Accurate Georgia Sales Tax Calculator for Businesses

For business owners in Georgia, calculating sales tax accurately is essential. Whether you run a small business or are self-employed, mistakes in tax calculations can lead to penalties or customer dissatisfaction. A Georgia Sales Tax Calculator is a valuable tool that simplifies this process. In this article, we will explain the Georgia sales tax system, the advantages of using a sales tax calculator, and strategies to manage taxes effectively.

Overview of Georgia Sales Tax

Georgia imposes a statewide sales tax of 4% on most goods and certain services sold within the state. In addition to the state tax, local counties and cities may add their own taxes, which makes the total sales tax rate vary by location. Understanding these rates is crucial to ensure correct taxation for each transaction.

Sales tax in Georgia applies to items like electronics, clothing, furniture, and some services. However, exemptions exist for certain products, including most groceries and prescription medications. Knowing which products are taxable is necessary to avoid errors when collecting tax from customers.

Benefits of Using a Georgia Sales Tax Calculator

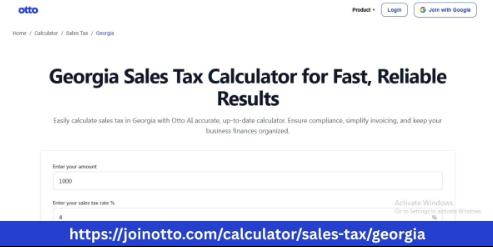

Manual calculations of sales tax can be challenging and time-consuming. A Georgia Sales Tax Calculator simplifies this by allowing you to enter the sale amount and location, instantly providing the correct tax. This ensures your calculations are accurate and compliant with Georgia tax laws.

Using a calculator prevents common issues such as overcharging or undercharging customers. Overcharging can create disputes, while undercharging may result in penalties and interest. By using a sales tax calculator, you ensure precise tax collection and maintain customer trust.

Features of an Efficient Sales Tax Calculator Georgia

A reliable sales tax calculator should have the following capabilities:

-

Up-to-date tax rates for Georgia and local jurisdictions

-

Ability to calculate taxes for multiple locations automatically

-

User-friendly interface for quick and easy calculations

-

Options to include or exclude tax-exempt items

Some advanced calculators integrate with accounting software or point-of-sale systems, allowing tax calculations to be automatically recorded and reported. Otto AI provides tools that streamline this process, helping business owners save time and avoid errors.

Practical Tips for Managing Georgia Sales Tax

-

Stay Updated on Tax Rates

Tax rates can change frequently in Georgia. Keeping up with official updates ensures that you are always charging the correct rate for every sale. -

Maintain Accurate Records

Tracking all sales, tax collected, and exemptions is essential. Detailed records simplify filing returns and provide proof in case of audits. Using a Georgia Sales Tax Calculator ensures accuracy for every transaction. -

Separate Tax from Revenue

Separating sales tax from your overall revenue helps avoid confusion during reporting and simplifies remittance. Accounting software can assist with this, and Otto AI offers tools to integrate tax calculations efficiently. -

Understand Taxable and Non-Taxable Items

Not all items and services are subject to Georgia Sales Tax. Being clear about which products are taxable prevents mistakes. Food for home consumption, for instance, is usually exempt, whereas prepared foods often carry a tax. -

Plan for Business Fluctuations

Seasonal spikes in sales can affect tax calculations. Using a Georgia Sales Tax Calculator ensures that taxes are accurately calculated even during busy periods.

Common Mistakes to Avoid

Many business owners make errors in managing sales tax. Common mistakes include:

-

Using outdated or incorrect tax rates

-

Failing to charge tax on taxable items

-

Misclassifying exempt items

-

Delayed remittance of collected taxes

A Georgia Sales Tax Calculator reduces these risks by providing accurate, real-time calculations for every sale.

Advantages of Using a Sales Tax Calculator Georgia

The benefits of using a sales tax calculator include:

-

Accuracy: Ensures correct tax calculation for all transactions.

-

Time-Saving: Eliminates the need for manual calculations.

-

Compliance: Reduces the chance of errors and penalties.

-

Customer Confidence: Proper tax collection builds trust with customers.

-

Simplified Record-Keeping: Tracks tax collected for reporting and audits.

Integrating a Sales Tax Calculator into Business Operations

Using a Georgia Sales Tax Calculator within your business workflow makes tax management easier. Point-of-sale systems can automatically apply tax at checkout, while accounting software can generate reports for tax filing. Tools like Otto AI provide solutions to streamline tax calculations and reporting, giving business owners more time to focus on growth and operations.

Conclusion

Accurate sales tax management is critical for businesses in Georgia. A Georgia Sales Tax Calculator simplifies this process for small business owners and self-employed entrepreneurs, ensuring precise tax collection and compliance with state laws. Staying informed about Georgia sales tax rates, maintaining detailed records, and using reliable tools like Otto AI can make tax management straightforward and stress-free. By leveraging a sales tax calculator, businesses can improve accuracy, efficiency, and customer trust while focusing on growth and success.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Musica

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness