Europe’s Industrial Automation Boom: Opportunities and Constraints in the Journey to 2032

The Driving Forces Behind Europe’s €103–$104 Billion Industrial Automation Boom to 2032

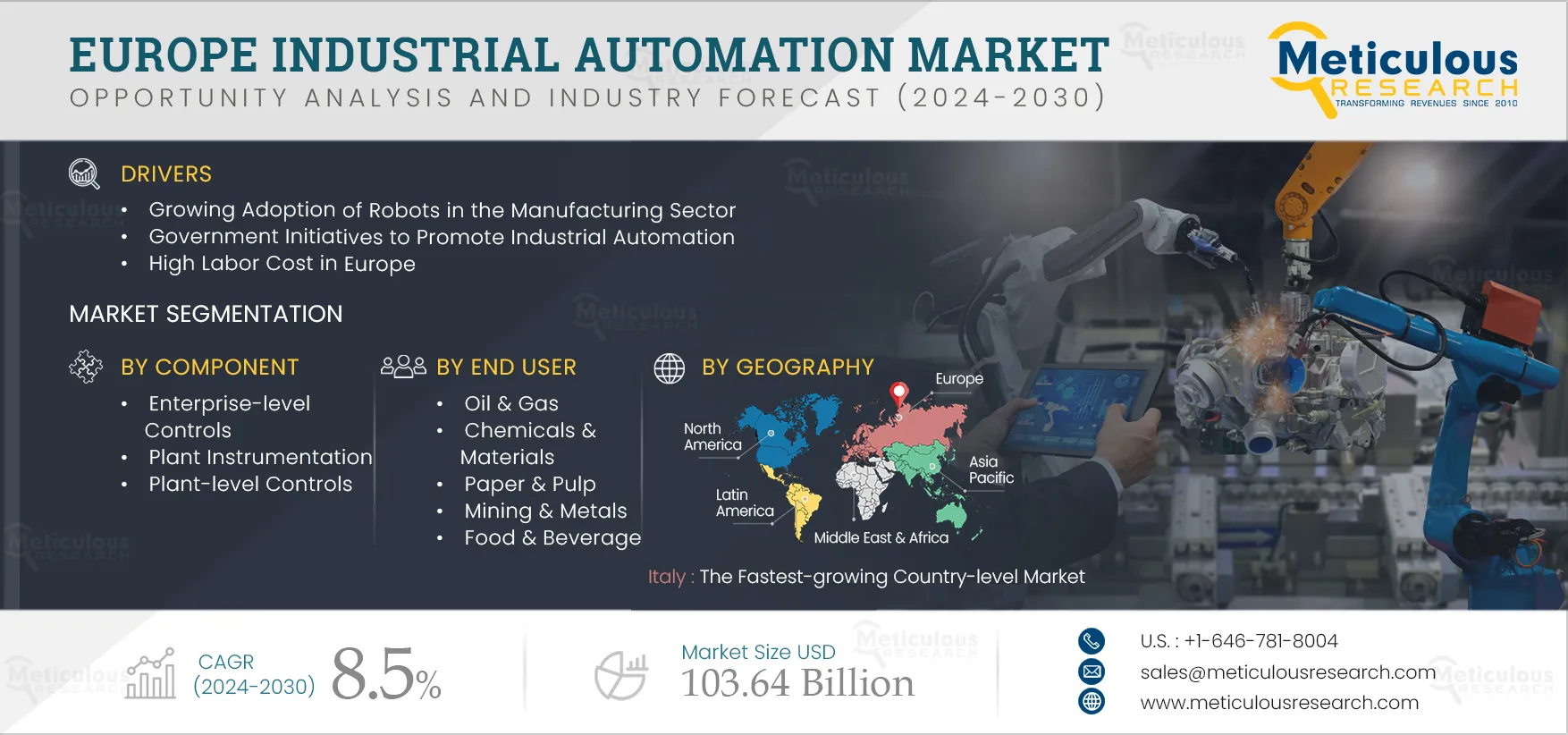

Europe’s industrial automation market is on a rapid rise. It is expected to reach valuations of €103–$104 billion by 2032, changing how factories, logistics centers, and energy infrastructure operate. What is driving this growth, and which countries are leading? This analysis reveals the key factors behind market expansion and forecasts the trends that will influence Europe’s digital manufacturing landscape for years.

Powerhouse Nations: Who’s Leading the Charge?

Germany, the United Kingdom, France, Italy, Spain, Switzerland, and the Netherlands are the main players in Europe’s automation boom. Germany serves as the region’s industrial backbone, known for quickly adopting robotics, sensors, and management systems.

The UK and France are making significant investments in connected automation and digital transformation. At the same time, Switzerland and the Nordics, like Sweden and Denmark, excel with innovations in process optimization and AI integration. These countries benefit from strong government support, high labor costs, and a pressing need for innovation, placing them at the forefront of Europe’s automation growth.

Why Do Growth Estimates Differ? Decoding Market CAGR Discrepancies

Different market research firms provide varying compound annual growth rate (CAGR) estimates. Meticulous Research predicts an 8.5% CAGR, while other sources suggest 9.6%. These differences arise from distinct methods:

Segmentation Focus : Some analysts concentrate on infrastructure and software, such as PLM, ERP, and MES, while others focus on hardware like sensors and robotics.

Scope of End Users : Including or excluding smaller sectors like food and beverage or process industries affects market projections.

Currency and Base Years : Different calculations based on euro or dollar conversions and varying baseline years lead to variations.

Regional Definitions : Reports focusing solely on Western Europe may show different figures from those including Central or Eastern European growth.

These discrepancies highlight the complexity and diversity of Europe’s automation ecosystem, encouraging stakeholders to consider data in context.

SMEs and IIoT: Catalysts for Widespread Adoption

Small and medium-sized enterprises (SMEs) play a crucial role in Europe’s shift towards full-scale industrial automation. Traditionally held back by high upfront costs and limited digital skills, SMEs are now adopting automation to remain competitive amid rising labor costs and unstable global markets.

The European Union’s digital incentives, along with affordable IIoT solutions—like connected sensors and cloud-based monitoring—help even smaller factories improve operations, increase output, and quickly respond to changing demands.

IIoT (Industrial Internet of Things) is especially impactful. By connecting machines, gathering real-time data, and enabling predictive maintenance, IIoT boosts productivity and enhances manufacturing flexibility and resilience.

As its use grows, expect the lines between traditional industry and tech-driven enterprises to blur, creating new business models and customer experiences throughout the supply chain.

Cyber Risks and Workforce Challenges: Growth Roadblocks

Despite noteworthy progress, Europe’s industrial automation sector faces significant challenges. Cybersecurity is a rising issue. More connected production lines create more entry points for hackers, posing risks to intellectual property, customer data, and operational stability.

Companies are investing in strong security measures, but the threat landscape changes rapidly, requiring constant attention.

Another pressing issue is the skilled labor shortage. Automation tech needs a highly trained workforce, but Europe’s talent pool often struggles to keep pace with technological advancements.

Hiring and retaining experts in robotics, AI, and cybersecurity is difficult, which may slow adoption rates and leave some SMEs unable to take full advantage of available opportunities. Upskilling and targeted educational programs will be necessary as the region works to maximize its automation potential.

The Fastest Growing Industry Segments: Shifting Gears in Automotive, Oil & Gas, F&B

Among all sectors, automotive manufacturers are poised to see the most significant automation growth. Increased use of machine vision and sensor technologies is transforming assembly lines, welding, and quality control. The sector’s need to reduce rework, ensure consistency, and automate repetitive tasks makes it the fastest-growing adopter in Europe’s automation landscape.

The oil and gas industry uses automation for safety monitoring, predictive analytics, and efficient resource management, especially in risky environments. The food and beverage sector integrates automated process controls for quality assurance, traceability, and compliance, ensuring rapid growth as health and safety standards become stricter.

Why Invest in Meticulous Research’s Europe Automation Report?

Meticulous Research’s detailed Europe Industrial Automation Market report is a valuable resource for business leaders, technology adopters, and investors looking to understand the market better. It provides:

- Insights by country for targeted market entry.

- In-depth breakdowns of key technologies, growth opportunities, and user adoption rates.

- Comprehensive data on challenges and risk management—vital for strategic planning.

Gain a competitive advantage with this essential resource and take the lead in the automation movement in Europe.

Download Sample Report Here @

https://www.meticulousresearch.com/download-sample-report/cp_id=5639

Contact Us:

Meticulous Research®

Email- sales@meticulousresearch.com

Contact Sales- +1-646-781-8004

Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jeux

- Gardening

- Health

- Domicile

- Literature

- Music

- Networking

- Autre

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness