India Residential Real Estate Market Size & Forecast (2024-2032) | UnivDatos

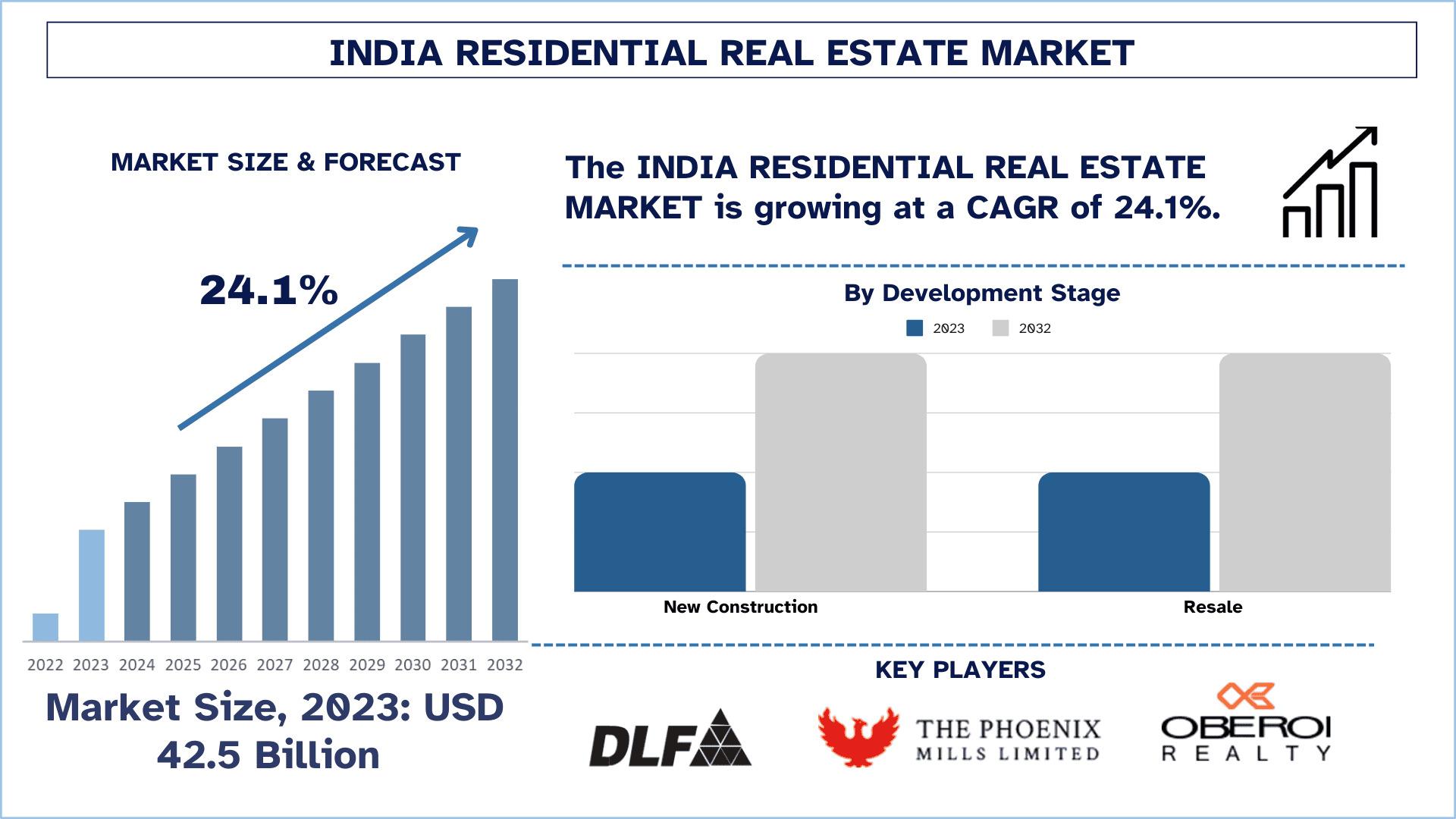

According to the UnivDatos, rapid urbanization, growing government initiatives, and low interest rates on housing will drive the scenario of the Indian residential real estate market. As per their “India Residential Real Estate Market” report, the market was valued at ~USD 42.5 billion in 2023, growing at a CAGR of about 24.1% during the forecast period from 2024-2032 to reach USD billion by 2032.

Significant funds have been invested in the country’s residential real estate sector due to various circumstances such as greater demand for housing, increased rate of urbanization, and policies put in place by the government. Here are some key areas of investment:

Access sample report (including graphs, charts, and figures): https://univdatos.com/reports/india-residential-real-estate-market?popup=report-enquiry

· AFFORDABLE HOUSING:

Through liberal policies, the Indian government has encouraged the absorption of affordable housing structures. The realization of such a vision was boosted by the implementation of the Pradhan Mantri Awas Yojana (PMAY) which triggered both public and private sector interest. Big builders like Godrej Properties Limited, DLF, and Hiranandani Group have invested heavily in affordable housing strategies in the Micro-Market & Peripheral market both in urban as well as semi-urban centers for fulfilling the dream of low- and middle-income households.

· HIGH-RISE APARTMENTS, LUXURY VILLAS & INTEGRATED TOWNSHIPS:

Loans to gated communities and integrated townships have risen steeply due to the increasing focus of developers on offering their consumers secure and inherent living spaces. Real estate players such as Lodha Developers and Prestige Estates Projects are developing large multi-plex projects, where residents can get residential, commercial, and entertainment under one roof for families without compromising on their lifestyle.

· LUXURY AND HIGH-END SEGMENT:

Metropolitan residences particularly Mumbai, Delhi, and Bengaluru have also seen high investment in luxury residential spaces. Residential projects attract investors with above-average income and institutional investors since they include luxurious facilities and strategic locations. Some investment and attention has been given to various projects from firms such as Oberoi Realty and Tata Housing.

· PROPTECH AND DIGITAL PLATFORMS:

A consequence of the growth of PropTech is the appearance of new investments in technologies that improve real estate operations. Internet-based property listing, virtual property tours, and trading companies that have come up have attracted venture capitalists and private equity firms. Traditional agents and brokers are some of the investors in the market disruptors of the current age, which include NoBroker and Housing.com, which are already creating platforms that ease the process of buying or selling homes.

· FOREIGN DIRECT INVESTMENT (FDI):

The Indian housing market has gained steady interest of stranger investors due to modern policies enabling 100 % FDI in the Indian housing segment. Internationally renowned real estate companies like Blackstone and Brookfield have already ventured into the Indian market to give a strong thrust to residential as well as commercial property developments. Their participation has not only contributed capital to their organizations but also inflows global business practices and benchmarking standards.

· INFRASTRUCTURE DEVELOPMENT:

Real estate investment has a direct correlation with infrastructure facilities like metro rail, roads, and airports for the residential segment. As seen where there is infrastructure development, values and demand of properties tend to increase in the given regions. This aspect is significantly encourages developers to locate their projects in this niche since it provides the prospects with attractive buying propositions besides ensuring that the projects are located in areas that are most likely to receive a boost in infrastructure.

· SUSTAINABILITY AND GREEN BUILDING INITIATIVES:

Sustainability was defined as the environmental aspect or action that involves the successful interaction of people with resources so that they may be conserved not only in the present but more importantly in the future Green Building Initiatives refer to strategies that are used in construction to ensure that it is sustainable. There has been a rising trend in investment towards environment-friendly and green buildings with many developers including Mahindra Lifespace and Sobha. These products are suitable for the ‘green’ consumers and available for subsidies.

Click here to view the Report Description & TOC: https://univdatos.com/reports/india-residential-real-estate-market

Recent Developments in the market are:

Ø In October 2024, Realty major Signature Global will soon start the construction of its premium residential project in Delhi-NCR. The Gurugram-based developer has awarded the contract worth Rs 1203 crore for the construction of -- Titanium SPR -- to Capacit’e Infraprojects Limited, a renowned construction company.

Ø In October 2024, Realty firm Prestige Estates Projects Ltd will invest around Rs 7,000 crore to develop a township in Ghaziabad as it looks to expand business in the Delhi-NCR property market. Bengaluru-based Prestige Estates is building a commercial project at Aerocity in the national capital. It has also forayed into the Delhi-NCR housing market by acquiring three land parcels in Delhi, Noida, and Siddharth Vihar, Ghaziabad.

Conclusion

In conclusion, the investment environment of Indian residential real estate is also complex and diverse depending on segments. The market is expected to expand as it is buoyed by economic growth and demographic changes and the interest it has attracted so far shows that it will stimulate further investment that will encourage innovation to meet demand.

Contact Us:

UnivDatos

Contact Number - +1 978 733 0253

Email - contact@univdatos.com

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness