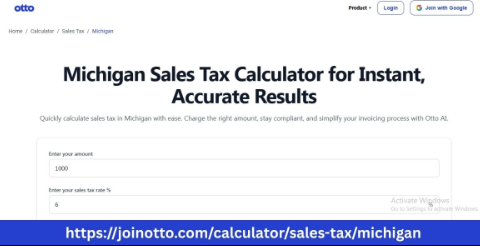

Michigan Sales Tax Calculator for Easy Tax Filing

Running a business in Michigan comes with many responsibilities, and understanding sales tax is one of them. Sales tax affects how you price products, how much you collect from customers, and how you report your income to the state. A Michigan Sales Tax Calculator can make this process much easier. It takes the guesswork out of tax calculation, giving you quick and accurate results so you can focus more on running your business.

Understanding Sales Tax in Michigan

In Michigan, sales tax is a 6% state tax charged on most goods and some services sold within the state. As a business owner, you are responsible for collecting this tax from customers and sending it to the Michigan Department of Treasury. This applies whether you run a physical store, sell online, or provide taxable services.

For example, if you sell a $50 product, the sales tax would be $3, making the total price $53. While this might sound simple, when you’re processing hundreds of sales or dealing with exemptions, calculations can quickly get complicated.

Why Use a Sales Tax Calculator Michigan

Calculating sales tax by hand may seem easy for one sale, but over time, manual calculations increase the risk of errors. A sales tax calculator Michigan tool helps by automatically applying the correct rate, ensuring you never overcharge or undercharge.

Key benefits include:

-

Accuracy: Eliminates manual mistakes in tax amounts.

-

Speed: Calculates instantly, even for multiple transactions.

-

Consistency: Ensures every sale follows the same tax rules.

For self-employed entrepreneurs and small business owners, using a calculator can save time and provide peace of mind.

Items That Are and Are Not Taxable

Not every product sold in Michigan is taxable. Understanding this helps you know when to use the calculator.

Taxable items include:

-

Tangible goods such as electronics, clothing, and furniture

-

Prepared food and beverages

-

Certain services

Exempt items include:

-

Most unprepared groceries

-

Prescription medications

-

Some medical devices

By knowing what is exempt, you avoid applying sales tax where it is not required.

How a Michigan Sales Tax Calculator Works

Using a Michigan Sales Tax Calculator is simple. You enter the sale amount, and it instantly shows you the sales tax and total amount to charge.

Example:

-

Sale price: $200

-

Sales tax: $200 × 0.06 = $12

-

Total: $212

Most calculators automatically use Michigan’s 6% rate, so you don’t have to set it each time. This ensures accuracy even when dealing with many transactions in a day.

Benefits for Different Business Types

-

Retail Stores: Speeds up checkout and keeps customers happy.

-

Online Sellers: Ensures correct tax amounts for each sale.

-

Freelancers and Service Providers: Makes billing easy when tax applies.

By streamlining tax calculations, you can focus on your products and services instead of getting caught up in number crunching.

Avoiding Common Sales Tax Mistakes

Even with a calculator, there are pitfalls to watch out for:

-

Using the wrong rate: Michigan’s rate is 6%, but always verify.

-

Applying tax to exempt sales: Avoid charging tax on groceries and prescription drugs.

-

Forgetting to tax shipping: In Michigan, shipping fees are often taxable if part of the sale.

Awareness of these rules keeps your business compliant and prevents issues with the Department of Treasury.

The Role of Sales Tax Michigan in Compliance

Sales tax is not just about adding a small amount to a price—it’s about meeting state regulations. Failure to collect and remit the correct sales tax can result in penalties, interest charges, and damage to your business reputation. Customers also expect accurate, transparent pricing, which a reliable calculator helps provide.

Integrating Tools into Your Workflow

You don’t have to calculate sales tax separately for each sale. Many point-of-sale systems and online platforms already include sales tax calculators. For those without such systems, there are online Michigan Sales Tax Calculator options you can use directly or integrate with accounting software.

This integration saves time and ensures that every transaction is correctly taxed from the start.

Making Tax Season Easier

When tax season arrives, organized records make reporting much simpler. Using a calculator means you have clear documentation of every tax amount collected throughout the year. This reduces stress, minimizes errors in your filings, and helps you stay on the right side of state law.

Why Otto AI is Worth Considering

For small business owners who want more than just a calculator, Otto AI offers smart business tools that can automate tax calculations, track transactions, and organize records. Integrating such technology into your workflow means fewer manual tasks, more accuracy, and more time to focus on customers.

With automation handling sales tax and other repetitive processes, you can reduce stress and improve efficiency.

Conclusion: The Value of a Michigan Sales Tax Calculator

Whether you’re a store owner, freelancer, or online seller, sales tax compliance is an essential part of doing business in Michigan. A Michigan Sales Tax Calculator ensures that your tax amounts are accurate, consistent, and compliant with state laws.

By using this tool, you save time, improve accuracy, and build trust with your customers. For even greater efficiency, consider combining your calculator with smart business solutions like Otto AI to make tax management a smooth, stress-free part of your daily operations.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness