Why CFOs Are Switching to Automated Depreciation Software?

Depreciation isn’t simply an accounting term—it’s the heartbeat of proper financial reporting for every asset in any organization. Depreciation management is crucial for CFOs and it becomes a tedious exercise when it is done manually.

To improve compliance, expedite workflows, and do away with the laboriousness of manual computations, more and more CFOs are now using Automated Depreciation Software . Let us examine the reasons for this change and why it makes perfect financial sense.

The Traditional Way of Managing Depreciation

For decades, finance teams relied on spreadsheets and basic accounting tools to track asset depreciation. Every asset added meant another row, another formula, another risk for error. As the asset base grew, so did the complexity.

This manual method often led to:

- Miscalculations

- Non-compliance issues

- Hours of wasted time fixing spreadsheet bugs

- Difficulties during audits

The Rise of Automation in Financial Operations

From invoice processing to forecasting, automation is changing the face of finance and accounting. Depreciation, once a slow and cumbersome process, is now being transformed by smart software that can handle hundreds (or thousands) of assets in seconds.

Automation isn’t just a tech trend. It’s a necessity for CFOs under pressure to do more with less

What is Automated Depreciation Software?

These tools are software systems designed to calculate, manage, and report depreciation with minimal human input. They integrate seamlessly with accounting systems, asset management platforms , and ERP software to ensure all data stays synchronized.

Key features typically include:

- Automatic calculation based on asset type, lifespan, and policy

- Support for multiple depreciation methods (SLM, WDV, MACRS, etc.)

- Real-time reporting and analytics

- Compliance-ready formats for different laws, like the Income Tax Act and the Companies Act.

Top Reasons CFOs Are Choosing Depreciation Automation Software

1.Accuracy in Calculations: :

TLet’s face it: even the best spreadsheet wizards make mistakes. Automated tools apply logic consistently and without bias, reducing human error and ensuring clean, audit-ready books.

2.Time and Resource Efficiency:

Why spend hours doing what software can do in seconds? CFOs are freeing up their teams for more strategic work by letting automation handle the grunt work.

3. Real-Time Asset Tracking:

With automated depreciation tools integrated into your asset management system, updates happen in real time. That means fewer surprises, better forecasting, and smarter asset planning.

4. Simplified Audits:

Come audit season, CFOs equipped with automation tools are smiling while others scramble. These systems generate standardized reports, full depreciation history, and compliance logs at the click of a button.

5. Multi-Standard Compliance:

Whether it’s the Companies Act, IFRS, or IT Act, top depreciation tools come pre-configured to handle various regulatory standards. That’s one less thing for CFOs to worry about.

Manual Depreciation Posting Run Process

The manual depreciation posting process involves several time-consuming and error-prone steps:

- Track depreciation tasks manually using emails and spreadsheets

- Log into the ERP system and post asset entries periodically

- Run depreciation in test mode to review for errors

- Analyze simulation reports, asset changes, and compare with previous data

- Execute the depreciation in production mode and update the task status manually

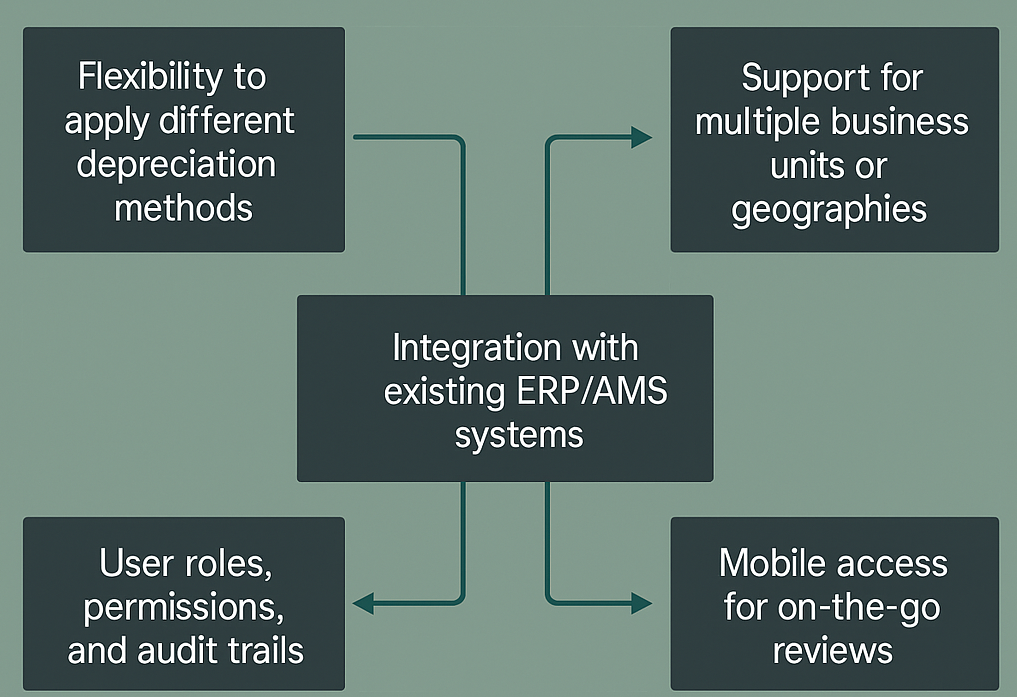

Core Features to Look For in Automated Depreciation Tools

If you’re shopping for a solution, here’s what you should keep an eye on:

- Flexibility to apply different depreciation methods

- Support for multiple business units or geographies

- Integration with existing ERP/AMS systems

- User roles, permissions, and audit trails

- Mobile access for on-the-go reviews

The ROI of Automation

Sure, there’s an upfront investment. But over time, the returns are significant:

- Reduced labor costs

- Improved compliance (avoiding fines)

- Better decision-making with accurate data

- Enhanced asset lifecycle management

Why Choose the Right Tool?

Here’s a quick checklist to help you decide:

- Can it integrate with your current ERP/AMS?

- Does it support your region’s compliance needs?

- Is the UI intuitive for your team?

- Are you getting good customer support?

Final Thoughts

Depreciation may not be the most prominent aspect, but it plays a vital role in ensuring financial accuracy. With Maco Infotech’s automation solution, Maco AMS, depreciation management is seamless and precise. In today’s fast-paced finance world, manual processes are no longer enough. For CFOs aiming to save time, minimize errors, and make confident decisions, choosing Maco Infotech isn't just smart—it’s essential.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness