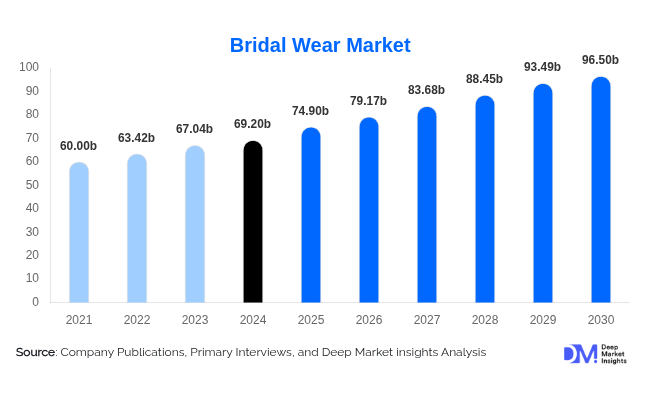

Global Bridal Wear Market to Reach USD 96.5 Billion by 2030, Driven by Tradition, Innovation, and Digital Transformation

According to deep market insights the latest industry analysis, the global bridal wear market, valued at USD 69.2 billion in 2024, is projected to expand from USD 74.9 billion in 2025 to USD 96.5 billion by 2030, growing at a CAGR of 5.7% (2025–2030).

The bridal wear industry remains resilient as weddings continue to hold deep cultural significance across regions. At the same time, the sector is undergoing transformation, driven by consumer demand for sustainability, personalization, and digital-first shopping experiences.

Market Insights

-

Product Segments: Gowns and dresses held a 52.1% share in 2024, fueled by Western wedding traditions and luxury designer brands. Accessories, footwear, and groom wear are expanding sub-segments, reflecting broader spending patterns.

-

Distribution Channels: Offline retail accounted for 68.9% of sales in 2024, supported by boutique fittings and in-store experiences. However, e-commerce adoption is accelerating with the use of AI-driven recommendations, virtual try-ons, and home trial kits.

-

Regional Breakdown:

-

Asia-Pacific led the global market at USD 22.9 billion in 2024, supported by elaborate wedding customs and strong regional designer ecosystems.

-

North America reached USD 18.3 billion, driven by high per-wedding spending and advanced digital bridal platforms.

-

Europe followed at USD 16.7 billion, backed by heritage brands and demand for sustainable bridal fashion.

-

Latin America recorded USD 6.1 billion, shaped by urbanization, rising middle-class affluence, and hybrid attire.

-

Middle East & Africa stood at USD 5.2 billion, with Dubai emerging as a global luxury bridal hub.

-

Emerging Trends

-

Fusion and Cultural Hybrid Styles: Cross-cultural weddings are fueling demand for hybrid collections that blend traditional attire with Western tailoring. Designers like Anita Dongre, Vera Wang, and Rahul Mishra are introducing culturally inclusive collections.

-

Minimalist and Non-Traditional Styles: Increasingly, brides are opting for sleek silhouettes, minimalist gowns, and unconventional options such as jumpsuits. Jenny Yoo’s 2025 “Elysian” collection highlights this preference for clean, understated elegance.

-

Digital Transformation: Nearly 40% of bridal purchases are now researched or made online. Players like David’s Bridal and Azazie have expanded digital tools, while Etsy launched an AI-curated bridal boutique in 2025. Japan’s Zozotown introduced AR-enabled smart suits for precise virtual fittings.

-

Sustainability and Circular Fashion: Platforms like Rent the Runway and My Wardrobe HQ are promoting rentals and resale bridal wear. Pronovias expanded its “Second Life” initiative in January 2025, offering brides alteration kits and reuse options.

Market Drivers and Restraints

Drivers:

-

Rising disposable incomes in emerging economies such as India, Brazil, and Indonesia.

-

Social media and celebrity weddings influencing global bridal trends.

-

Growth of destination weddings, driving demand for lighter, convertible gowns.

Restraints:

-

Premium gowns often exceed USD 5,000, limiting affordability for middle-income groups.

-

Import duties and limited availability in smaller regions inflate costs.

-

Sustainability concerns surrounding single-use bridal wear and fabric waste.

Regional Highlights

-

North America: High consumer spending, multicultural bridal demand, and bridal tech startups like Anomalie are driving growth.

-

Europe: Luxury hubs in Paris and Milan lead, alongside sustainability-driven design and minimalistic bridal fashion.

-

Asia-Pacific: The largest market, led by India’s USD 12+ billion bridal sub-industry, with Western gowns gaining traction among urban consumers.

-

Latin America: Expansion supported by cultural hybrid weddings, rising affluence, and bridal tourism in destinations such as Mexico and Colombia.

-

Middle East & Africa: Dubai has emerged as a global bridal hub, while Saudi Arabia and Africa are witnessing rising demand due to cultural reforms and growing affluence.

Competitive Landscape

The global bridal wear industry is fragmented, with a mix of couture labels, regional designers, and e-commerce disruptors.

-

Pronovias Group dominates across Europe and North America through flagship stores and sustainability initiatives.

-

David’s Bridal continues to scale its digital solutions, including its AI-based 3D gown customizer launched in March 2025.

-

Other key players include Maggie Sottero Designs, Justin Alexander, Monique Lhuillier, BHLDN (Anthropologie), Zuhair Murad, Sabyasachi, Lela Rose, and Marchesa.

Recent Developments

-

January 2025: Pronovias expanded its Second Life program to 25 countries, enabling dress alterations and reuse.

-

March 2025: David’s Bridal launched its Dream It, Design It AI-powered customization tool to enhance online personalization.

Outlook

The bridal wear market is set to grow steadily, reaching USD 96.5 billion by 2030. As the industry evolves, brands that embrace digital innovation, cultural inclusivity, sustainability, and affordability will be positioned to capture the shifting demands of modern brides while respecting global traditions.

- #BridalWear

- #WeddingIndustry

- #MarketGrowth

- #LuxuryFashion

- #EcommerceFashion

- #WeddingTrends

- #ConsumerInsights

- #CulturalFashion

- #SustainableFashion

- #AIInFashion

- #FusionBridalWear

- #CoutureDesign

- #AsiaPacificFashion

- #NorthAmericaFashion

- #EuropeFashion

- #MiddleEastFashion

- #LatinAmericaFashion

- #DestinationWeddings

- #FashionTech

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness