Unlocking the Future of the E-Bike Market: Regional Leaders, Growth Drivers & Profit Potential Revealed

MARKET OVERVIEW

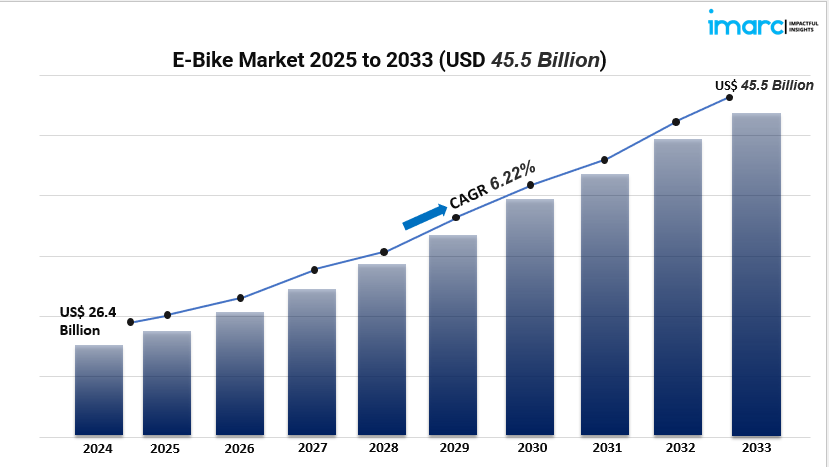

The global e-bike market trends reached USD 26.4 Billion in 2024 and is set to expand to USD 45.5 Billion by 2033, driven by urbanization, government incentives, improving battery tech and rising demand for affordable, low-emission transport. Strong manufacturing in Asia Pacific, growing last-mile and commuter use, and greater adoption of pedal-assist and connected features are steering sustained growth at a 6.22% CAGR (2025–2033).

STUDY ASSUMPTION YEARS

- BASE YEAR: 2024

- HISTORICAL YEAR: 2019–2024

- FORECAST YEAR: 2025–2033

E-BIKE MARKET KEY TAKEAWAYS

- Market size (2024): USD 26.4 Billion; Forecast (2033): USD 45.5 Billion; CAGR (2025–2033): 6.22%.

- Asia Pacific dominates with >76.6% market share in 2024.

- Mode: Pedal Assist leads (~66.9%) as consumer preference for exercise + assistance grows.

- Motor type: Hub Motors largest (~63.6%) for cost and ease of maintenance.

- Battery: Lithium-ion dominant (~68.6%), powering improved range and adoption.

- Class & Design: Class I and non-foldable e-bikes hold the largest shares, catering to commuters and recreational segments.

- Application: City/Urban is the largest application (~63.7%), reflecting strong demand for urban micro-mobility.

MARKET GROWTH FACTORS

Technological advancement in battery and drive systems

Recent advancements in lithium-ion cell chemistry, battery management systems (BMS), and lightweight pack design are driving significant growth in the e-bike market. With lithium-ion batteries capturing about 68.6% of the market share, we've seen steady improvements in energy density and cycle life. This means e-bikes can now offer longer ranges and lighter packs, making them more appealing for daily commuters and recreational riders alike. Manufacturers and battery suppliers are pouring resources into fast-charging capabilities, better thermal management, and modular designs that help reduce overall ownership costs and boost consumer confidence. At the same time, upgrades in motors and sensors—like torque sensors, more efficient hub and mid-drive systems, and integrated controllers—are enhancing the smoothness of pedal assist and improving hill-climbing performance. These enhancements are leading to a wider variety of products (think city, cargo, trekking, and mountain bikes) and encouraging original equipment manufacturers (OEMs) to roll out higher-value smart features, such as connectivity and ride diagnostics. As a result, the appeal of these products is growing across different age groups and regions, driving up unit sales and average selling prices, which directly contributes to the market's projected compound annual growth rate (CAGR) through 2033.

Regulatory incentives, infrastructure and public policy

Supportive government policies, subsidies, and smart urban planning are really boosting e-bike adoption around the globe. Many governments in the Asia-Pacific region, along with some municipalities in Europe and North America, are offering incentives like purchase discounts, tax breaks, and road-use benefits. These initiatives help lower the effective cost of e-bikes, making them more appealing to consumers. Additionally, public investments in bike lanes, micro-mobility parking, and charging stations make it easier and safer for people to use e-bikes daily, which encourages more commuters and fleet operators to hop on board. Policies aimed at reducing emissions and traffic congestion are pushing cities to focus on compact electric mobility. Pilot programs and public procurement for last-mile delivery fleets are also driving up the demand for cargo e-bikes. Plus, having clear regulations around e-bike classifications (Class I/II/III) in many areas simplifies their integration with traffic laws, which helps expand retail distribution and rental or subscription services. All these policy and infrastructure efforts are breaking down barriers to adoption, creating economies of scale for manufacturers, and supporting the long-term growth of the market that’s expected to continue expanding in the coming years.

Shifting consumer behaviour and business models

Consumer preferences are shifting towards sustainable, cost-effective, and health-conscious transportation options, and this is really changing the way we think about mobility—especially in cities where traffic jams and parking fees can be a real headache. E-bikes are taking the lead, making up about 63.7% of urban transport choices, as commuters opt for them for their short to medium trips. The pedal-assist models, which hold around a 66.9% share, are particularly appealing because they blend exercise with electric assistance, attracting a diverse range of riders, including older adults. On the commercial side, cargo bikes are becoming popular for last-mile deliveries and corporate wellness initiatives, which is expanding the demand even further. Innovative business models like subscription services, rentals, and shared micro-mobility fleets are making these options more accessible and lowering the initial costs, encouraging more people to give them a try. Plus, the rise of e-commerce is making it easier to find a variety of price points and brands, while local manufacturing in the Asia Pacific is helping to cut costs and speed up delivery times. All these changes in behaviour and new distribution and ownership models are driving growth across different regions and supporting a wider range of products.

Request for a sample copy of this report: https://www.imarcgroup.com/e-bike-market/requestsample

MARKET SEGMENTATION

Analysis by Mode

- Throttle: E-bikes with a throttle provide motor power independent of pedaling; often used for short commutes or by riders preferring zero-pedal assistance, boosting accessibility for non-cyclists.

- Pedal Assist: Pedal-assist e-bikes deliver motor assistance only while pedaling, blending exercise with electric support; this versatile mode appeals widely to commuters and recreational riders.

Analysis by Motor Type

- Hub Motor: Motors integrated into wheel hubs; favored for simple installation, low maintenance and quiet operation—making them popular for city and foldable e-bike designs and cost-conscious buyers.

- Mid Drive: Motors mounted near the crank deliver efficient torque and better hill performance; preferred for high-performance, trekking and mountain e-bikes where balance and power delivery matter.

- Others: Includes alternative motor architectures and hybrid systems; used in niche or experimental models, providing innovative layouts for specialized applications like cargo or high-torque needs.

Analysis by Battery Type

- Lead Acid : Traditional, lower-cost chemistry with heavier weight and limited cycle life; typically found in very low-cost or legacy models where upfront cost is the primary constraint.

- Lithium Ion: Dominant chemistry (≈68.6% share) offering high energy density, lighter weight and longer life; drives range improvements and consumer adoption across commuter and performance segments.

- Nickel-Metal Hydride (NiMH): Intermediate option with better cycle life than lead acid but lower energy density than lithium; used in some low-to-mid tier applications and transitional products.

- Others: Encompasses emerging chemistries and experimental pack designs (solid-state, flow, hybrid) that manufacturers explore to improve safety, cost or energy density.

Analysis by Class

- Class I: Pedal-assist only, with motor assistance up to a set speed; resembles traditional bicycles and is the largest class, favored by commuters and recreational riders.

- Class II: Throttle-enabled e-bikes that can provide power without pedaling; attractive to users seeking instant motor assistance for short trips or accessibility reasons.

- Class III: Higher-speed pedal-assist models often capped at higher assist speeds; targeted at commuters seeking faster urban transit and performance-oriented riders.

Analysis by Design

- Foldable: Compact, collapsible frames designed for multimodal commuters and urban users needing easy storage on trains or in small apartments; convenience prioritized over heavy-duty performance.

- Non-Foldable: Conventional, rigid frames offering greater stability and broader model variety (commuter, mountain, cargo); dominate the market due to durability and performance across terrains.

Analysis by Application

- Mountain/Trekking Bikes: Off-road and long-distance models with suspension and durable frames; geared to adventure riders and recreational users seeking extended range and rugged performance.

- City/Urban: Designed for daily commuting, short trips and maneuvering congested streets; highest share (~63.7%) due to rising urban micro-mobility demand.

- Cargo: Heavy-duty frames and enhanced power for transporting goods or packages; increasingly adopted by delivery services and urban logistics providers.

- Others: Niche uses including leisure, specialty utility, and bespoke designs that do not fall into the main application buckets but contribute to total market diversity.

Breakup by Region

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

REGIONAL INSIGHTS

The Asia Pacific region is set to lead the e-bike market, capturing over 76.6% of the share by 2024. This surge is largely fueled by widespread adoption in China, robust local manufacturing, high urban density, and specific subsidies aimed at boosting sales. With lower production costs, an expanding infrastructure, and a rising middle class eager for affordable and diverse e-bike options, this area is becoming the powerhouse of global growth and innovation in the e-bike sector.

RECENT DEVELOPMENTS & NEWS

Recent updates from the source page shine a light on exciting product launches, strategic market entries, and an expanded lineup of models. In 2024, major retailers and OEMs rolled out next-generation e-bikes—like Decathlon’s RR900e featuring Bosch integration and Hero Lectro’s H4 and H7+ tailored for Indian consumers—showcasing both premium and budget-friendly options. Companies and conglomerates, such as Posco Daewoo, are signaling their return or growth in key markets, while manufacturers keep pouring resources into battery operations and smart features. The rise of rental and subscription models, along with cargo variants, combined with ongoing government incentives, is transforming availability and use cases across various regions, according to the report’s market updates.

KEY PLAYERS

- AIMA Technology Group Co., Ltd.

- Giant Manufacturing Co., Ltd.

- Kalkhoff Werke GmbH

- Merida Industry Co., Ltd.

- Pedego Inc.

- Riese & Müller GmbH

- Specialized Bicycle Components, Inc.

- SUNRA (Jiangsu Xinri E-Vehicle Co., Ltd.)

- Trek Bicycle Corporation

- Yadea Technology Group Co., Ltd.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=1604&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (+1-201971-6302)

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Inicio

- Literature

- Music

- Networking

- Otro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness