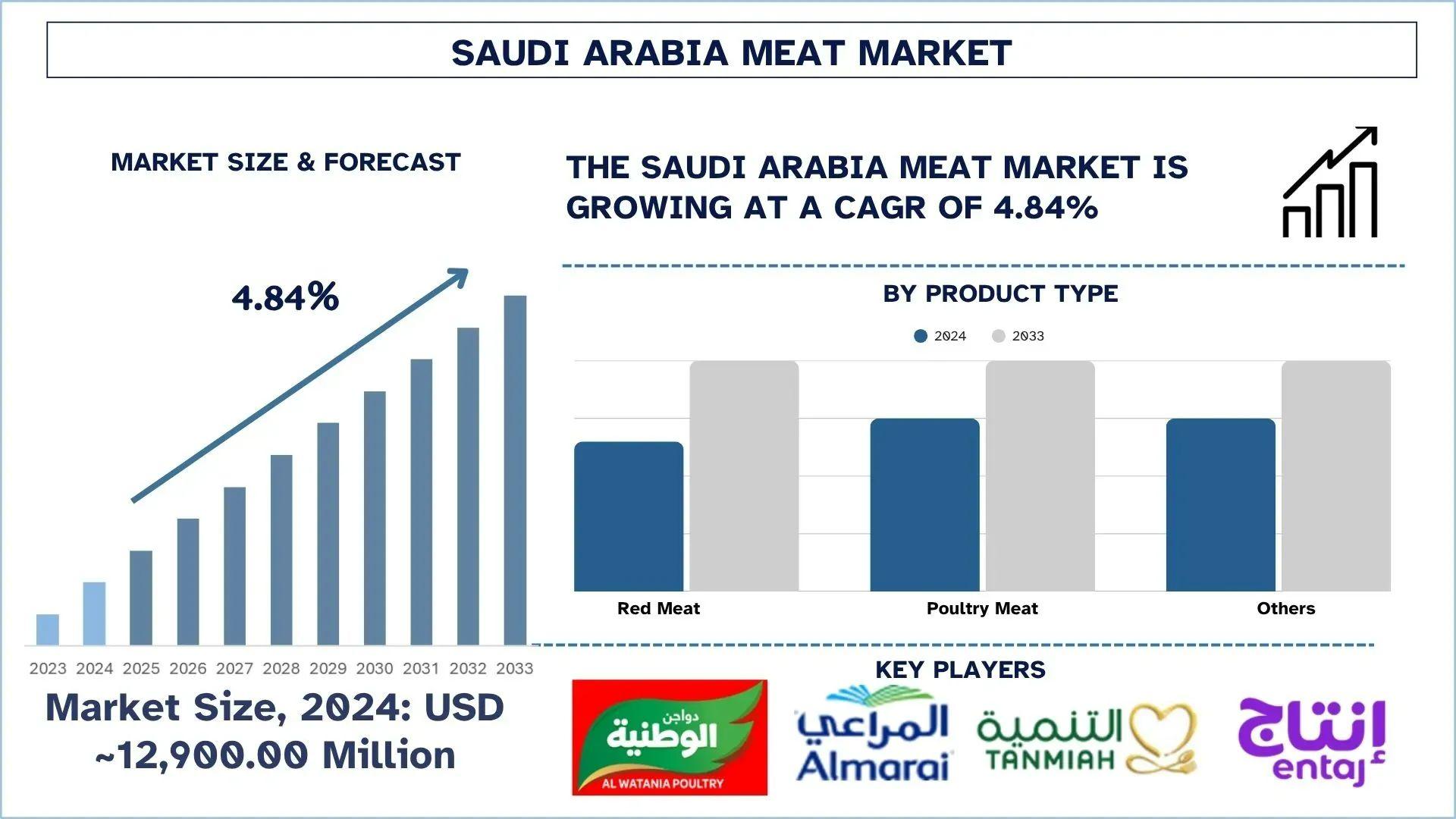

According to UnivDatos, the growing population and urbanization, high per capita meat consumption, government food security initiatives, rising demand from HORECA sector, cultural and religious significance, increased disposable income, growth of organized retail, technological advancements in meat processing, expansion of poultry and red meat farms, supportive trade agreements and import partnerships drive the Saudi Arabia Meat market. As per their “Saudi Arabia Meat Market” report, the market was valued at USD 12,900.00 Million in 2024, growing at a CAGR of about 4.84% during the forecast period from 2025 - 2033 to reach USD Million by 2033.

Halal certification and modern and smart farming technologies are the two potent forces that are changing Saudi Arabia from an import-intensive market to a high-potential meat exporter. With the world experiencing increased demand in halal meat, as well as domestic objectives of ensuring food security as part of Vision 2030, the Kingdom has embarked on a reengineering process of its meat supply chain to increase production, quality, and achieve global standards.

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/saudi-arabia-meat-market?popup=report-enquiry

Halal Certification: The Kingdom’s Global Advantage

With its strict implementation of halal, Saudi Arabia has an inherent competitive advantage over other Muslim countries in exporting its goods to large Muslim countries such as Indonesia, Malaysia, the UAE, and African countries. The Saudi Food and Drug Authority (SFDA) simplified the issuance of halal certification, enabling companies to easily streamline the process of complying with halal requirements in this country as well as in other international destinations.

The largest meat producers are capitalizing on this by enhancing slaughter procedures, investing in traceability, and obtaining universal halal certifications. It opens up new export markets for them and also improves their image as high-quality, reliable suppliers.

The Islamic Food and Nutrition Council of America (IFANCA) would like to inform all clients and partners of the latest updates regarding halal exports to Saudi Arabia. The Saudi Food and Drug Authority (SFDA) Halal Center launched a new platform for the registration of halal certificates and the issuance of shipment certificates, which took effect on October 1, 2024.

Key Requirements for Halal Certification:

· GSO Certification: All production facilities exporting halal-certified products to Saudi Arabia must be certified under GSO (Gulf Standardization Organization) standards.

· Platform Registration: Both the facility certificate and products must be registered on the new Saudi Halal Center platform.

· Shipment Certificates: Each shipment to Saudi Arabia must be accompanied by a shipment certificate generated through the Saudi Halal Center platform.

· Fees: Additional application, registration, and processing fees will apply as part of the new certification process.

Smart Farming: Boosting Performance and Efficiency

Manufacturers are implementing IoT-powered surveillance solutions, mechanized feeding devices, and AI in livestock health monitoring.

Moreover, poultry companies are expanding their operations with the help of climate-controlled poultry houses and highly targeted farming processes, enabling them to meet more than 60 percent of the domestic poultry industry's needs. This enhances food security, stimulates domestic employment, and positions Saudi producers to meet the growing demand both domestically and in the international market. For example, on July 11, 2025, the Saudi Smart Flock system, launched under the Sustainable Rural Agricultural Development Programme (Saudi Reef), was implemented on six farms last year as part of efforts to modernise small-scale animal farming. The system identifies animals using facial features, tracks their productivity, monitors health, and stores farm records in one platform.

From Import Dependence to Export Ambition

Saudi Arabia continues to import large quantities of red meat, primarily from Brazil, India, and Australia. Additionally, dependence is being reduced by the government through measures such as promoting local production, subsidizing smart farming, and investing in the private sector.

Moreover, the local industry is also becoming more resilient and able to export after making investments in cold chain logistics, modern processing facilities, and packaging innovation. Manufacture of domestic meat brands is gaining more popularity among retailers and foodservice businesses that want fresh, traceable, and halal-certified products easily available in the country, and increases the demand among local producers.

Click here to view the Report Description & TOC https://univdatos.com/reports/saudi-arabia-meat-market

Saudi Arabia Fresh or chilled boneless bovine meat imports by country in 2023, World Integrated Trade Solution (WITS)

Saudi Arabia imports of Fresh or chilled boneless bovine meat was USD 259,786.05K and quantity 26,139,100Kg.

Saudi Arabia imported Fresh or chilled boneless bovine meat from Brazil ($75,044.22K , 7,550,790 Kg), Pakistan (USD 49,350.88K , 4,965,580 Kg), Australia (USD 48,900.15K , 4,920,230 Kg), India (USD 30,805.81K , 3,099,620 Kg), Ethiopia (excludes Eritrea) (USD 20,079.31K , 2,020,340 Kg)

The Road Ahead: Building a Global Reputation

The meat industry in Saudi Arabia is undergoing significant changes. This strategy of prioritizing halal compliance and technology adoption is helping the country to create a meat industry that will not only satisfy the local demand but also compete in the international markets. The development of a globally competitive meat supply chain foundation is underway, although challenges still exist, including dependence on the importation of feeds and a lack of infrastructure.

As smart farms accelerate production benefits and the ability to export halal meat through its halal certification, Saudi Arabia is emerging as a halal meat powerhouse, having previously transitioned from being a meat importer.

Related Report :-

India Meat Substitutes Market: Current Analysis and Forecast (2024-2032)

Plant-Based Meat Market: Current Analysis and Forecast (2024-2032)

Dehydrated Meat Products Market: Current Analysis and Forecast (2024-2032)

Frozen Food Market: Current Analysis and Forecast (2024-2032)

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness