FP&A Manager vs Financial Controller: Key Differences CFOs Should Know in 2025

n today’s dynamic financial landscape, US CFOs face growing pressure to deliver both strategic insights and regulatory accuracy. Two roles often at the center of this conversation are the FP&A Manager and the Financial Controller. While both are critical to an organization’s success, they serve distinct purposes that CFOs must understand to make the right hiring and structural decisions.

But what exactly are the key differences between these positions? And why does the fp&a manager vs financial controller debate matter more than ever in 2025? Let’s explore.

Why the Distinction Matters for CFOs

CFOs today are no longer just gatekeepers of budgets; they are strategic leaders guiding companies through market volatility, digital transformation, and regulatory shifts. For them, understanding whether they need stronger forecasting or tighter compliance controls can make or break financial performance.

This is where knowing the difference between FP&A Managers and Financial Controllers becomes invaluable.

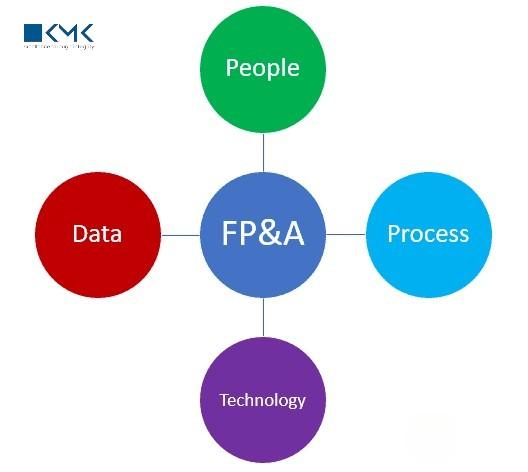

FP&A Managers: The Architects of Forecasting

Financial Planning and Analysis (FP&A) Managers are forward-looking professionals focused on shaping the future of the business. They ask questions like:

-

What revenue streams will grow over the next 12 months?

-

How should we allocate resources to maximize ROI?

-

What risks and opportunities are emerging in our industry?

Core Responsibilities of FP&A Managers

-

Budgeting & Forecasting: Preparing rolling forecasts that adapt to market realities.

-

Scenario Planning: Modeling potential outcomes for different business strategies.

-

Strategic Decision Support: Turning data into actionable insights for the C-suite.

-

KPI Tracking: Monitoring financial and operational performance.

In short, FP&A managers provide the “what could be” perspective that helps businesses grow strategically.

Financial Controllers: The Guardians of Compliance

On the other side of the spectrum, financial controllers focus on the accuracy and integrity of current and historical financial data. They ensure the numbers are reliable and compliant with regulations.

Core Responsibilities of Financial Controllers

-

Regulatory Compliance: Maintaining adherence to GAAP, IRS rules, and industry standards.

-

Financial Reporting: Producing timely, accurate reports for internal and external stakeholders.

-

Internal Controls: Preventing fraud and ensuring accountability.

-

Audit Readiness: Preparing documentation for external audits and investor reviews.

If FP&A managers are architects of the future, controllers are the protectors of the present and past. Their work ensures credibility and financial stability.

FP&A Manager vs Financial Controller: A Side-by-Side Comparison

| Aspect | FP&A Manager | Financial Controller |

|---|---|---|

| Focus | Forward-looking strategy | Compliance and accuracy |

| Timeframe | Future (forecasts, plans) | Past & present (historical data) |

| Primary Tools | BI dashboards, financial models | ERP systems, accounting ledgers |

| Key Contribution | Drives growth and strategy | Ensures compliance and trust |

| Collaboration | Works with executives, product, sales | Works with auditors, regulators, accountants |

This table highlights that the roles aren’t interchangeable but complementary.

Why CFOs Should Care in 2025

For CFOs navigating today’s environment, both roles are indispensable:

-

Investors demand accuracy. Without strong financial controls, CFOs risk losing credibility.

-

Boards demand insights. Without robust FP&A, strategic decisions may lack data-driven support.

-

Markets demand agility. Companies must balance compliance with adaptability to survive.

In 2025, when technology is reshaping industries at lightning speed, CFOs cannot afford to over-index on one role while ignoring the other.

Real-World Example: A US Tech Company

Take a mid-sized SaaS firm planning an IPO.

-

The FP&A Manager builds models to forecast subscription revenue, customer churn, and future expansion costs. This helps the CFO present a compelling growth story to potential investors.

-

The Financial Controller ensures the company’s books follow GAAP, tax filings are accurate, and audit requirements are met—instilling investor confidence in the company’s credibility.

Together, these roles create a complete financial strategy: one that tells an exciting growth story while proving the numbers are reliable.

When Should CFOs Prioritize One Role Over the Other?

Every company’s needs are different, but some patterns emerge:

-

Early-stage startups: Often prioritize FP&A to model growth, while outsourcing compliance.

-

Scaling businesses: Bring controllers in-house as transaction volumes grow and compliance risks increase.

-

Mature enterprises: Require both roles, often with entire teams supporting FP&A and financial control.

For CFOs, timing is key. Hiring too early or too late in either role can create inefficiencies or risks.

The Future Outlook: Collaboration, Not Competition

The debate isn’t about whether to choose an FP&A Manager or a Financial Controller—it’s about how to balance them. In forward-thinking companies, CFOs are fostering collaboration between these roles.

-

FP&A insights guide where resources should go.

-

Controllers ensure the financial framework supports those investments safely.

As technology evolves, automation may streamline aspects of both jobs. But the need for strategic foresight and compliance oversight will remain.

Conclusion

The discussion of fp&a manager vs financial controller is more relevant than ever in 2025. FP&A managers provide forecasting and strategy that help companies grow. Financial controllers safeguard compliance and accuracy that keep organizations trustworthy.

For CFOs, the real question is not “Which role is more important?” but “How can these roles work together to build a finance function that supports both growth and compliance?”

In the coming years, the CFOs who understand this balance will lead companies that are not just compliant, but also competitive and future-ready.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness