Breakfast Cereal Market Size, Share, Growth Strategies & Trends, 2032

Market Overview:

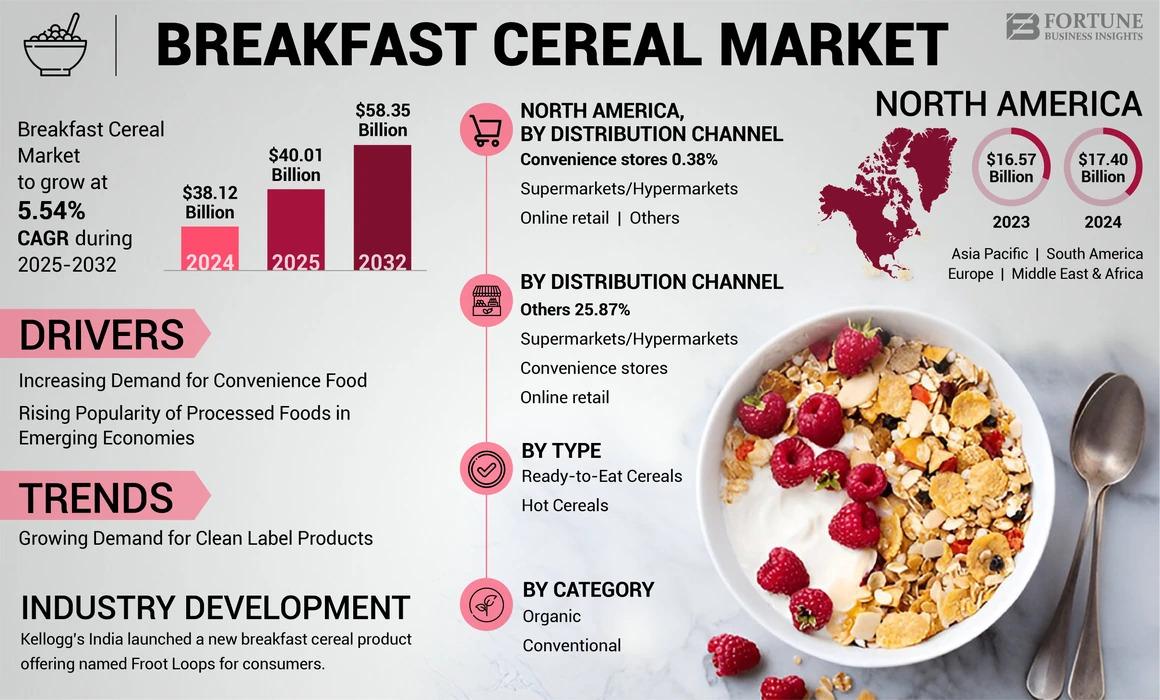

The global breakfast cereal market size was valued at USD 38.12 billion in 2024. The market is projected to grow from USD 40.01 billion in 2025 to USD 58.35 billion by 2032, exhibiting a CAGR of 5.54% during the forecast period. North America dominated the breakfast cereals market with a market share of 45.64% in 2024. Moreover, the breakfast cereal market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 20.82 billion by 2032, driven by the increased launch of novel breakfast cereal products with different flavors and properties in the country.

Breakfast cereals refer to processed food products that usually feature grains, including oats, wheat, barley, and others. Western diets are increasingly being adopted, and consumers are exploring new products and processed foods in various flavors. The surging popularity of processed foods in emerging economies is driving the market’s growth.

List of Key Players Mentioned in the Report:

- Kellogg’s Company (U.S.)

- Nestle S.A. (Switzerland)

- Post Holdings (U.S.)

- General Mills, Inc. (U.S.)

- Ltd. (U.S.)

- Marico Limited (India)

- Bagrrys India Limited (India)

- B & G foods (U.S.)

- Sanitarium Health Food Company (Australia)

- Bob’s Red Mill Natural Foods (U.S.)

Source: https://www.fortunebusinessinsights.com/industry-reports/breakfast-cereals-market-100535

Segmentation:

On-the-go Consumption of Ready-to-eat Cereals to Impel Segment Growth

On the basis of type, the market is segmented into ready-to-eat cereals and hot cereals. The ready-to-eat cereals segment occupies the largest share, driven by the quick consumption of ready-to-eat cereals.

High Availability of Conventional Products to Boost Segment Expansion

In terms of category, the market is categorized into conventional and organic. The conventional segment witnesses the largest breakfast cereal market share owing to the huge availability of conventional products.

Distribution Channels

The breakfast‑cereal market is segmented by sales channel into four groups: supermarkets and hypermarkets, convenience stores, online retail, and other outlets. Among these, supermarkets and hypermarkets command the biggest share, thanks to their extensive product assortments that allow shoppers to find a wide variety of cereals in a single location.

Geographic Segments

Geographically, the market is broken down into five regions: South America, Asia‑Pacific, Europe, North America, and the Middle East & Africa.

Report Coverage

The competitive strategies deployed by top companies to attain the largest share have been mentioned in the research report. Besides this, it provides a comprehensive coverage of the top trends, notable industry developments, and the impact of the COVID-19 pandemic on market growth. It further highlights the key factors propelling the market growth.

Drivers and Restraints:

Increasing Demand for Convenience Food to Expedite Market Growth

The market has witnessed a surge in the popularity and demand for portable cereals, including ready-to-eat products, among consumers, driven by the rising popularity of the on-the-go lifestyle. Owing to their convenient nature and longer shelf life, processed foods such as breakfast cereals are increasingly becoming popular among consumers.

Despite such growth opportunities, the presence of sugars and carbohydrates, which are related to many diseases, discourages product adoption, further stifling the breakfast cereal market growth.

Regional Insights:

North America Led, Owing to Encouragement by Health Associations to Purchase Products with Lower Sugar Content

North America occupied the largest market share in 2023 as health associations are encouraging consumers to buy products with lower sugar content, which creates awareness and reduces their sugar consumption.

Asia Pacific’s market growth is fueled by the rising popularity of Western diets. Rise in disposable incomes, shift in consumer behavior, and escalating demand for processed food boost substantial growth.

Competitive Landscape:

Key Players Leverage Partnerships to Release Innovative Products

The breakfast cereal market is experiencing growing consumer interest in affordable, portion-controlled single-serve cereal packs. To maintain a competitive edge, leading companies are adopting various strategies, including mergers, acquisitions, joint ventures, and capacity expansions. Additionally, many brands are entering into strategic partnerships to drive innovation and bring new, unique products to market.

Key Industry Development:

April 2024: Kellogg’s India launched a new breakfast cereal product offering named Froot Loops for consumers. The product is targeted specifically at kids and provides a fruity and colorful offering to consumers.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness