Egypt Home Appliances Market Size, Growth, and Forecast 2025-2033

Egypt Home Appliances Market Overview

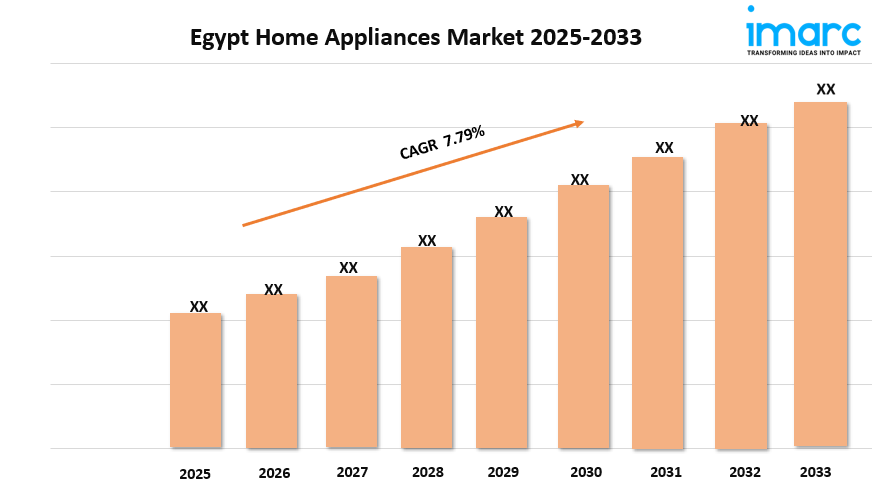

Market Size in 2024: USD 6,848.0 Million

Market Size in 2033: USD 13,451.5 Million

Market Growth Rate 2025-2033: 7.79%

According to IMARC Group's latest research publication, "Egypt Home Appliances Market Report by Product (Major Appliances, Small Appliances), Distribution Channel (Multi-brand Stores, Exclusive Stores, Online, and Others), and Region 2025-2033", the Egypt home appliances market size reached USD 6,848.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 13,451.5 Million by 2033, exhibiting a growth rate (CAGR) of 7.79% during 2025-2033.

How AI is Reshaping the Future of Egypt Home Appliances Market

- AI-driven innovations are transforming Egypt home appliances market, with companies like Unionaire launching AI-powered stoves and refrigerators featuring virus-eliminating technology, elevating consumer convenience and hygiene.

- The Egyptian government’s National AI Strategy supports AI integration by training over 5,000 officials and fostering 250+ AI firms, boosting sector efficiency and accelerating smart appliance adoption.

- Online sales of home appliances in Egypt have surpassed 5.5% of total sales, aided by rising internet penetration and digital platforms, increasing consumer access to AI-enabled products.

- Major players like Samsung Egypt are introducing smart, energy-efficient appliances with AI features like adaptive cooling and Wi-Fi connectivity, catering to growing urban demand for tech-savvy appliances.

- Investment in local manufacturing is growing, with Unionaire’s EGP 6bn factory expansion in Egypt aiming to increase AI-powered appliance production and exports, supporting regional market growth.

Grab a sample PDF of this report: https://www.imarcgroup.com/egypt-home-appliances-market/requestsample

Egypt Home Appliances Market Trends & Drivers:

The rapid urbanization in Egypt is a key driver reshaping the home appliances market. As more households form in growing cities like Cairo and Alexandria, there is a surge in demand for essential and modern appliances such as refrigerators, washing machines, and air conditioners. This urban migration combined with rising incomes among middle-class families is pushing demand for convenience and efficiency in daily living. The trend is further supported by a boom in residential projects, including smart cities and affordable housing, making appliances an integral part of modern Egyptian homes and lifestyles, fueling market expansion in these urban hubs.

Another major factor boosting the market is the increasing focus on energy efficiency and eco-friendly appliances. Egypt's government initiatives promote energy-saving products through mandatory energy-efficiency labeling and tax incentives for local assembly of smart appliances. This regulatory push aligns perfectly with the growing consumer consciousness about sustainability and cost savings on electricity, encouraging the adoption of advanced, tech-enabled appliances integrated with IoT and AI features. Companies like LG and Bosch are actively launching products designed with energy efficiency and allergen care, reflecting both consumer preferences and regulatory trends pushing cleaner, smarter home solutions.

Significant investments and local manufacturing capacity expansions are another key trend supporting market growth. Recently, major players such as BSH and Midea have inaugurated new factories in Egypt with investments exceeding $100 million, creating thousands of jobs and enabling local production of refrigerators, cookers, and other durable goods. This localization helps reduce costs, enhances export potential, and aligns with government policies to boost the domestic industry. Additionally, government-backed initiatives to cut consumer prices on key goods through cooperative retailer programs help maintain affordability, making home appliances accessible to a wider population segment while supporting overall market momentum.

We explore the factors propelling the Egypt home appliances market growth, including technological advancements, consumer behaviors, and regulatory changes.

Egypt Home Appliances Industry Segmentation:

The report has segmented the market into the following categories:

Product Insights:

- Major Appliances

- Refrigerators

- Freezers

- Dishwashing Machines

- Washing Machines

- Ovens

- Air Conditioners

- Others

- Small Appliances

- Coffee/Tea Makers

- Food Processors

- Grills and Roasters

- Vacuum Cleaners

- Others

Distribution Channel Insights:

- Multi-brand Stores

- Exclusive Stores

- Online

- Others

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Egypt Home Appliances Market

- June 2025: Bosch launches its first home appliance factory in Africa, located in Egypt, with a €55million investment. The facility boosts local employment and aims to export 50% of its annual 350,000-unit output, focusing on high-efficiency gas cookers tailored for Egyptian homes.

- June 2025: Midea steps up its commitment to Egyptian manufacturing by investing $105million in a new industrial complex. The project is expected to create about 3,900 jobs and support nationwide exports, driving forward the country's status as a regional appliance hub.

- May 2024: Haier inaugurates a vast ecological park in 10th of Ramadan City—this 200,000-square-meter facility combines advanced production with local workforce development and will anchor Haier’s growing presence in Middle Eastern and African markets.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Inicio

- Literature

- Music

- Networking

- Otro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness