Economic Analysis of Setting Up a Lube Oil Refinery

Setting up a lube oil refinery is a capital-intensive yet highly profitable venture, driven by the growing demand for lubricants across automotive, industrial, and machinery sectors. An economic analysis is crucial before investing, as it helps investors understand the viability, risks, and potential returns of the project.

1. Market Demand and Revenue Potential

The primary factor influencing the economic feasibility of a lube oil refinery is market demand. Global lubricants demand is steadily rising due to the expanding automotive industry and industrial machinery requirements. According to recent market reports, Asia-Pacific and Middle Eastern countries exhibit the highest growth rates, making them attractive markets. Estimating potential revenue involves analyzing product grades, such as automotive oils, industrial oils, and greases, and their corresponding market prices. Premium lubricants often offer higher margins but require sophisticated refining technology.

2. Capital Expenditure (CapEx)

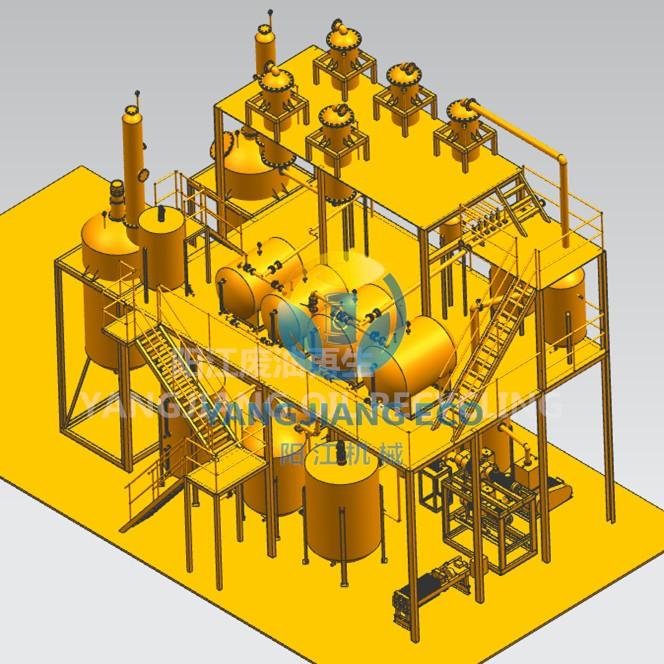

Setting up a refinery involves substantial upfront costs. These include purchasing land, constructing processing units, and installing equipment like vacuum distillation units, hydro-treaters, and blending systems. Depending on capacity, a small-scale refinery with a 5,000–10,000 barrels per day output may require capital ranging from $10 million to $50 million. Larger refineries could exceed $100 million. Investors must also consider infrastructure costs, such as storage tanks, pipelines, and utilities, which significantly affect initial investment.

3. Operational Expenditure (OpEx)

Operational costs include labor, raw material acquisition, utilities, maintenance, and logistics. Base oils are the primary raw material, typically sourced from crude oil or imported lubricating oil stocks. Prices fluctuate based on global crude oil rates, influencing profitability. Efficient energy utilization and technology adoption can significantly reduce operational costs. For instance, integrating energy recovery systems or automating processes can optimize production efficiency and reduce expenses.

4. Regulatory and Environmental Considerations

Compliance with environmental regulations adds another layer of economic consideration. Licensing, waste management protocols, and emission controls can be expensive but are mandatory. Non-compliance risks fines, production shutdowns, or legal penalties. Including these costs in the financial model ensures a more realistic projection of profitability.

5. Profitability and ROI Analysis

Financial projections are critical for economic feasibility. Typically, a medium-scale lube oil refinery can achieve break-even within 3–5 years, depending on market conditions, operational efficiency, and product pricing. Net profit margins vary between 10%–25%, with higher margins achievable in niche high-performance lubricant markets. Sensitivity analysis, considering fluctuations in raw material prices and demand, helps stakeholders understand potential risks and returns.

Conclusion

Economic analysis of setting up a lube oil refinery emphasizes thorough market research, accurate cost estimation, and strategic operational planning. While initial investments are substantial, the long-term returns from the growing demand for lubricants can be lucrative. Careful planning, efficient operations, and compliance with regulations ensure a sustainable and profitable venture.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness